Key takeaways

- MTN Yello Save lets you save directly from your MoMo wallet and earn interest of up to 8% annually.

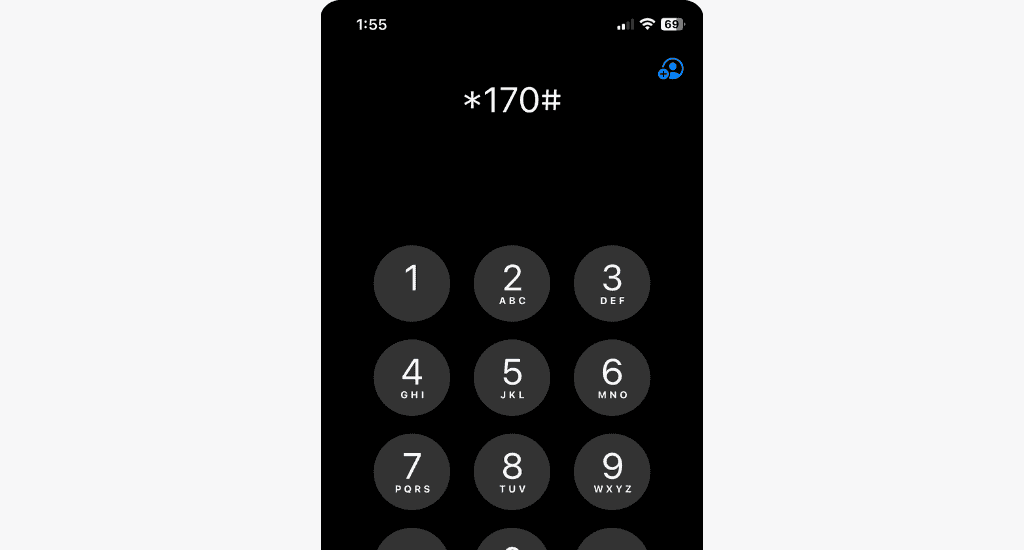

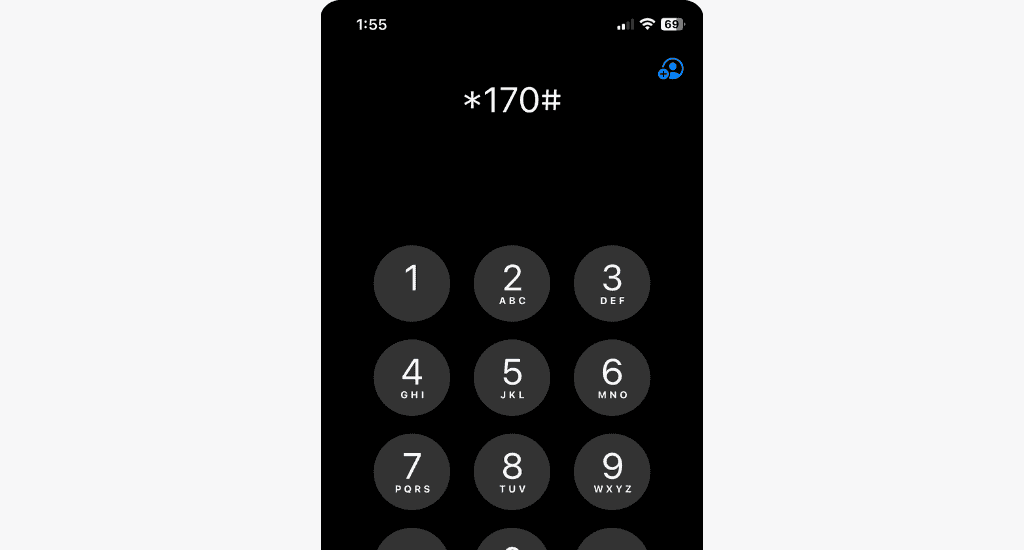

- You can register by dialling *170# and depositing a minimum of GHS 2.

- Making three or more withdrawals in a month reduces the interest rate to a flat 3% annually.

If you’re an MTN MoMo user, Yello Save lets you save, earn interest, and withdraw your money anytime—just like you’ll do with traditional banks.

Sounds easy, right? Here’s a guide on how to get started.

What is MTN Yello Save?

Yello Save is a mobile savings service offered by Fidelity Bank in partnership with MTN Ghana. It allows MTN MoMo users to save conveniently and also earn interest on the savings.

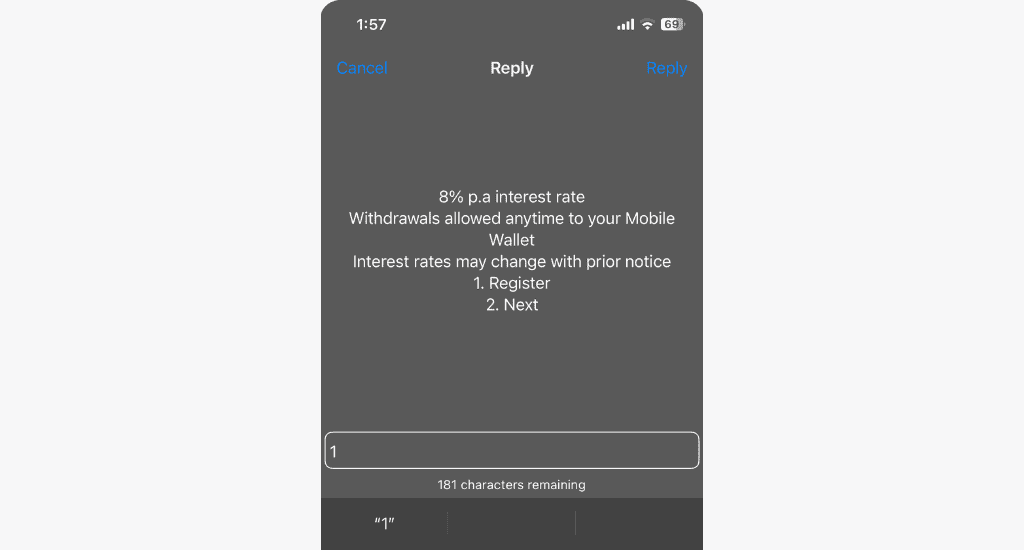

It operates like a digital savings account linked to your MoMo wallet. You can deposit, withdraw, and earn an annual interest of up to 8% on your account balance. The interest is paid out monthly.

Here are the interest rates for various account balances:

| Account balance | Interest rate |

| GHS 1 – GHS 1,000 | 5% |

| GHS 1,001 – GHS 5,000 | 6% |

| GHS 5,000 – GHS15,000 | 7% |

| Above GHS 15,000 | 8% |

Note: Interest rates are subject to change by Fidelity Bank based on prevailing markets.

How to register for MTN Yello Save?

Registering for MTN Yello Save is straightforward. Here’s how to get started:

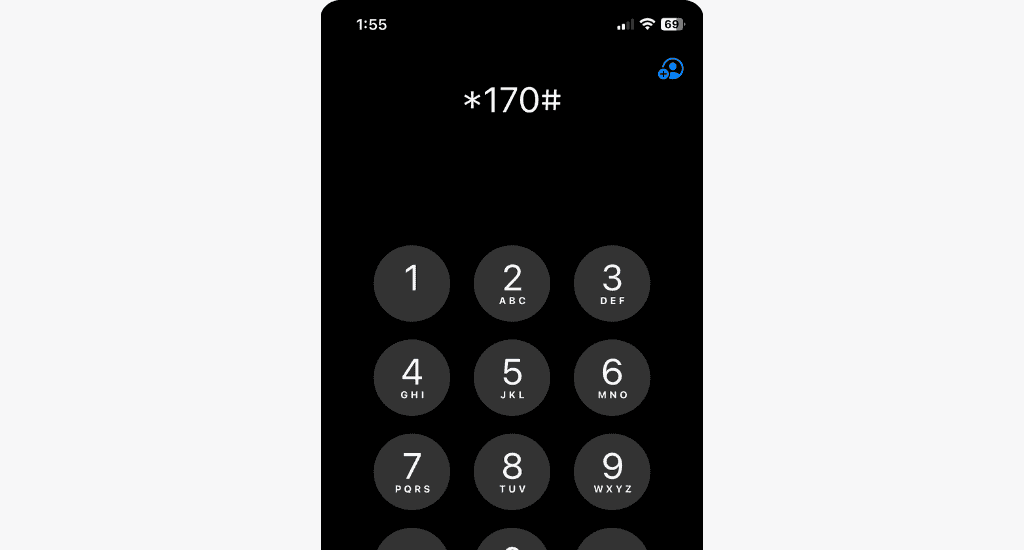

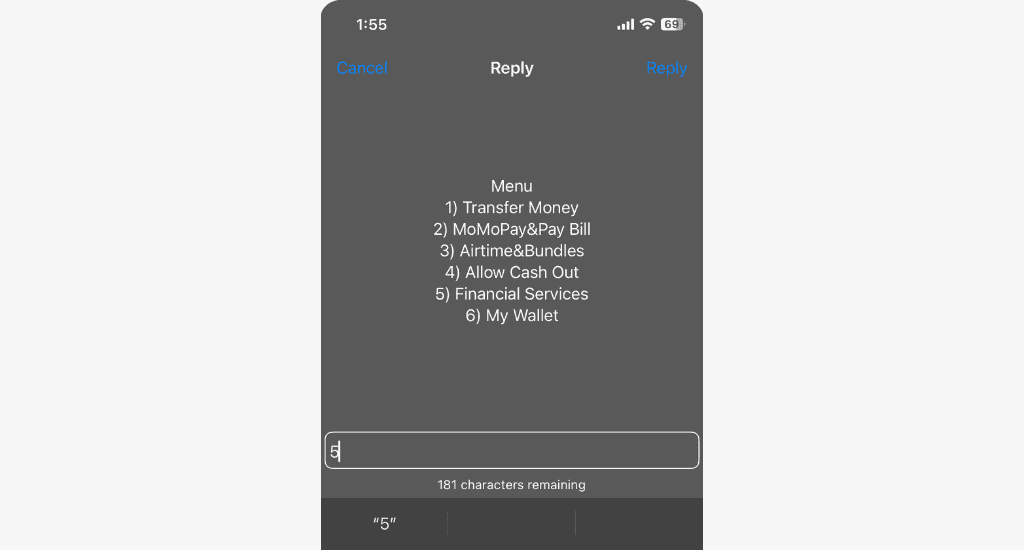

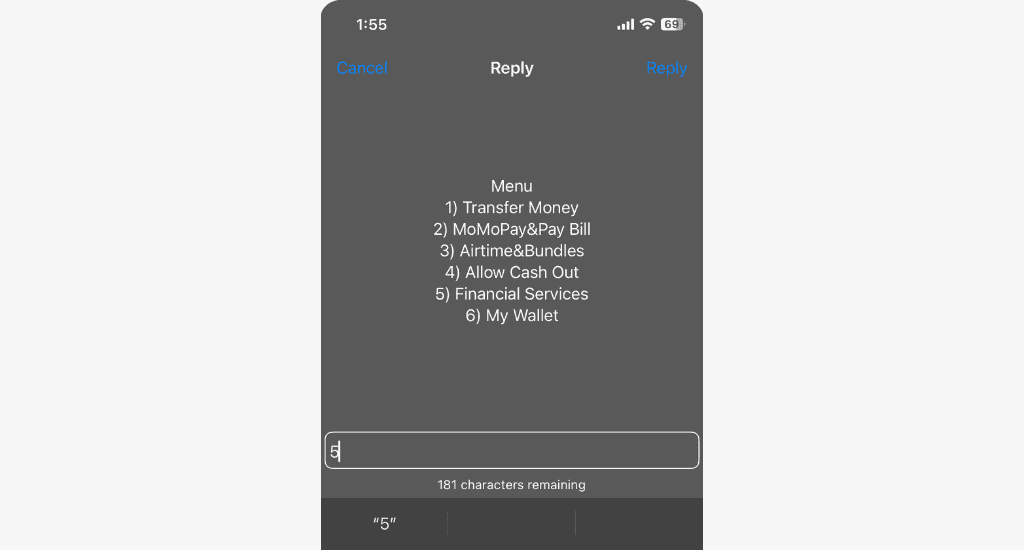

- Dial *170#.

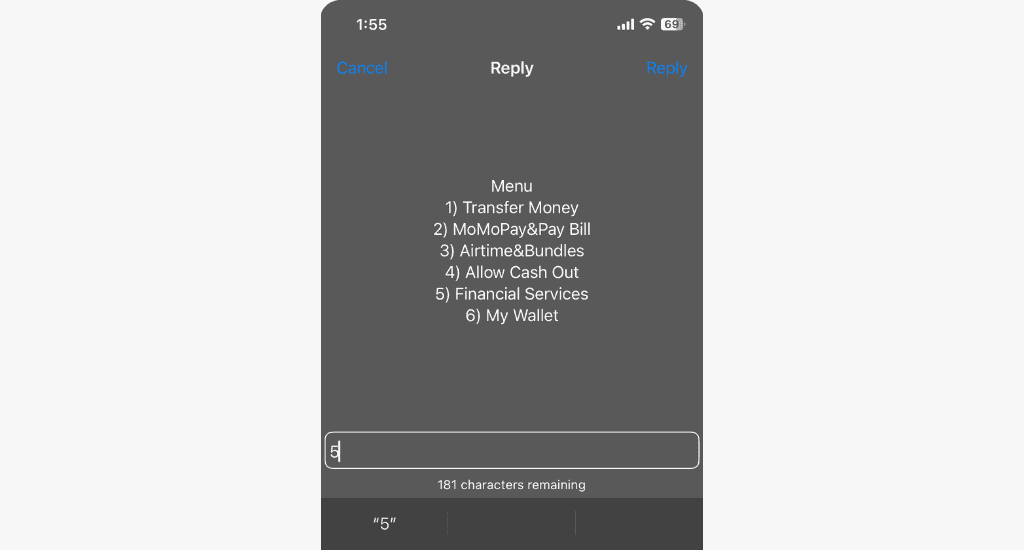

- Select Financial Services.

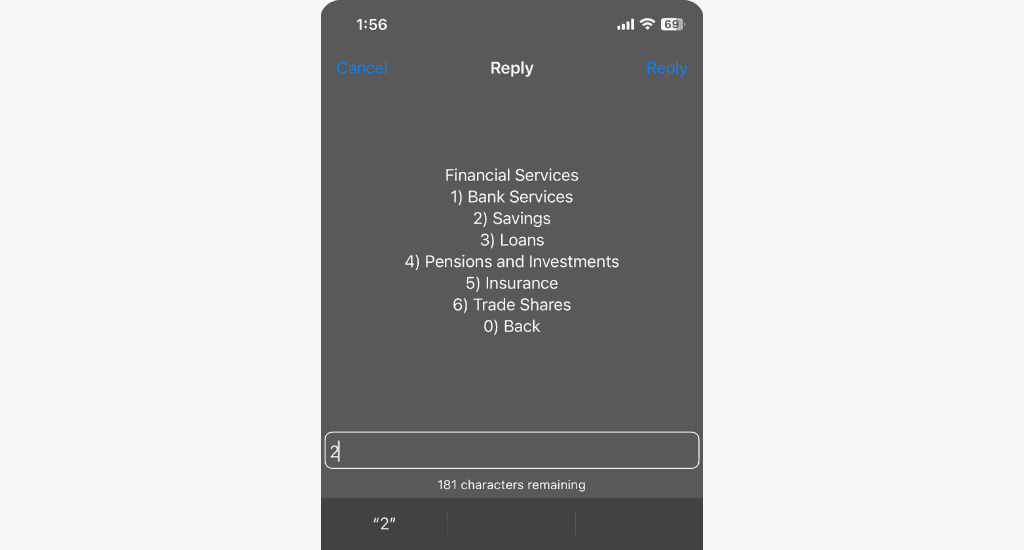

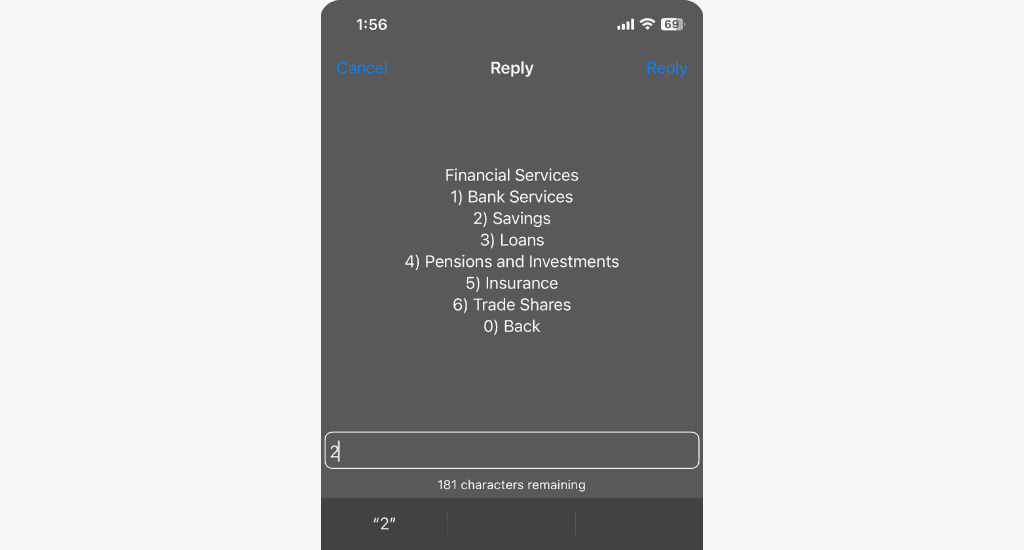

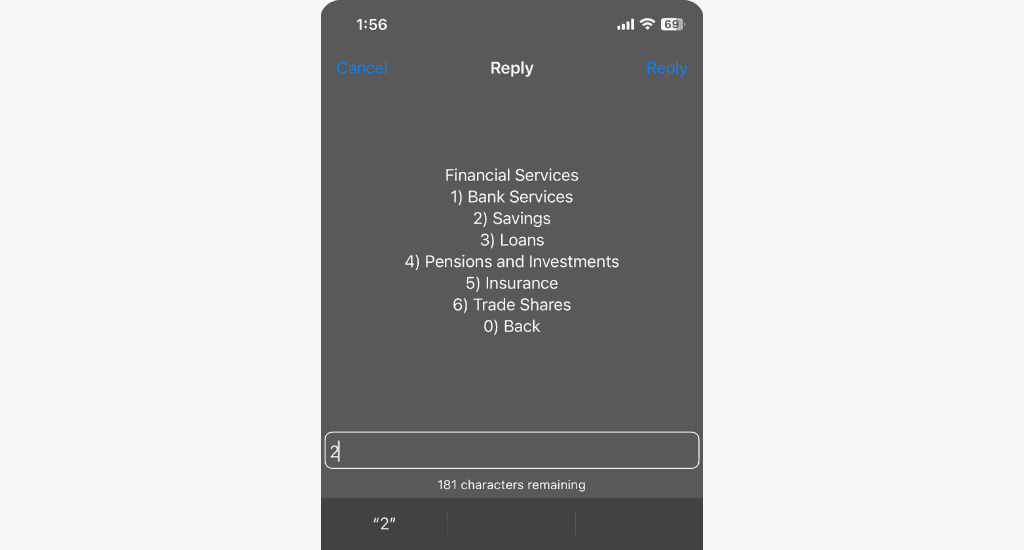

- Select Savings.

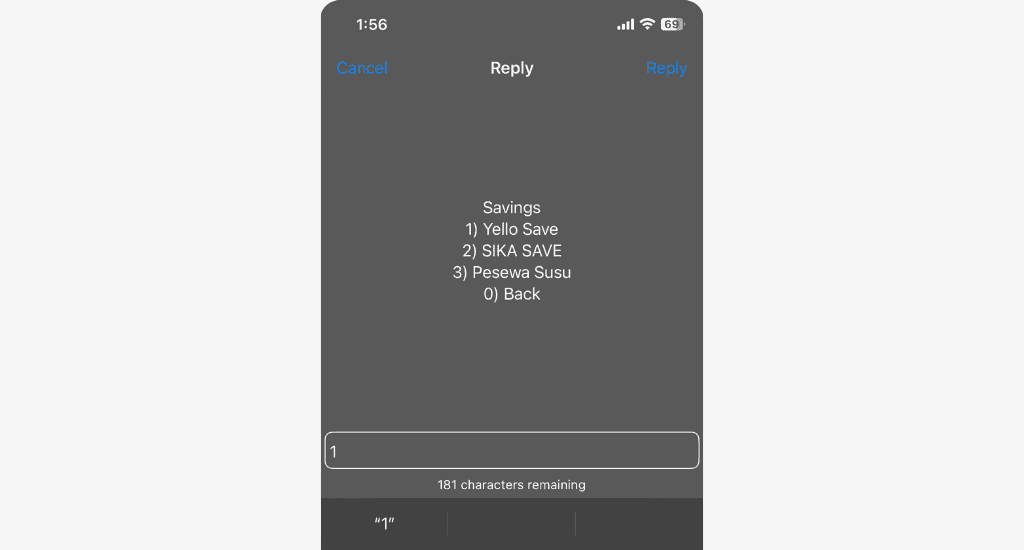

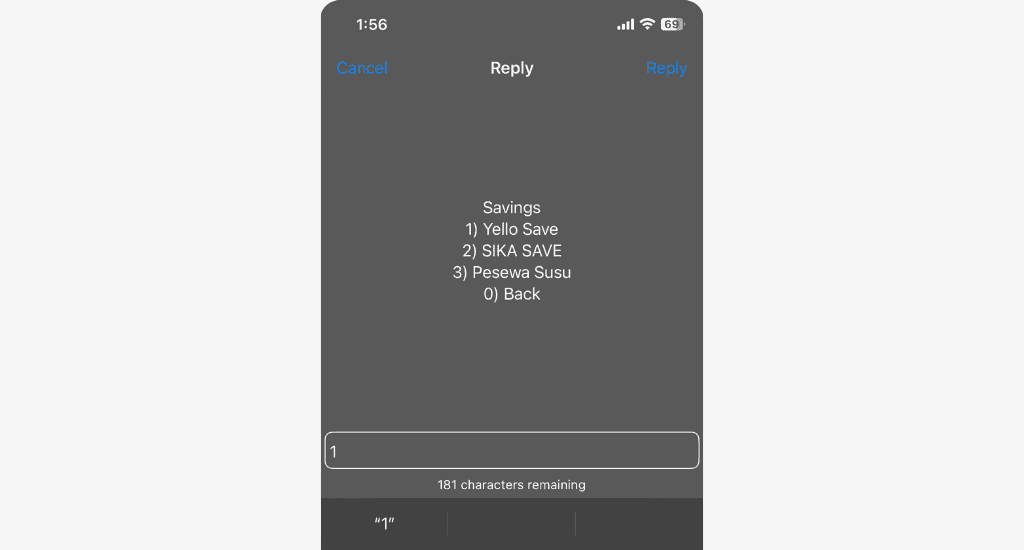

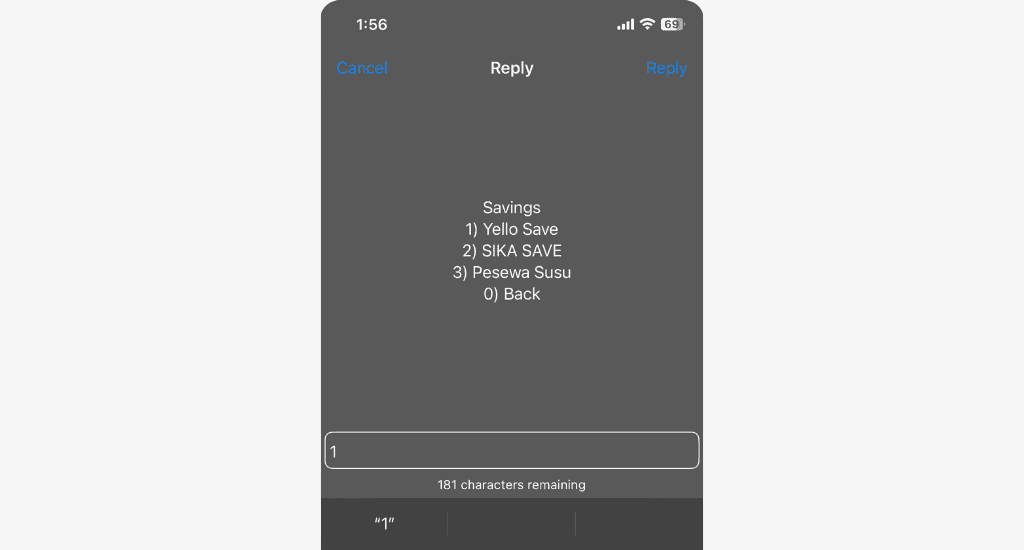

- Choose Yello Save.

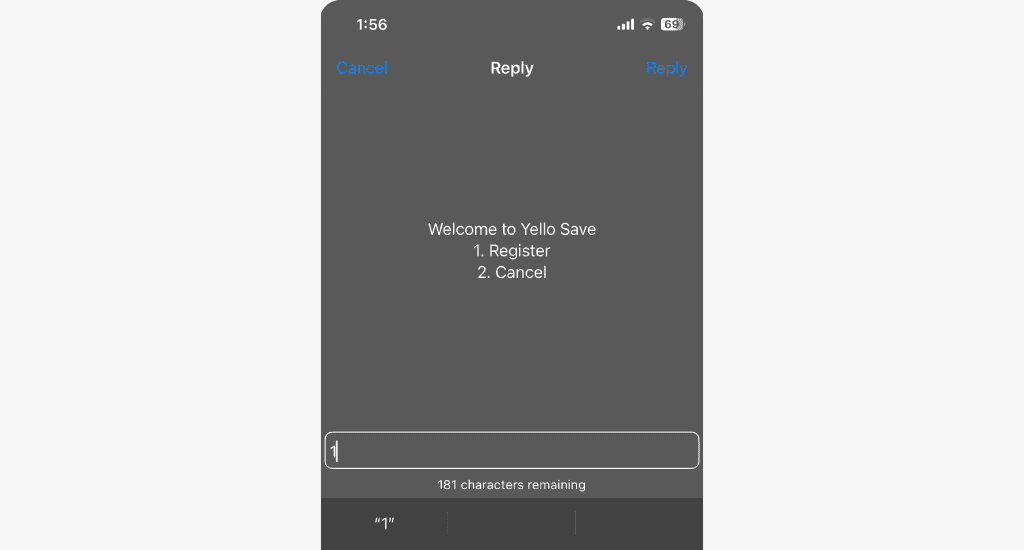

- Select Register.

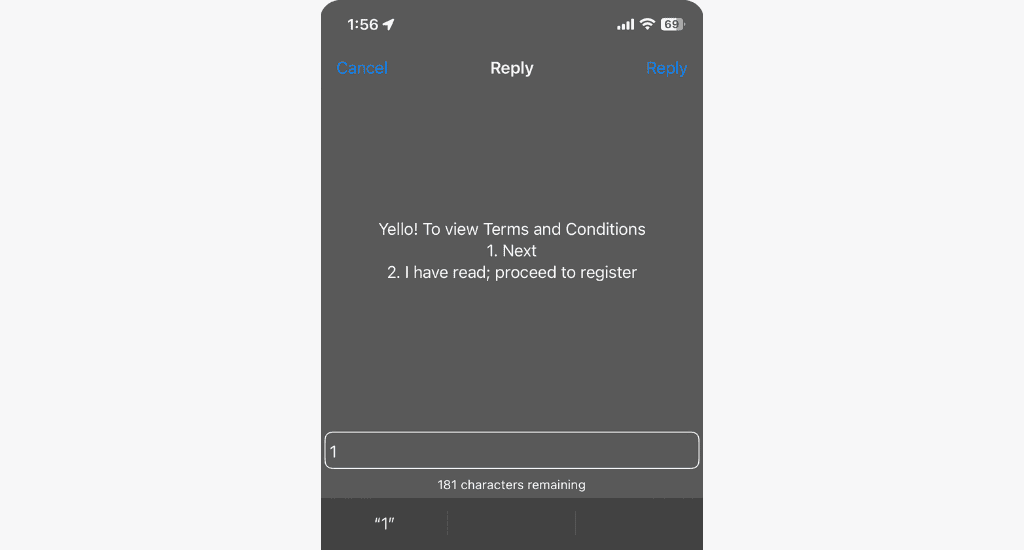

- Select Next to read the Terms and Conditions.

- Select Register to accept the Terms and Conditions.

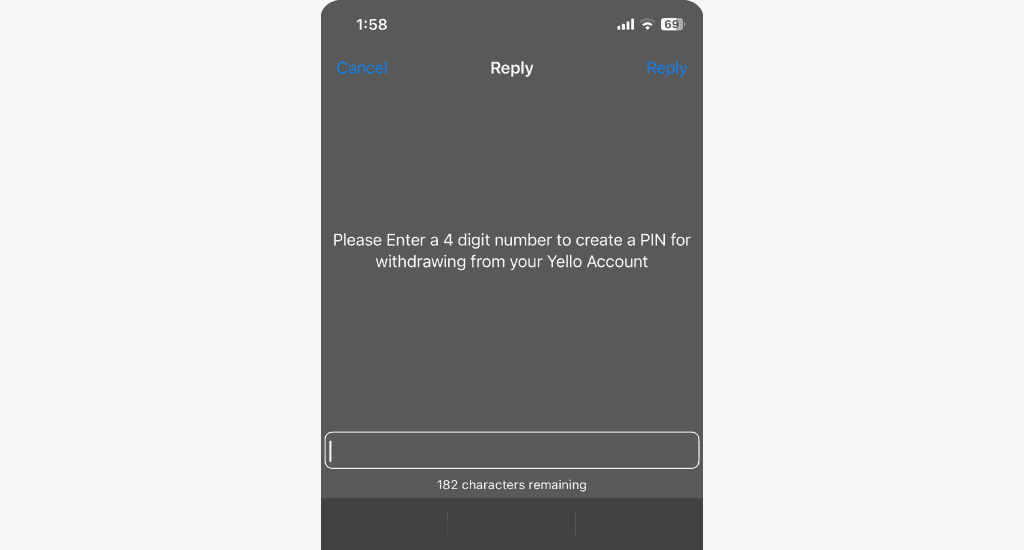

- Choose a four-digit PIN.

Note: You’ll need your Yello Save PIN to withdraw and access your account, so be sure to remember it. It can be the same or different from your MTN MoMo PIN.

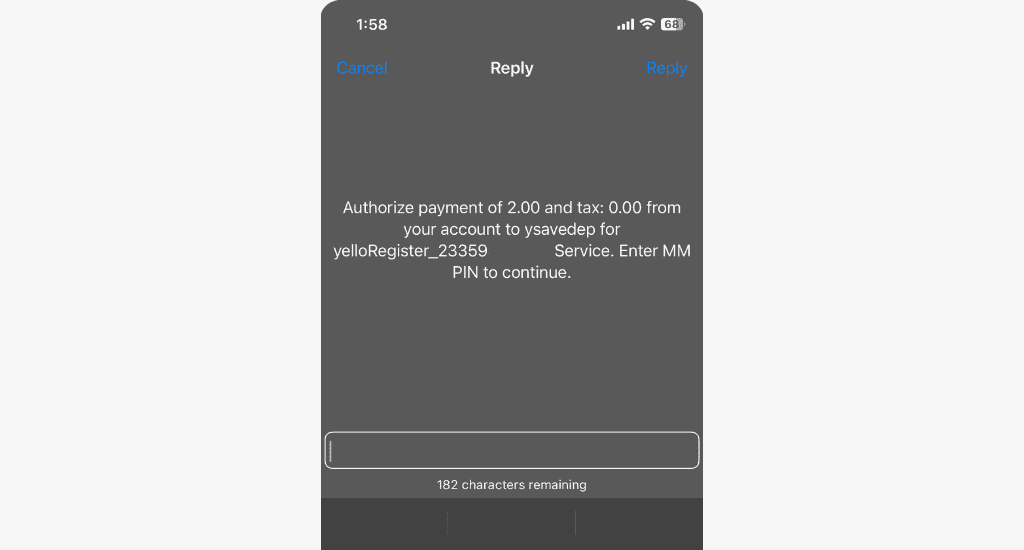

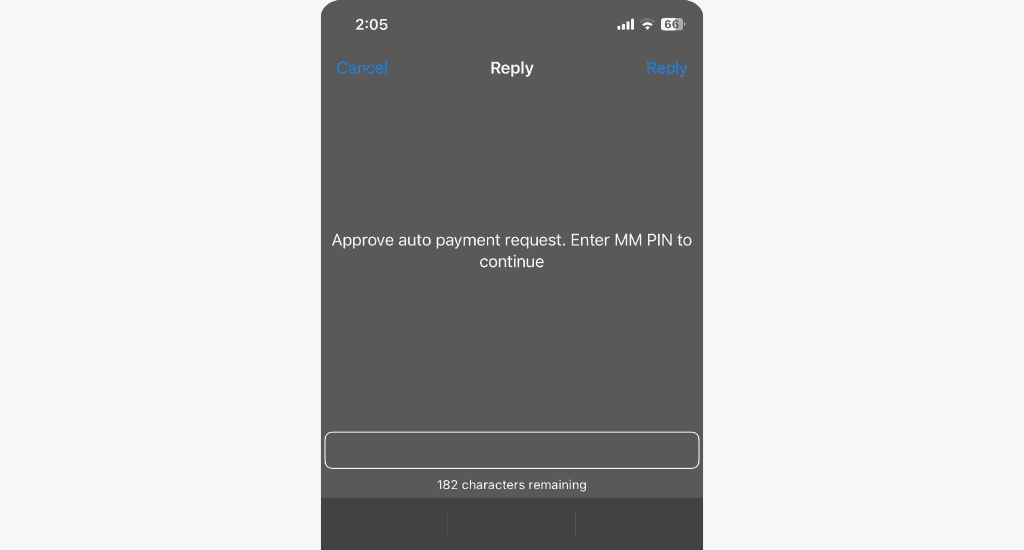

- Enter your MTN MoMo PIN to confirm payment of GHC 2 as your initial deposit.

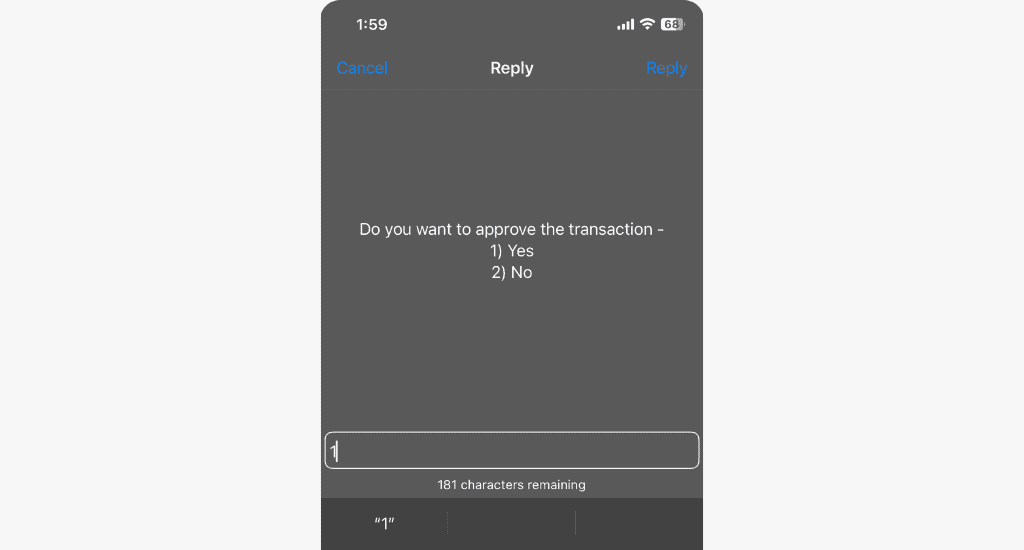

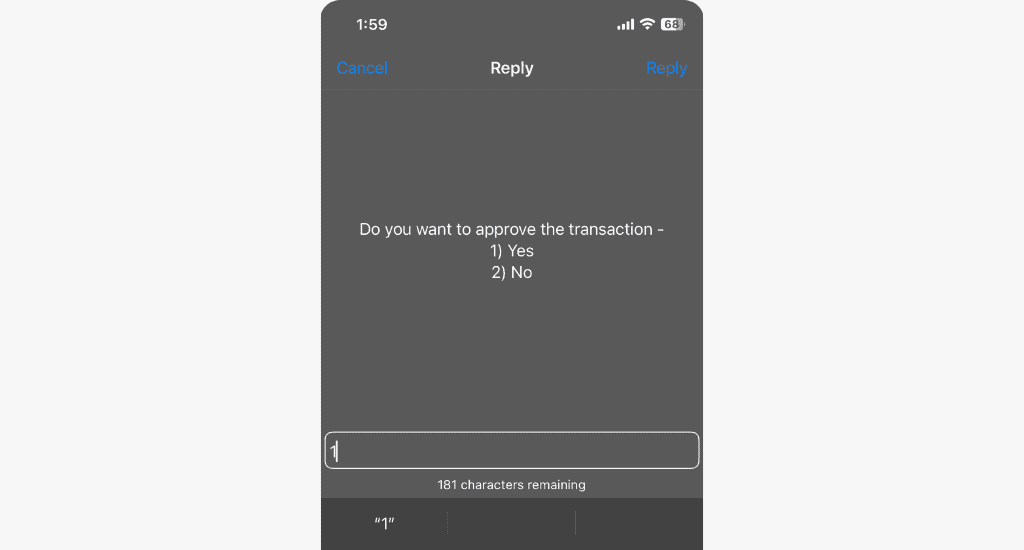

- Choose option 1 to approve the transaction.

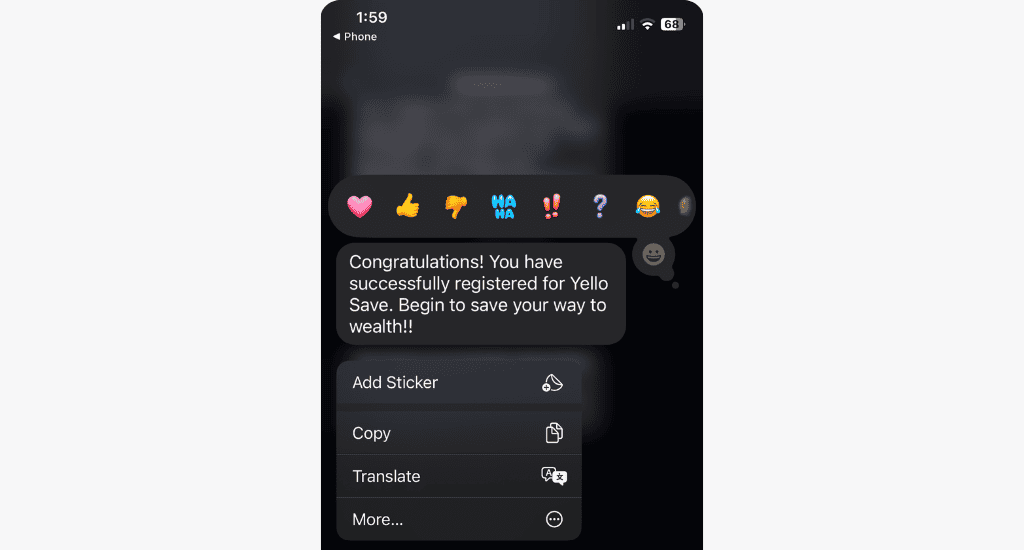

- You should receive an SMS confirming your registration.

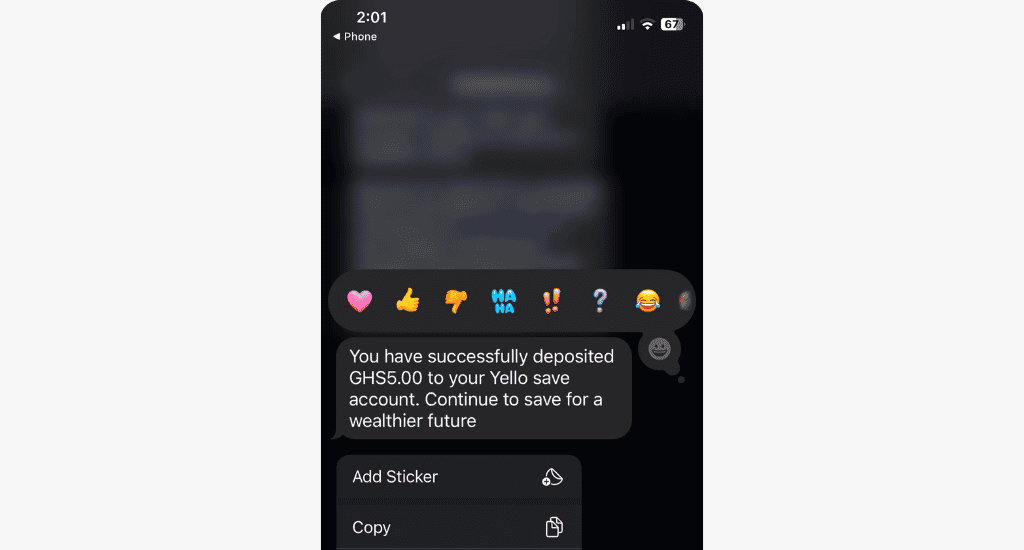

That’s all. MTN will send another notification confirming your initial GHS 2.00 deposit.

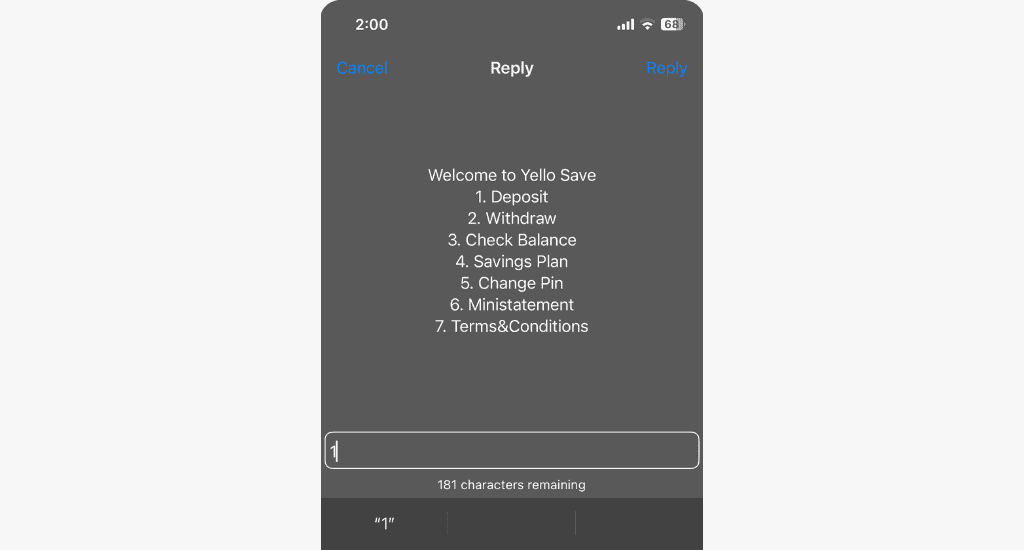

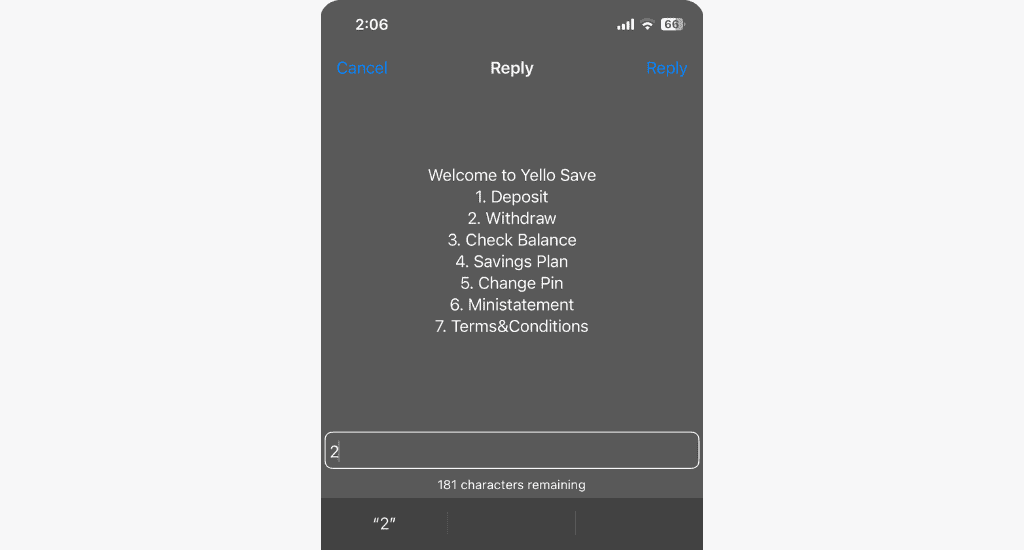

How to deposit money on MTN Yello Save?

After registering, saving money with Yello Save is easy:

- Dial *170#.

- Select Financial Services.

- Select Savings.

- Select Yello Save.

- Select Deposit.

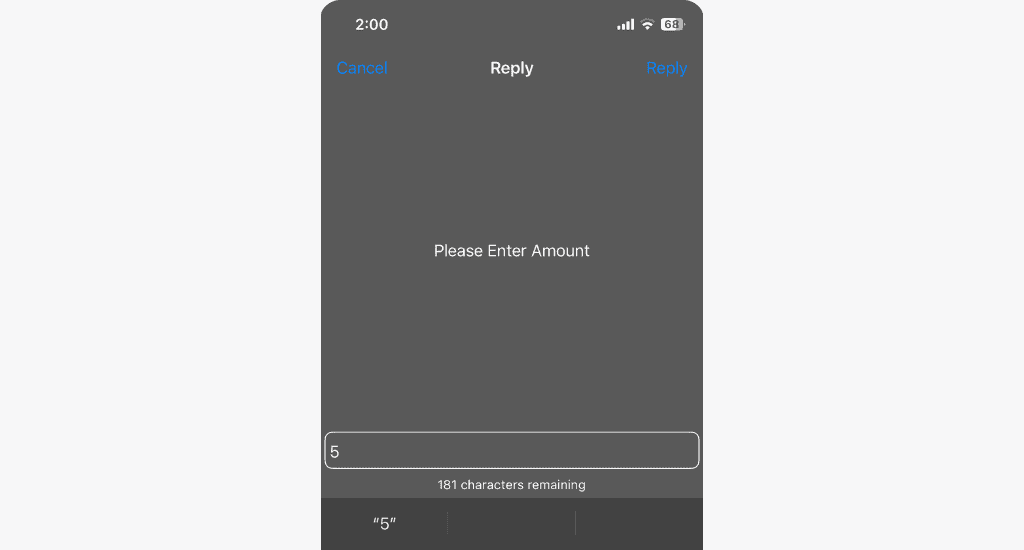

- Enter the amount to be deposited.

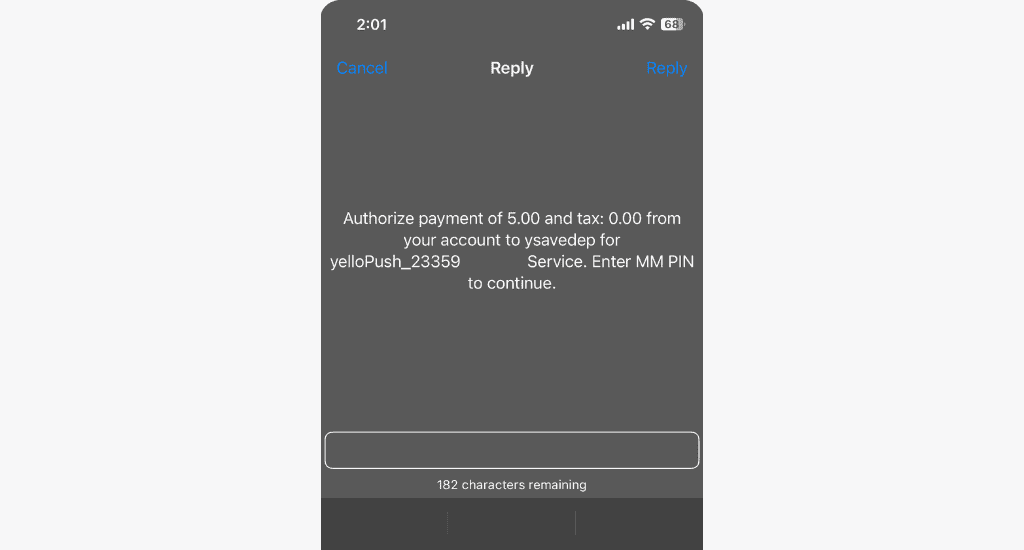

- Enter your MTN MoMo PIN to authorise payment.

- Choose option 1 to approve the transaction.

- You’ll receive an SMS confirming your deposit.

Voila, you’ll start earning interest on your deposit immediately.

Alternatively, you can create a daily, weekly, or monthly savings plan. This allows automatic deduction from your MoMo account without a deposit.

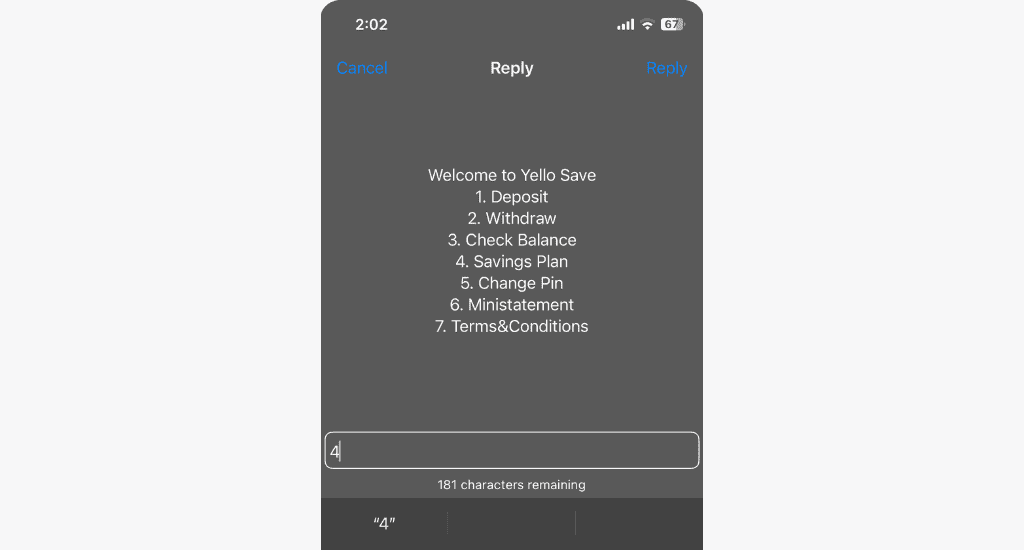

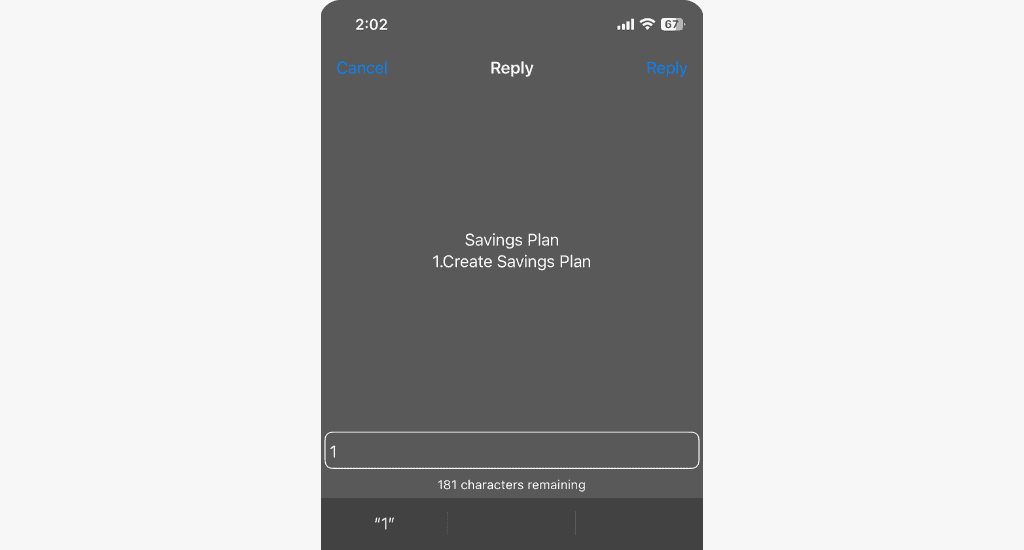

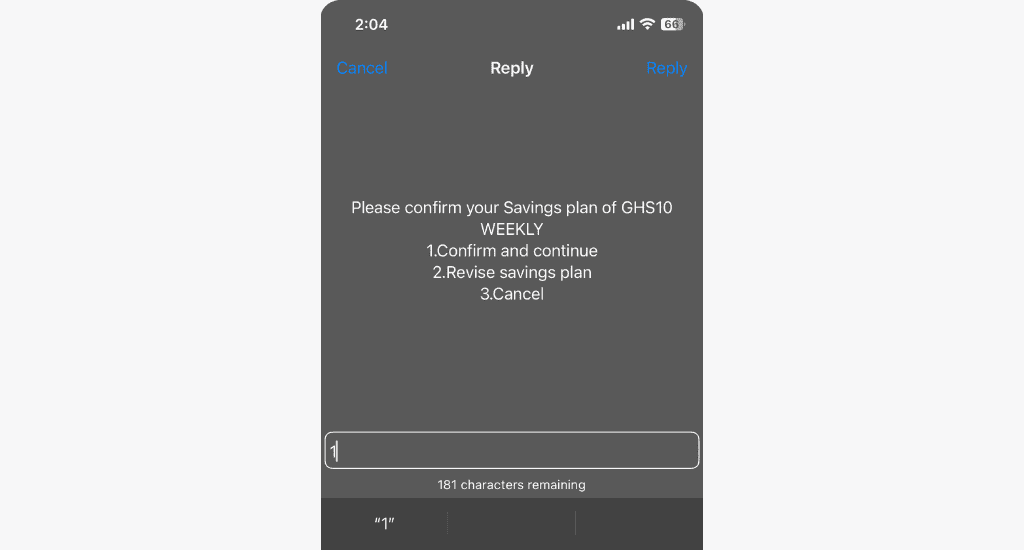

To do this, follow steps 1 to 4 above, then:

- Select Savings Plan.

- Select Create Savings Plan.

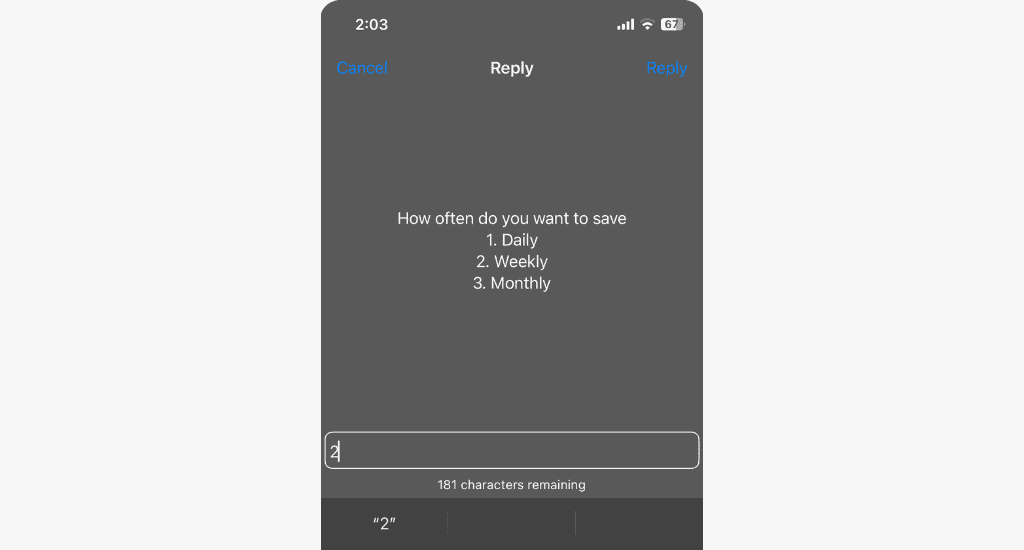

- Choose the preferred period for deposits.

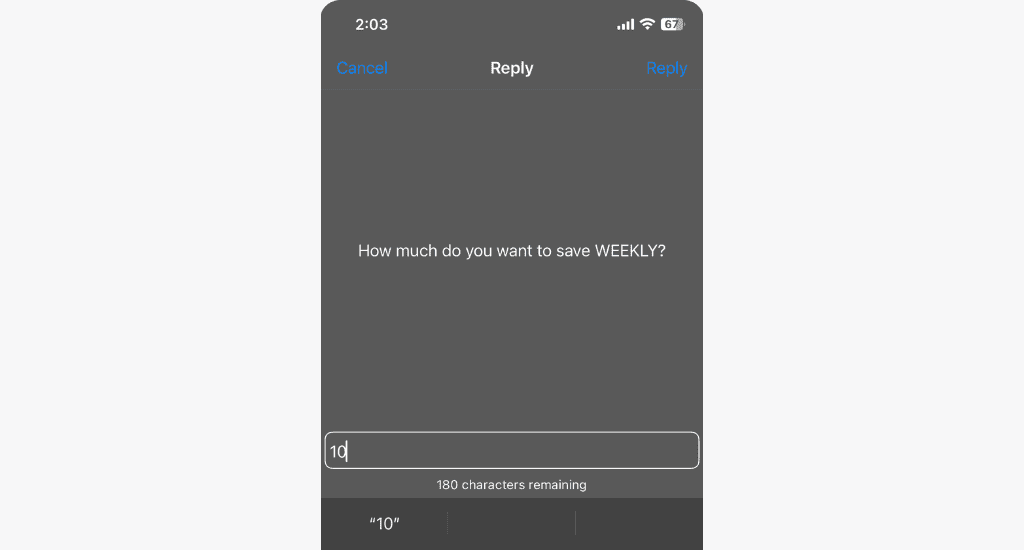

- Enter the amount you want to save.

- Select Confirm and continue.

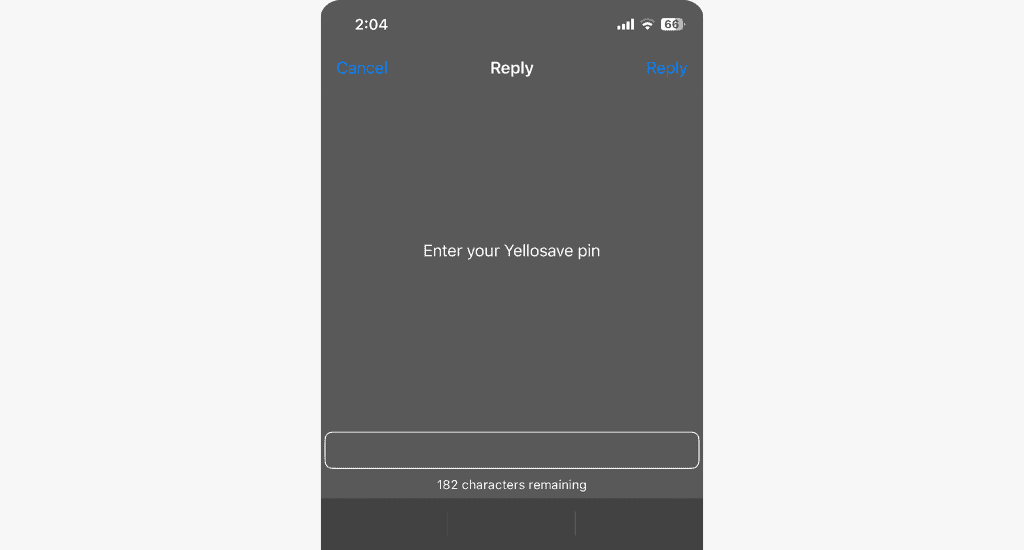

- Enter your Yello Save PIN.

- Enter your MTN MoMo PIN to approve your savings plan.

That’s it. MTN would automatically deduct funds from your MoMo wallet at your set interval to credit your Yello Save account.

How to withdraw money from MTN Yello Save?

Although Yello Save is designed to encourage saving, you can withdraw your money whenever you need it:

- Dial *170#.

- Select Financial Services.

- Select Savings.

- Select Yello Save.

- Select Withdraw.

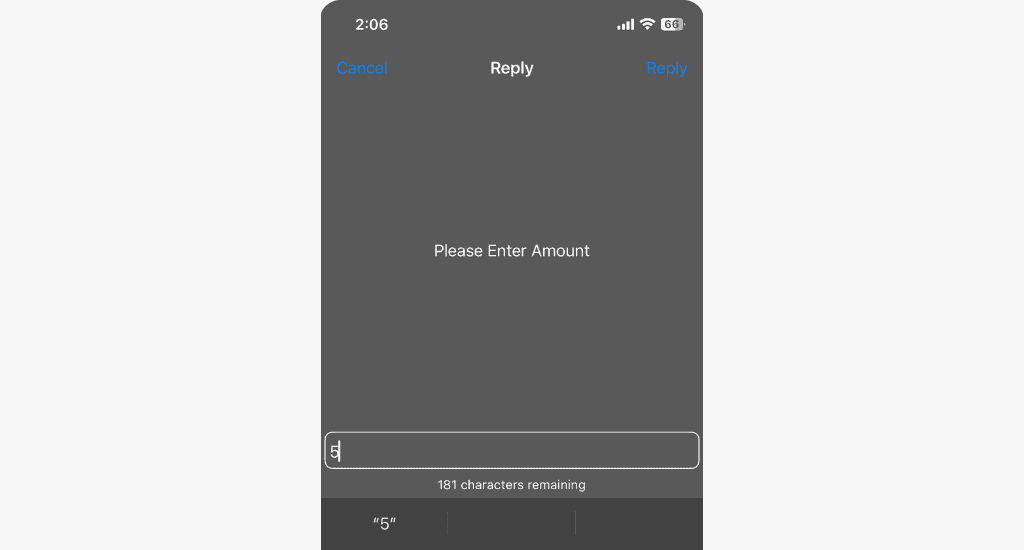

- Enter the amount you want to withdraw.

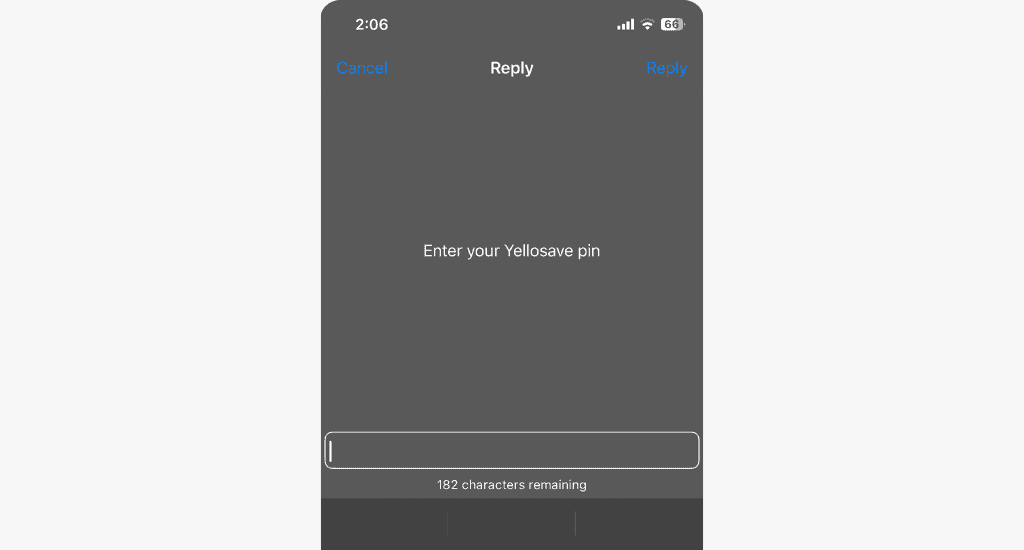

- Enter your your Yello save PIN.

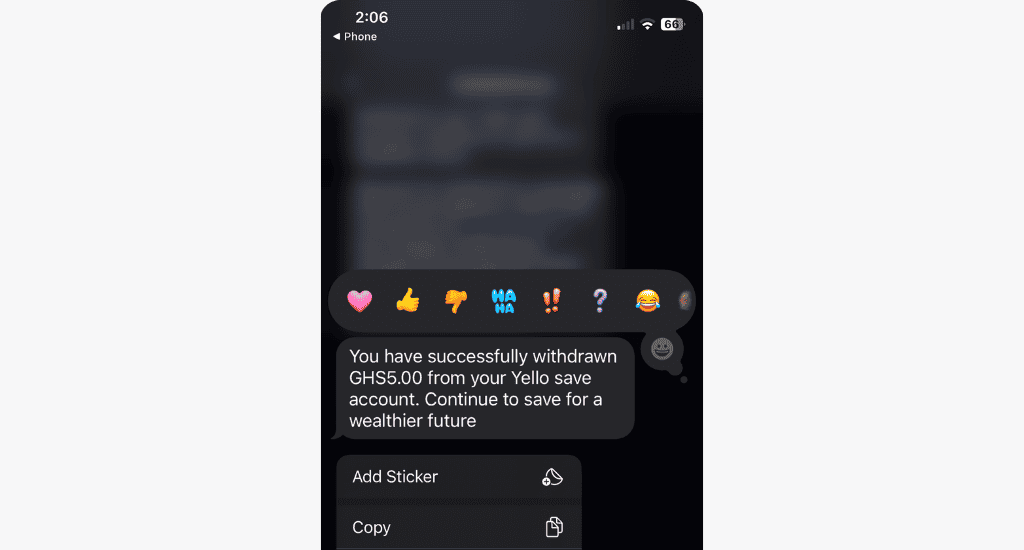

- Wait for the confirmation message.

It’s that simple—save when you want, withdraw when you need.

Must-know terms for using Yello Save

Before using Yello Save, it is important to understand these terms and conditions:

- If you make 3 or more withdrawals in any month, you’ll earn a flat interest rate of 3% per annum, regardless of your account balance.

- One month’s written notice must be provided to close your account. However, you must ensure that you have no outstanding liabilities.

- Fidelity Bank reserves the right to change interest rates without giving you prior notice.

- Fidelity Bank may terminate the banking relationship at any time with reasonable notice, except in cases of suspected fraud, impersonation, or forgery.

Other MTN MoMo savings options

MTN Ghana offers other avenues for customers to save. These include:

- MTN MoMo

- SIKA Save

- Pesewa Susu.

Unfortunately, SIKA Save and Pesewa Susu are yet to be rolled out.

MTN MoMo offers interest on your wallet balance every quarter depending on your transactions and available balance.

FAQs

Should I create a savings plan on Yello Save?

Yes, you should create a savings plan on Yello Save. Making your deposits automatic can help you develop discipline and achieve your goals faster.

How do I check my MTN Yello Save balance?

To check your MTN Yello Save balance, dial *170#, navigate to Financial Services, select Savings, then Yello Save, and choose Check Balance. Enter your PIN, and you’ll receive a notification with your balance.

Does MTN Yello Save have a limit on deposits?

No, there are no limits on deposits.

Conclusion

MTN Yello Save is a convenient, secure, and rewarding way of taking charge of your financial journey.

It’s perfect for anyone who wants to build their savings without the hassle of visiting a bank. So why not give it a try? Dial *170# and start saving today.

Share your experiences and questions with us in the comments

47 Comments. Leave new

Hello how can I reset my yellow save account

Hello Eric, please reach out to MTN concerning this for swift resolution.

They said my yello save PIN is blocked so I should contact system administrator,how?

Hello Emmanuel, you’ll need to reach out to MTN customer care directly for help with your blocked Yello Save PIN. They are the only ones who can reset or unblock it for you.

My yello save account is block and i don’t know why

Hello Emmanuel, we’ll recommend reaching out to MTN directly to help solve the issue.

Please l deposit money at yello saving I want to withdraw the money the money have reduce for 260 to 10.4 can any help

Hello Torsu, we’re unsure what happened. Please reach out to MTN directly concerning this for a resolution.

After the registration of the sikasave i can’t get access to it why please

Sorry, Angela. Are you still facing this issue?

I have already registered but my pin has blocked

Hi Hilda, sorry about this; please reach out to MTN customer care by calling 100 for further help.

I tried registering for yello save today but it’s not working? What may be the issue?

Hello Maame, what feedback/challenge do you encounter when you try registering?

I’ve been able to register now thank you . Can you please enlighten me on pesewa save and sika save ?

Glad to hear you were able to register successfully. 🙂

Pesewa Susu and Sika Save are both savings options, just like Yello Save. However, please note that Pesewa Susu is currently unavailable.

Sika Save is active and offers you 8%–10% interest annually. Your deposits are split 50% into Savings and 50% into Investments, but you can adjust this split anytime. You’ll see a prompt asking you to accept this when setting up the service.

Ow thank you very much . That answers why I’ve tried activating pesewa save for a while now but to no avail. Please bring back pesewa save 😔!

Haha! We’re happy we could help. 🙂

During the year which date and month do yello save give out the interest rate especially this year thanks

Hi Isaac, Y’ello Save interest is usually paid monthly, but MTN doesn’t publish the exact dates. It often appears around the end or start of the month.

Do I need to save daily before I can my interest or depends on what is in my yellow save account?

Hi Abdul, you don’t need to save daily to earn interest. The interest you earn on Yello Save depends on the total balance in your account, not how often you save.

Just keep money in the account, and it will grow over time with interest.

I initiated withdrawal from my yello save account of 200 cedis since 19th July and l didn’t receive it till now 21st July however the amount was deducted from my yello account. How do l contact you.

Hello Maud, your question is unclear. Can you please explain again what happened?

Hi please im unable to register for the savings

Hello Mary, is your situation resolved?

I haven’t been able to check my balance in my yellow save account for sometime now.

This is likely a temporary challenge, Victoria. We’d recommend reaching out to MTN directly if the situation isn’t resolved.

Please yello save is not letting me know the amount in my account

I will follow the process and still won’t give me the amount I have in the account

Please I want to know if there has been changes

Hello Mercy, this is likely a temporary challenge. Please wait a while and check again or reach out to MTN directly to learn more.

What amount can I earn to my money when I deposited 100 cedis in a week?

MTN’s Yello Save interest is paid monthly, so you’re likely not going to earn any money in the first week.

Please the 8% interest, will you be getting the interest motherly

Not exactly. Since the total interest rate is 8% per year, the monthly interest is approximately 0.6667% (8% ÷ 12). This means you earn about 0.6667% each month on your account balance, not the full 8% every month.

Is the an app for the yellow save or we always have to go through the *170#?

Unfortunately, there’s no dedicated app for MTN Yello Save. You can only use the USSD code to access the service.

Hi

How do I stop the transaction at the end of the year if I don’t want to continue, (or maybe along the line)?

You can always cancel your MTN Yello Save savings plan. Select Savings Plan, then Cancel to stop the transactions.

Supposed l deposit GH 1000 without any withdrawals for a (1) month, How much interest will earn on that amount?

If you deposit GHS 1000 at an annual interest rate of 5% with interest paid monthly, you’ll earn about GHS 4.17 in one month.

ĺet me teach math , 1000×0.05=Ghc50 in month

Well, not really. The calculation you used is for a full year, not one month.

The annual interest rate for account balances below GHS 1000 is 5%, so for one month you’d earn: 1000 × 0.05 ÷ 12 = GHS 4.17 approximately.

Was having gch 1825 in my yello save account I just applied for daily automatic deduction for ghc2.00 ,it was done successfully but instead of my money becomes 1827 it just came as 1826.26 ,I dnt understand

Hello Emmanuel, this is likely due to some charge/fee. Please reach out to MTN directly to learn more.

Forgot my pin .

Please reach out to MTN concerning this.

Good