Key takeaways

- MTN is the only telecom company in Ghana offering its shares to the public.

- MTN’s share price was GHS 1.56 on April 10, 2024. At the initial public offering (IPO) in 2018, it was GHS 0.75.

- You can buy MTN shares through MTN MoMo or licensed brokerage firms like IC Securities, Fidelity Bank, and Black Star Brokerage Limited.

MTN offers an exciting opportunity for Ghanaians to purchase its shares. This lets you invest in the company’s growth and potentially benefit from its success.

However, the process of purchasing MTN shares can be daunting for newcomers. In this guide, we will equip you with the knowledge to confidently navigate the process of buying MTN shares in Ghana.

MTN Ghana shares: What to know

MTN has proved itself a market leader as it’s the only telecommunications company in Ghana that sells its shares and is listed on the Ghana Stock Exchange.

This allows you to invest and share in the company’s growth through dividends and share value appreciation. You can purchase and sell MTN shares through brokerage firms or online trading platforms, subject to market conditions and regulatory requirements.

Buying shares from MTN, however, carries its risks. Therefore, conduct thorough research, understand the company’s financial performance, and consider your investment goals and risk tolerance before investing.

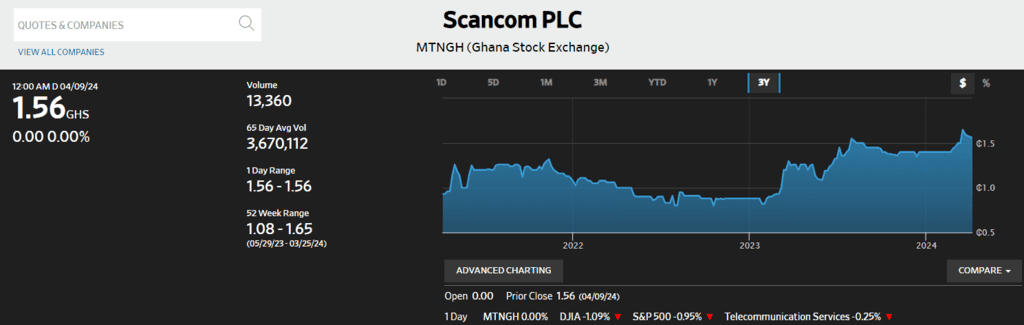

MTN Ghana (MTNGH) stock price

MTN’s share price has shown a generally positive trend with consistent growth. This reflects the company’s strong performance in the African telecommunications market. It has moved from 0.75 pesewas at the initial public offering (IPO) in 2018 to GHS 1.56, as at April 10, 2024.

However, past performance is not necessarily indicative of future results, and MTN shares fluctuate based on market conditions and company performance. You can find the current share price at any point on the Ghana Stock Exchange or other brokerage firms’ online platforms.

How to buy MTN shares in Ghana?

You can buy MTN shares in two ways: through your mobile money or a brokerage firm. Let’s discuss this further.

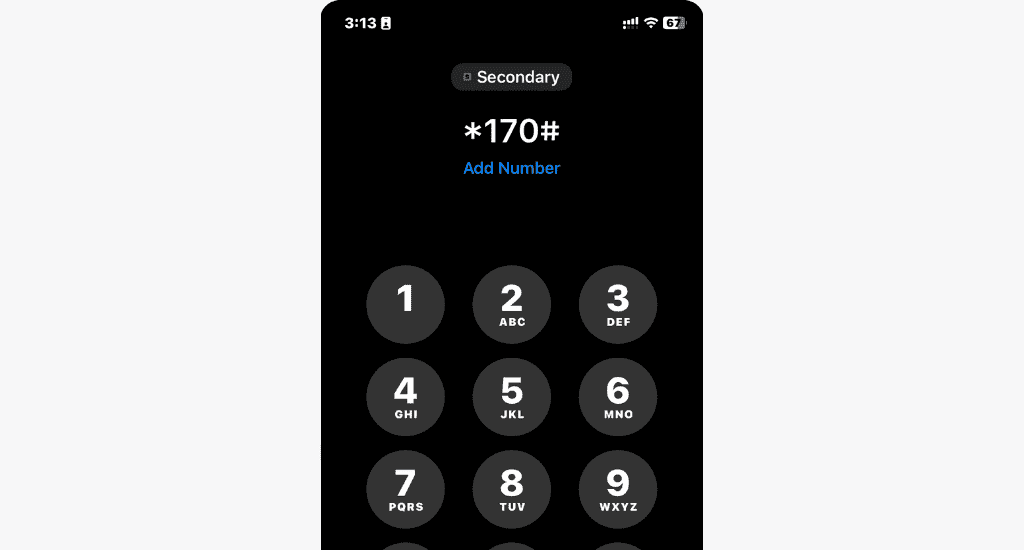

Method #1: Through mobile money

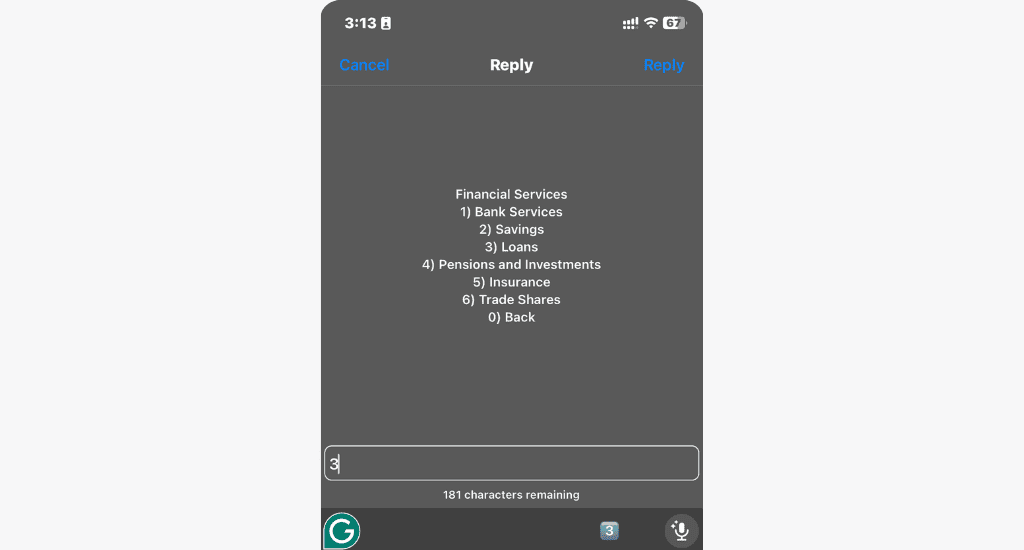

Here’s how to buy MTN shares using MoMo:

- Dial *170#.

- Select Financial Services > Trade Shares.

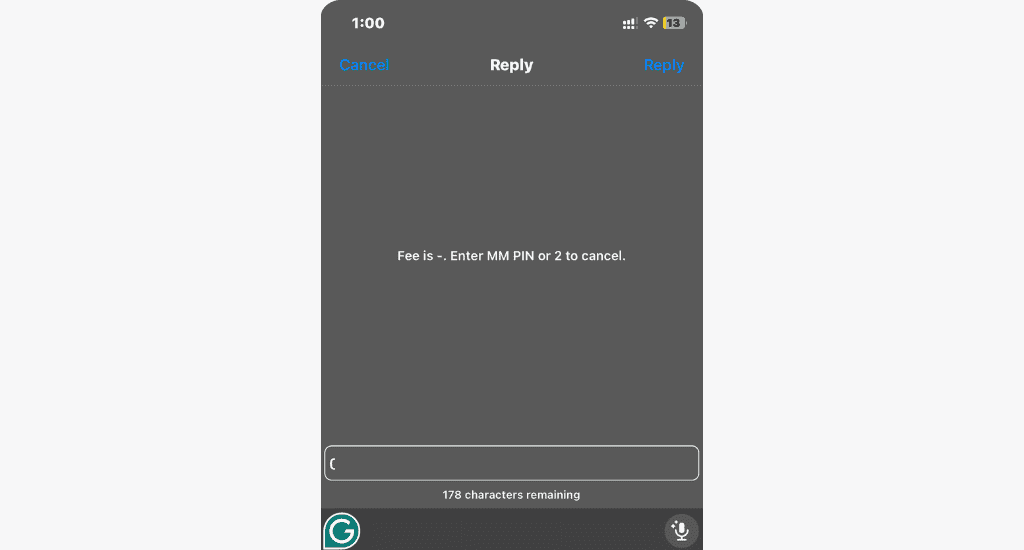

- Enter your MoMo PIN.

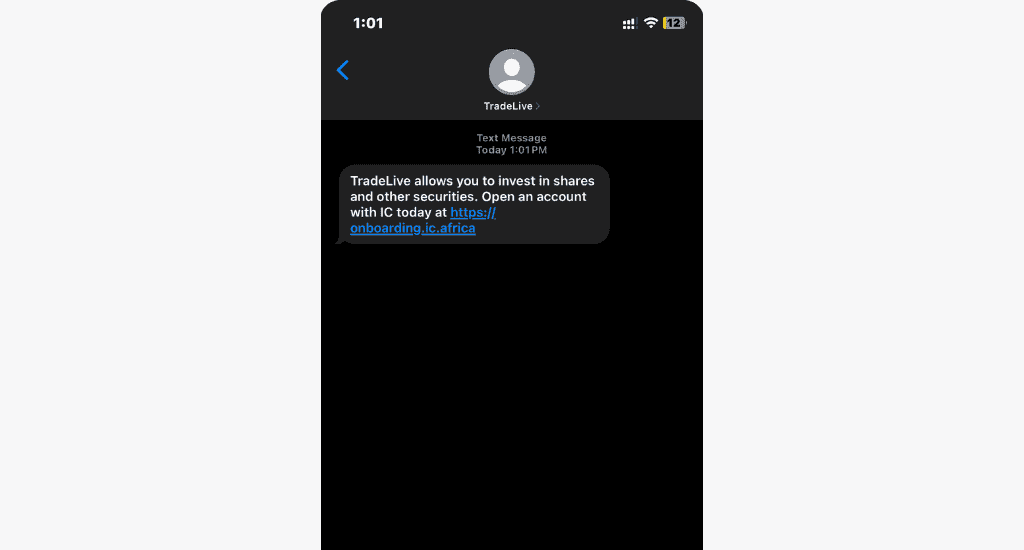

- You’ll receive an SMS with a link to register.

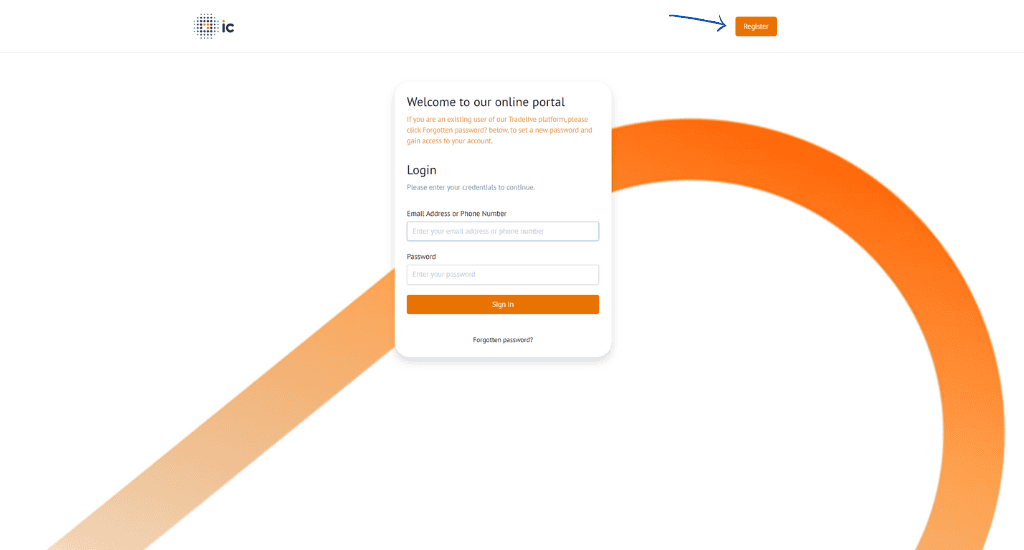

- Tap on the link to open and click on Register.

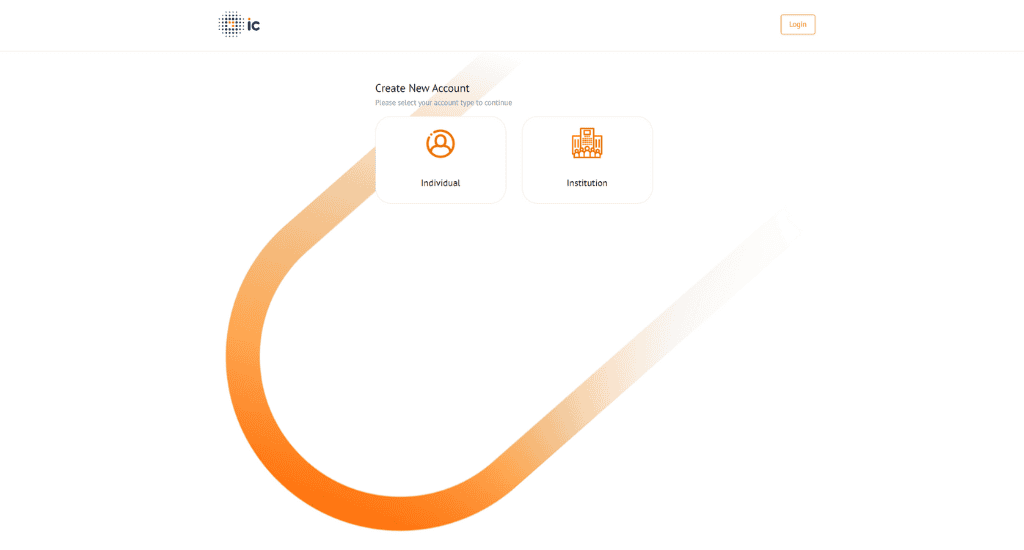

- Select your account type and fill out the form to register.

After registration, you can now purchase your shares. The amount will be deducted from your MoMo wallet, and the number of shares will be delivered to your Central Securities Depository (CSD) account with the Ghana Stock Exchange.

Method #2: Through a broker

Brokerage firms act as intermediaries, connecting the investor to the companies whose shares you want to buy or sell on the stock exchange. Here’s how to buy MTN shares through a brokerage firm:

Step 1: Choose a brokerage firm

Licensed brokerage firms in Ghana include IC Securities, Cal Bank, Fidelity Bank, and Black Star Brokerage Limited. Factors to consider when selecting a brokerage firm include fees, account minimums, investment options, trading platforms, and customer service.

Step 2: Open an account

After choosing a firm, open an account. This involves filling out an application and providing personal information, such as name, address, social security number, and identification.

Step 3: Fund your account

Before you can buy MTN shares, you’ll need to fund your brokerage account. This can be done via bank transfer, MoMo, or sometimes credit/debit card, the latter often incur additional fees.

Step 4: Place your order

This can usually be done through your brokerage’s online trading platform. Simply enter the ticker symbol of MTN (MTNGH), specify the number of shares you’d like to purchase, and place the order. Once your order is placed, your brokerage will execute the trade on your behalf.

Step 5: Confirmation

You will receive a confirmation of your order and its execution within a designated timeframe (usually 3-5 business days) by SMS.

What are the benefits of buying MTN shares?

Buy MTN shares, like any other company shares, offers many advantages. These include:

- Ownership: As a shareholder, you gain a stake in the company. This gives you the power to vote on important decisions.

- Dividends: A dividend is a cash reward given to investors as part of the profit made in a financial year. This offers an additional income stream for the shareholder.

- Capital gains: Capital gains are the profits an investor gains from selling their investments. When share prices increase, you can sell some or all of your shares at a higher price than when you bought them, thereby making a profit on the capital you invested.

FAQs

How many MTN shares can I buy?

You can buy as many MTN shares as you want, but a minimum of 10 shares.

Does MTN pay dividends on shares?

Yes, MTN Ghana pays dividends per share owned twice a year.

Disclaimer: The content provided in this article is for informational purposes only and should not be considered financial advice. We are not financial advisors, and the information presented here is not intended to serve as personalized investment guidance.

Conclusion

Investing in stocks has risks. We recommend conducting proper research or consulting with a qualified financial advisor before making any investment decisions. Seek professional advice tailored to your specific financial situation and investment objectives.

But if you’re sure of your decision, we hope this guide was helpful to begin your share investment journey with MTN Ghana. Don’t hesitate to share your feedback and experiences in the comment section below, they’re valuable to us.

33 Comments. Leave new

I’m outside Ghana without Ghana card,can still open brokerage account?

We recommend researching the brokerage firms in Ghana, it’s very likely not all require a Ghana Card before registration.

Please am interested in The buying

some of the MTN share.

Our guide above details the procedure to purchase shares from MTN.

Does mtn pay dividend on shares weekly, if yes how is it calculated

MTN Ghana does not pay dividends on a weekly basis. Instead, dividends are declared and paid out at specific intervals, i.e., sometimes quarterly or on annual basis.

The formula for calculating your total dividend is Dividend per Share × Number of Shares Owned. So for example, if you own 100 shares and the declared dividend is GH₵ 0.225 per share:

Total Dividend = GH₵0.225 × 100 = GH₵22.50

Let i buy 200 shares a year how much dividends can i make

This depends on the amount MTN pays per share, as it is not a fixed figure. For example, in May 2023, MTN announced a dividend of GHS 0.124 per share. If you own 200 shares, this amount multiplied by 200 would earn you GHS 24.80 as your total dividend.

Hi can I decide not to sell my shares but rather gain from the dividend I will be getting?

Yes, you can choose to keep your shares and earn money from the dividends instead of selling them. This way, you still get some income.

Share and T’bill which one will you recommend for me, give reasons.

Thank you

We cannot recommend which one to choose, but you can decide by thinking about how comfortable you are with risks, what you want to use the money for, and how long you plan to keep it invested.

Does a person below 18yrs qualify to own mtn shares

Yes, if you’re under 18, you can own MTN shares, but only with a parent or guardian managing them for you until you turn 18.

I’m Johnny and I’ve read your article on how to buy and sell shares from MTN. My question to you is if you’re living or staying outside of Ghana how can you buy your shares and monitor it? Thank you.

Hello Johnny, to trade MTN shares (Scancom PLC) outside Ghana, you’ll need to find a broker or investment platform in your country that allows trading on the Ghana Stock Exchange.

How do one sell it shares when price goes high

Same way you bought it, Isaiah. If you bought it through MoMo, you’ll have the option to sell via MoMo and if you did so with a broker, you can sell the shares through the broker.

Pls, buying shares through a broker and buying through momo, which one is ideal and safe?

Both methods of buying shares are equally safe. When you purchase shares through MTN MoMo (Mobile Money), MTN works with IC Wealth, who acts as their broker. While using MoMo is more convenient than going directly through a traditional broker, both approaches are secure and protected by financial regulations.

Please I have dail the code but no SMS from MTN office

Please contact MTN customer care for further assistance.

Same with me

Can one buy mtn shares on monthly?

Yes, you can buy MTN’s shares monthly.

I wanted a clear understanding of how I can benefits with the purchase of the shares

Hello Solomon,

When you buy shares, you own a small part of a company. This can help you make money in two ways:

1. First, if the company does well, they may give you some of their profits, called dividends.

2. Second, if the value of the shares goes up, you can sell them for more than you bought them to make profit.

Let’s say you bought MTN Ghana shares at GHS 1.56 per share in 2023 and the price increases to GHS 2.56 in 2024. You can sell your shares to make a profit of GHS 1.00 per share (GHS 2.56 selling price – GHS 1.56 buying price).

But while buying shares can help your money grow and give you extra money sometimes, when the share price drops, you’ll also loose money.

What are the disadvantages of buying mtn shares

The primary disadvantage of buying MTN shares is losing your principal when the share price falls below how much you bought it for.

For example, if you bought ten shares when it sold for GHS 1.56 and the price drops to GHS 1.40, the value of your investment will decrease accordingly. In this case, the total value of your ten shares would now be GHS 14.00, compared to the GHS 15.60 you initially invested.

Stock prices naturally go up and down due to market conditions, company performance, and other external factors. However, if you have the patience and the stomach for the volatility, you can wait it out and benefit from future price increases.

How much profit do I get per share?

As explained above, if, for example, you bought MTN Ghana shares at GHS 1.56 per share in 2023 and the price increases to GHS 2.56 in 2024. You can sell your shares to make a profit of GHS 1.00 per share (GHS 2.56 selling price – GHS 1.56 buying price).

What is the current price per share

MTN’s share price as of 12th June, 2025 is ₵2.85. You can follow it here.