Mobile money enables individuals to send, receive, save, and manage their finances using their mobile phones.

Since its launch in 2009, Ghana’s mobile money ecosystem has grown to over 74 million registered accounts, with nearly 60% of adults actively using the service, processing GH₵1.92 trillion in transactions annually and contributing 9.3% to the nation’s GDP.

Key takeaways

- The mobile money market is projected to reach USD 934 billion by 2033, doubling every 4 years.

- Mobile money contributed 9.3% to Ghana’s GDP in 2023, amounting to $530 per capita.

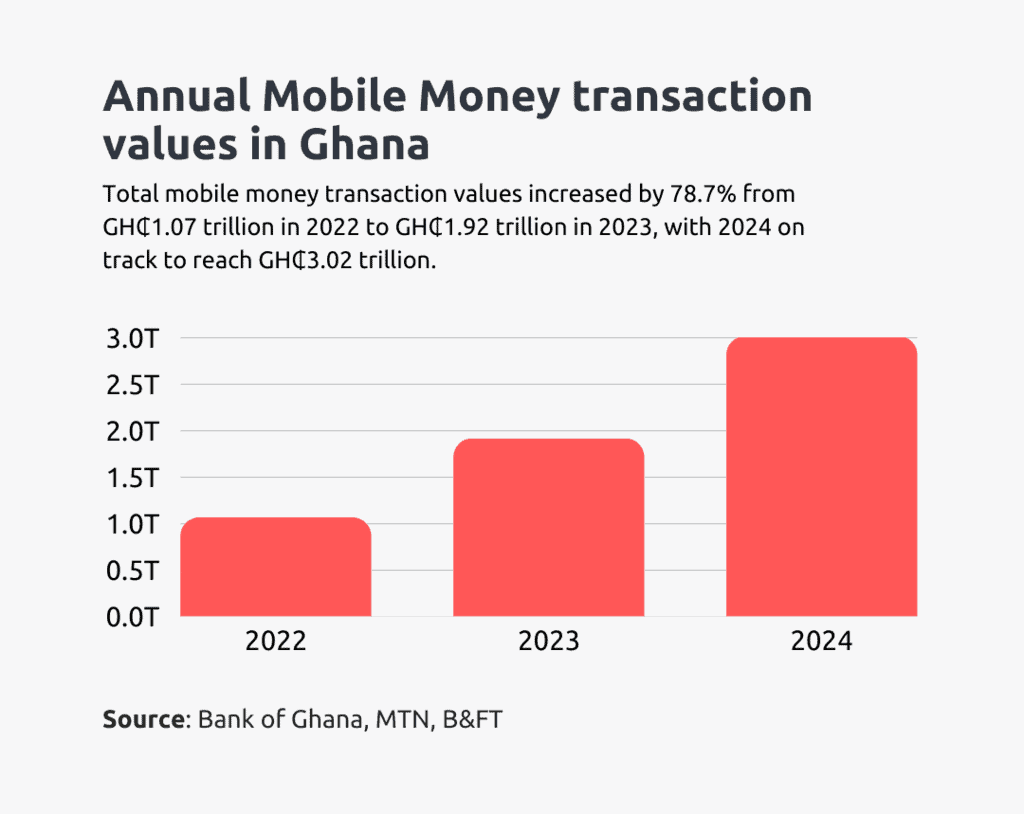

- Total mobile money transaction value rose from GH₵1.07 trillion in 2022 to GH₵1.92 trillion in 2023.

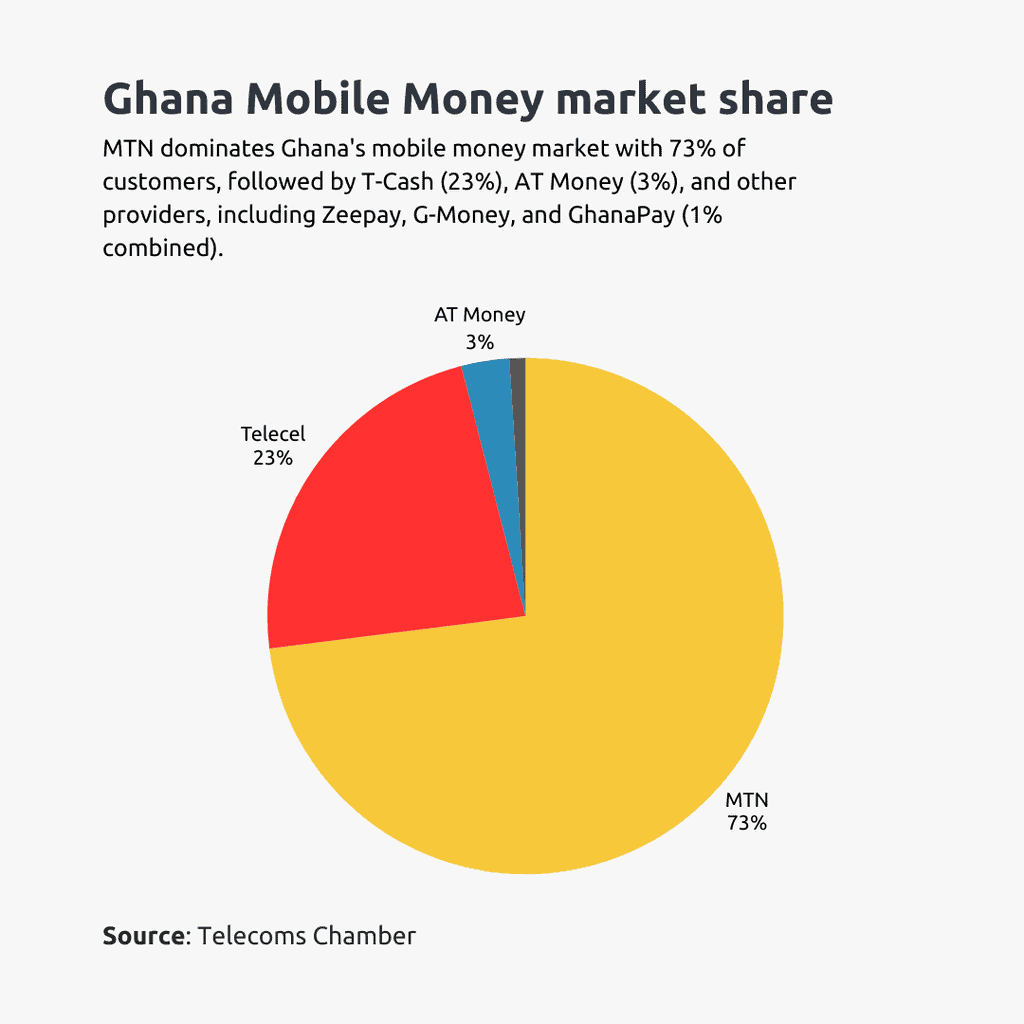

- MTN dominates with 73% market share and 89% of mobile financial services revenue.

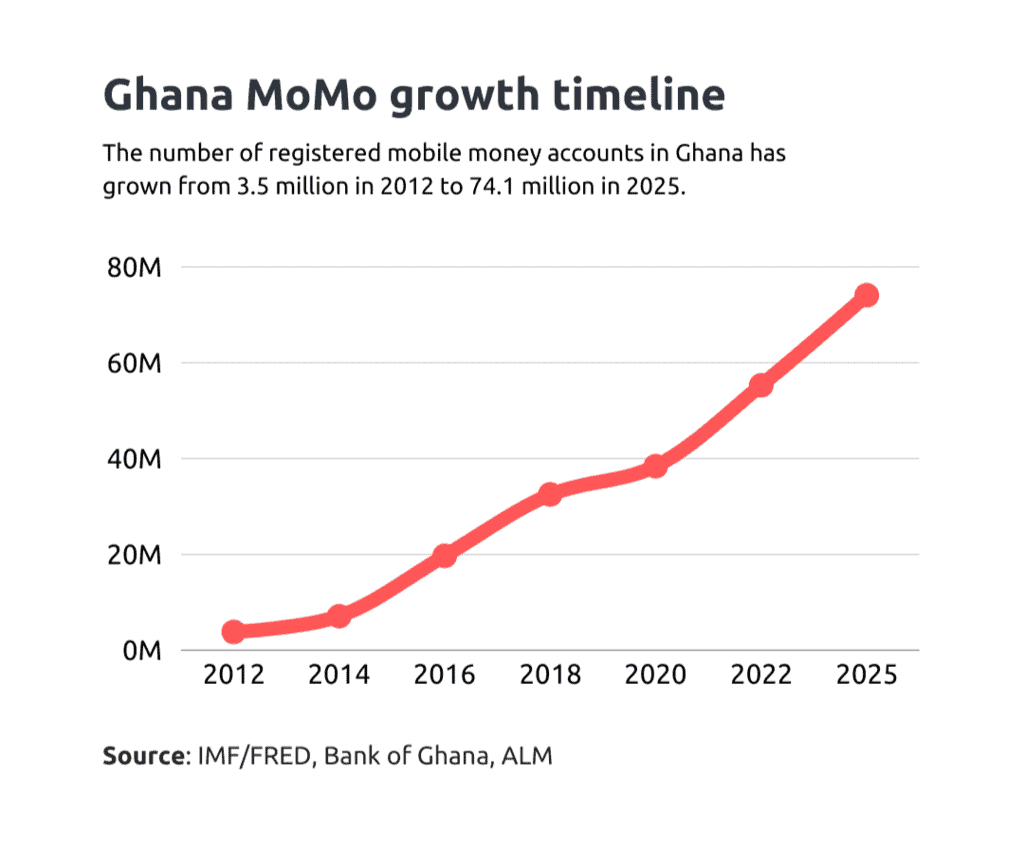

- As of 2025, there are 74.1 million registered mobile money accounts.

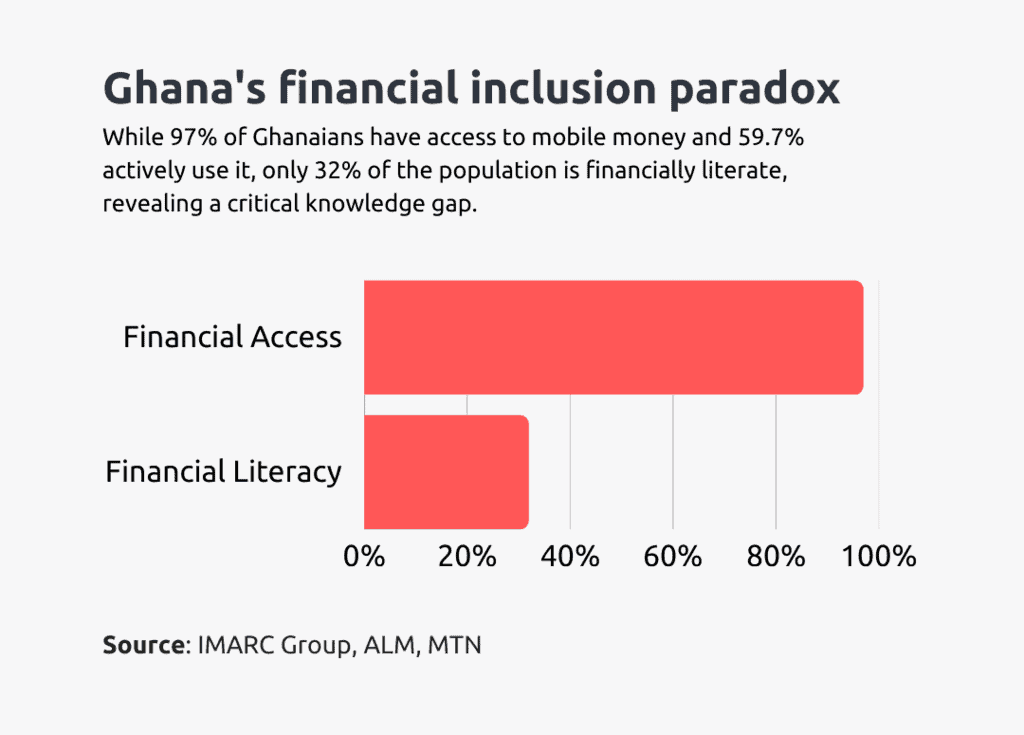

- 59.7% of adults in Ghana actively use mobile money, though only 32% are financially literate.

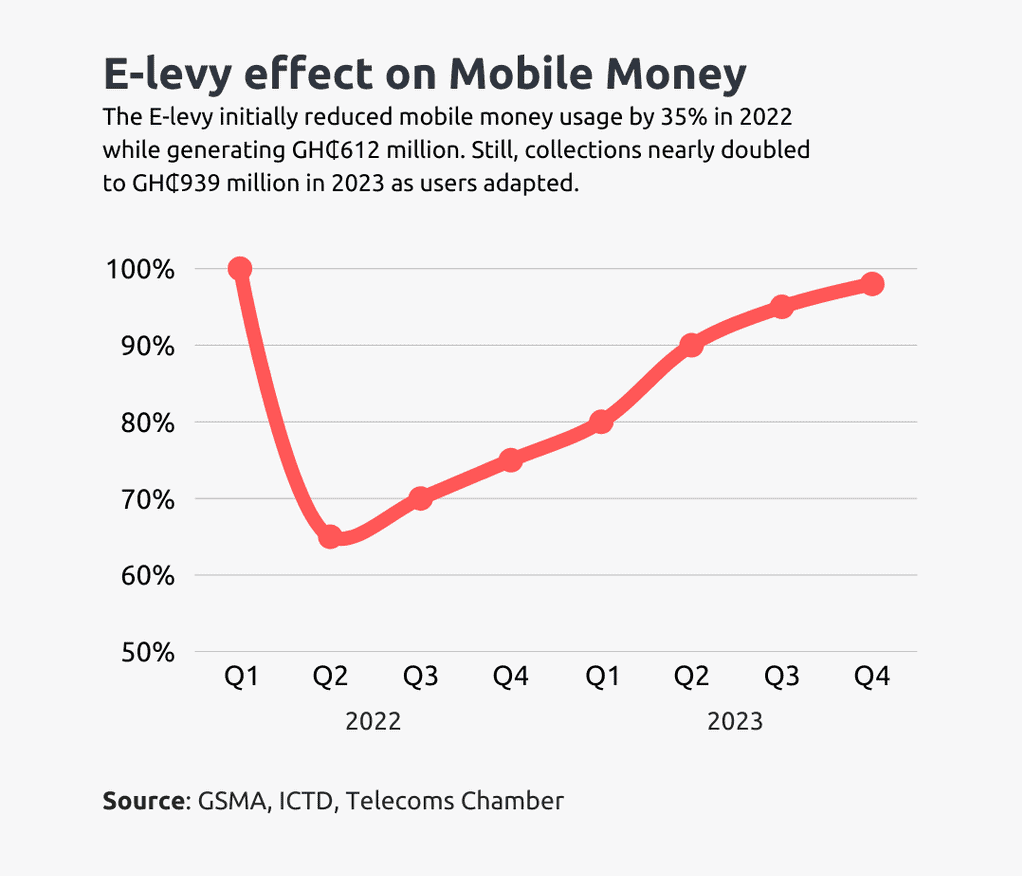

- The implementation of the E-levy in 2022 initially reduced mobile money use by up to 35%, but collections nearly doubled in 2023.

- Wallet-to-wallet transfers were the highest revenue-generating transaction type in 2023, contributing GH₵27.2 billion.

- Cross-border mobile money transfers to Nigeria began pilot testing in early 2025.

Historical background

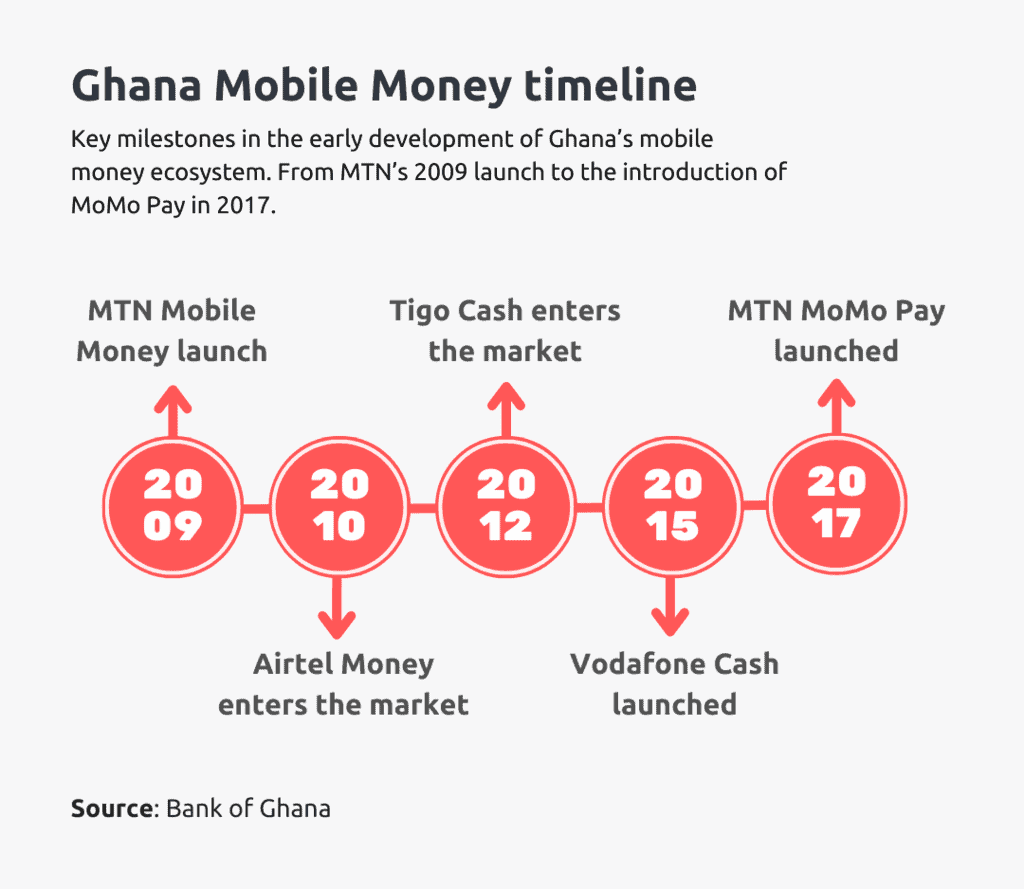

1. MTN mobile money was officially launched in July 2009. (Bank of Ghana, Modern Ghana)

Under the leadership of then-CEO Brett Goschen, MTN Ghana launched its Mobile Money service on 21 July 2009, in partnership with Universal Bank. This established the blueprint for mobile digital financial services in Ghana.

2. Airtel and Tigo entered the mobile money market in 2010 and 2012, respectively, and later merged to form AirtelTigo Money in 2017. (Bank of Ghana, World Remit)

Airtel Ghana launched its mobile money services in 2010, with Tigo following suit in 2012. To strengthen their competitive position, the two merged in 2017 to form AirtelTigo Money, creating a single brand with about 400 retail outlets nationwide.

3. Vodafone Cash followed suit in 2015, rebranding to Telecel Cash after the 2023 acquisition. (World Remit, Telecel)

Vodafone Ghana introduced Vodafone Cash in 2015 and rapidly grew to over two million customers. When Telecel Group acquired Vodafone Ghana in February 2023, the service transitioned to Telecel Cash, preserving Vodafone’s user base under the new ownership.

4. MTN Mobile Money and AirtelTigo Money achieved International Organisation of Standardisation (ISO) certification in 2016, boosting user trust. (News Ghana, Africa Business)

Both MTN and AirtelTigo Mobile Money achieved ISO/IEC 27001:2013 certification in 2016, a globally recognised standard for information security management. Such accreditation signalled robust data-protection practices, thereby enhancing user trust.

5. In 2016, MTN had the most mobile money agents in Ghana. (Bank of Ghana)

MTN’s early lead extended beyond users to physical presence, controlling over half (54%) of mobile money agents nationwide in 2016. Tigo Cash followed with 24.9%, Airtel Money with 11%, and Vodafone Cash with 10.1%.

6. MTN launched MoMo Pay in January 2017. (GSMA)

By introducing MoMo Pay in 2017, MTN allowed businesses to receive payments via mobile money, integrating digital wallets into everyday commercial transactions.

7. MTN Mobile Money revenue almost doubled in 2023. (Statista, MTN, TechFocus24)

MTN commanded 89.3% of all Mobile Financial Services (MFS) revenue in Ghana in 2022, generating about GH₵1.9 billion. By 2023, this revenue had risen sharply to more than GH₵2.8 billion.

8. MTN Mobile Money revenue grew over 200% from 2019 to 2023. (Statista)

MTN Ghana’s mobile money revenue has experienced remarkable growth of more than 200% since 2019, reaching GH₵2.8 billion (approximately $181 million) in 2023, demonstrating sustained expansion of the service.

9. In 2024, MTN Mobile Money increased customer transaction and balance limits. (Graphic Online)

In 2024, MTN Mobile Money customers’ daily transaction limits and account balance limits were increased following a review aimed at facilitating free-flow transactions, as approved by the Bank of Ghana.

10. Vodafone Cash introduced free interoperability for small transfers in 2020. (The Business and Financial Times).

In 2020, Vodafone Cash became the first provider in Ghana to enable its customers to send money below GH₵100 to all networks free of charge. This move aimed to reduce the financial burden on customers during the COVID-19 pandemic.

11. COVID-19 lockdowns in 2020-2021 drove massive mobile money adoption for contactless transactions. (MTN)

The coronavirus pandemic marked a critical juncture for mobile money growth, as physical distancing measures and banking disruptions prompted millions to shift toward digital payments for everyday transactions, government support disbursements, and bill settlements.

12. Despite smaller market shares, Vodafone Cash and AirtelTigo Money continued to innovate and contribute to inclusion. (TechFocus24)

In 2022, Vodafone Cash earned approximately GH₵66 million in revenue, representing 3% of MFS revenue in Ghana, while AirtelTigo Money generated approximately GH₵42 million, representing 1.97% of MFS revenue in Ghana.

Penetration and user base

13. In 2025, 74.1 million mobile money accounts were registered, up from 66.9 million in 2024. (African Leadership Magazine)

The total number of mobile money accounts climbed by 10.8% in one year, reflecting both new customer sign-ups and multiple wallet registrations per user.

14. Mobile money accounts grew from 65.6 million in 2023 to 74.1 million by 2025. (IMF/FRED, African Leadership Magazine)

Registered mobile money accounts in Ghana showed consistent growth from 65.6 million in 2023 (per IMF data) to 66.9 million in 2024, then jumped to 74.1 million by 2025, reflecting a 13% growth over two years.

15. MTN is the market leader in mobile money, with the largest customer base in Ghana. (Telecoms Chamber)

MTN Mobile Money has over 13 million mobile money customers, representing approximately 73% of the market. In contrast, Telecel Cash has 23%, AT Money has 3%, and Zeepay, G-Money, and GhanaPay jointly hold the remaining 1% of customers.

16. MTN Ghana is the country’s largest company by market capitalisation. (Statista)

MTN Ghana (Scancom PLC) holds the position as Ghana’s largest company by market capitalisation, maintaining its dominance in both telecommunications and mobile financial services.

17. MTN MoMo has expanded to 14 African countries by June 2025. (MTN)

MTN’s mobile money service now operates across 14 African nations, establishing the company as a key driver of continental financial inclusion and digital payment adoption.

18. Zeepay raised USD 18 million in debt financing in 2025 to expand in Africa and the Caribbean. (Daba Finance, TechFocus24)

Zeepay used fresh funds to expand its network and introduce new services. After earning 5.7% (GH₵120.4 million) of Ghana’s mobile money revenue in 2022, it aims to challenge larger providers both at home and abroad.

19. In 2024, the mobile money market in Ghana was valued at $192.24 billion. (Openpr)

The Ghana mobile money market was valued at USD 192.24 billion in 2024 and is estimated to grow at a rate of 18.24% from 2025 to 2033.

20. Sub-Saharan Africa mobile money platforms processed over $1.4 trillion in 2023. (MTN)

The region dominated global mobile money activity in 2023, processing transactions worth more than $1.4 trillion, underlining Africa’s position as the world’s leading mobile money market.

21. MTN Group’s MoMo service experienced fluctuations in active user numbers between late 2023 and mid-2024. (Statista)

By the second quarter of 2024, MTN Group’s Mobile Money service (MoMo) had around 66 million active users across its markets, a slight increase of about half a million from the previous quarter. However, this was down from a peak of over 72 million users in the fourth quarter of 2023.

22. MTN Ghana ranks fourth in subscriber base within the MTN Group. (Statista)

Within the MTN Group’s operations, Ghana ranks fourth in total subscriber base after Nigeria, Iran, and South Africa, with voice services leading in subscriptions, followed by data, mobile money, and digital services.

23. Nearly 60% of Ghanaian adults actively use mobile money, totalling 15.2 million users. (African Leadership Magazine, MTN)

Mobile money usage reaches 59.7% of adults in Ghana, who rely on digital wallets for payments, transfers, and savings, with the country expected to maintain 15.2 million active users by 2025.

24. Ghana has approximately 896,000 registered agents, though active agent numbers vary by source. (African Leadership Magazine, MTN)

While Ghana maintains around 896,000 registered mobile money agents, activity levels differ across reports.

African Leadership Magazine estimates 411,000 operational agents (46%), whereas MTN indicates that its network includes 228,000 agents nationwide.

25. Ghana gained a Mobile Money Regulatory Index (MMRI) score of 95.06% in 2024. (GSMA)

Ghana’s leading position on the GSMA MMRI reflects clear licensing frameworks, strong customer protections, and laws that make it easy for different mobile money networks to work together.

26 There was growth in mobile money interoperability in Ghana in 2024. (Techpoint Africa)

Cross-network mobile money transfers increased from Gh₵2.3 billion in December 2023 to Gh₵3.1 billion by the end of 2024.

27. Hubtel ranked 30th among Africa’s fastest-growing companies in 2024. (Financial Times)

Hubtel’s strong growth highlights how fintech firms, not just big telecoms, are shaping Ghana’s mobile money sector.

Transaction volumes and growth trends

28. There was an increase in the value of mobile money transactions in Ghana in 2024. (Mobile Money Africa)

Ghana’s total mobile money transaction value rose from GH₵199.3 billion in December 2023 to GH₵334.8 billion in December 2024. This 68% year-on-year increase signals strong momentum in digital financial activity.

29. Ghana and Côte d’Ivoire led West Africa’s mobile money surge, growing 12 percentage points faster than East Africa in 2023. (MTN)

The mobile money landscape shifted westward in 2023, as Ghana and Côte d’Ivoire’s growth rates exceeded those of East African markets by 12 percentage points, challenging the region’s traditional leadership in digital financial services.

30. Ghana’s mobile money transactions grew 78.7% to reach GH₵1.92 trillion in 2023. (Bank of Ghana, MTN)

Ghana recorded remarkable mobile money expansion in 2023, with transaction values jumping 78.7% from GH₵1.07 trillion in 2022 to GH₵1.92 trillion, while transaction volumes climbed from 5.07 billion to 6.81 billion.

The growth benefited from enhanced Mobile Money Interoperability (MMI) capabilities, enabling smooth cross-network transfers.

MMI transaction values grew from GH₵26.4 billion to GH₵32.8 billion during this period, with volumes increasing from 138.6 million to 171.4 million.

31. There was an increase in the average mobile money transactions per day in Ghana in 2023. (Bank of Ghana)

The average mobile money transactions per day in Ghana increased from 13,883,599 in 2022 to 18,646,575 in 2023.

32. There was an increase in the total value and volume of transactions conducted through mobile money interoperability in Ghana in 2025. (Bank of Ghana)

In April 2025, the total volume of mobile money transactions in Ghana increased to 23.1 million, up from 16.1 million in April 2024. The total value of transactions also rose from Gh₵2.4 billion in April 2024 to Gh₵4 billion in April 2025.

33. Wallet-to-wallet transactions contributed the highest to mobile money revenue in Ghana in 2023. (Statista)

In 2023, wallet-to-wallet transactions contributed the highest amount, approximately GH₵27.2 billion, to mobile money revenue, followed by wallet-to-bank payments.

34. There was an increase in mobile money float balance in June 2024 despite a slight decline in transaction value and volume. (Bank of Ghana)

The float balance, which represents the total amount of electronic money available to service providers, increased from GH₵21.13 billion in May 2024 to GH₵22.16 billion in June 2024.

However, during the same period, the transaction value decreased from GH₵234.3 billion to GH₵224 billion, and the transaction volume declined from 668 million to 644 million, both by approximately 4%.

This divergence may suggest people made fewer transactions and spent slightly less overall, possibly influenced by seasonal spending patterns or broader economic factors, even though the system itself remained well-funded.

35. Agent-to-agent transactions contributed the most to total transaction value in the second quarter of 2024, while third-party transfers led in transactions. (Bank of Ghana)

In Q2 2024, agent-to-agent transactions accounted for approximately 34% of mobile money value, followed by third-party transfers with 16%, and cash-out transactions with 11%.

In terms of volume, third-party transfers accounted for approximately 17%, with person-to-person transfers, airtime top-ups, and data or product purchases following at 16%.

36. There was an increase in the total volume and value of mobile money transactions in Ghana during the first half of 2024. (Bank of Ghana)

Mobile money transaction volume increased from 3.19 billion in the first half of 2023 to 3.80 billion in the first half of 2024. Similarly, transaction value rose from GH₵901.40 billion to GH₵1.237.30 billion over the same period.

37. In the second quarter of 2024, most transaction categories recorded value increases compared to the first quarter, except wallet-to-bank transfers. (Bank of Ghana)

The changes that occurred in the second quarter of 2024 compared to the first quarter of 2024 are depicted below:

| Transactions | 2024 first quarter (GH₵) | 2024 second quarter (GH₵) | Change |

| Agent-to-agent | 171.19 billion | 228.03 billion | 33% increase |

| Third-party | 96.22 billion | 103.42 billion | 7% increase |

| Bank-to-wallet | 42.60 billion | 47.17 billion | 11% increase |

| Cash-out | 64.34 billion | 73.21 billion | 14% increase |

| Cash-in | 55.69 billion | 63.59 billion | 14% increase |

| Wallet-to-bank | 39.19 billion | 33.88 billion | 14% decrease |

38. In 2022, Zeepay’s transaction value in Ghana increased. (TechFocus24)

Zeepay’s total value of transactions rose by 52.6% from US$1.9 billion in 2021 to US$2.9 billion in 2022.

Economic impact of mobile money

39. Mobile money contributed 9.3% to Ghana’s GDP in 2023. (GSMA)

In 2023, mobile money contributed an additional $17 billion to Ghana’s GDP, a 13% increase over 2022’s total GDP.

This contribution amounted to 9.3% of total GDP, placing mobile money on par with major sectors such as manufacturing and transport. It also contributed an additional $530 to GDP per capita in that same year.

40. High mobile money adoption areas showed 12% more local economic activity in 2023. (World Bank via MTN)

According to a World Bank study from 2023, local markets in regions with strong mobile money penetration demonstrated 12% greater economic activity than those with limited adoption, highlighting the service’s multiplier effect on local economies.

41. Mobile money now reaches 97% of Ghanaians, yet financial literacy remains low. (IMARC Group)

Nearly the entire population has access to mobile money, yet only about 32% of the population is financially literate. This highlights a significant gap in the ability to make informed financial decisions.

42. MTN Mobile Money contributed approximately one-fourth of Ghana’s total service revenue in 2024. (Techpoint Africa)

MTN Mobile Money accounted for 24.9% of Ghana’s total service revenue in 2024, up from 21.7% in 2023.

43. Data and voice services generate higher revenue than mobile money for MTN Ghana. (Statista)

While mobile money contributed GH₵2.8 billion to MTN Ghana’s revenue in 2023, data services generated GH₵5.8 billion ($374 million), and voice services generated GH₵3.6 billion ($232 million), showing that traditional telecom services still account for the majority of the company’s GH₵13.3 billion total revenue.

44. There was an increase in active mobile money agents in February 2024. (Statista)

The number of mobile money agents actively processing transactions increased by nearly 8,000 in early 2024, rising from 607,820 in January to 615,600 in February.

45. The E-levy initially reduced mobile money usage by up to 35% in 2022 but later exceeded revenue expectations (GSMA, ICTD, ICTD).

The introduction of the e-levy in 2022 led to a sharp decline in mobile money transactions, with usage dropping by up to 35% year-on-year.

Despite this, the levy generated GH₵612.34 million, exceeding the government’s target of GH₵611 million and contributed about 1% (US$129 million) to total tax revenue.

This figure, however, represented only 12% of the original revenue projection of GH₵6.96 billion.

46. The revenue collected by the telecommunications industry from the E-levy nearly doubled in 2023, reaching GH₵938.87 million. (Telecom Chamber)

After a disruptive first year, the telecommunications industry saw a 94% increase in e-levy collections in 2023. This rebound suggests that users have gradually resumed digital transactions, either by adapting to the levy or by finding cost-effective transaction strategies.

47. Fraud attempts against mobile money services rose 22% in 2023. (MTN)

Security challenges intensified in 2023 as mobile money providers faced a 22% surge in fraudulent activities, emphasising the ongoing need for robust cybersecurity investments.

48. There was an increase in the number of Korba agents in Ghana in 2024. (Forbes Africa)

Korba, a digital payment platform, expanded its agent network by about 10,000 outlets between March and April 2024.

49. MFS revenue in Ghana reached GH₵2.13 billion in 2022. (TechFocus24)

Combined earnings from MTN Mobile Money, Vodafone Cash, AT Money, Zeepay, and other providers hit GH₵2.13 billion in 2022.

Future outlook of mobile money

50. The mobile money market in Ghana is projected to grow at a rate of 18.24% per year, reaching USD 933.96 billion by 2033. (IMARC)

Ghana’s mobile money market is expected to grow at a compound annual growth rate (CAGR) of over 18% over the next decade.

This means the value of all mobile money payments will approximately double every four years, rising from USD 192.24 billion in 2024 to nearly USD 934 billion by 2033.

51. The Bank of Ghana approved a pilot for cross-border transfers to Nigeria in 2025. (Bank of Ghana)

In February 2025, Brij Fintech Ghana received permission to test BrijX. This platform enables select MTN MoMo and G-Money users to send funds to Nigeria without requiring foreign exchange.

The pilot could pave the way for a cross-border mobile-money corridor, benefiting migrants and businesses in different countries.

52. The African free trade agreement is projected to generate $80 billion in mobile money transactions by 2025. (MTN)

The African Continental Free Trade Area could stimulate $80 billion worth of annual mobile money transactions by 2025, potentially revolutionising cross-border digital payments across the continent.

53. MTN mobile money is required to localise its operations in Ghana by June 2025 under Ghana’s Payment Systems Act. (African Financials)

Under Ghana’s Payment Systems and Services Act of 2019, MTN Ghana is required to restructure its mobile money operations to ensure a minimum of 30% Ghanaian ownership by 13 June 2025.

To comply, MTN plans to dissolve its current mobile money subsidiary, MobileMoney Limited, and transfer its assets, staff, and operations to a newly incorporated entity, provisionally named New FinCo.

Conclusion

Mobile money has evolved from a niche service into a financial lifeline for millions of Ghanaians. Contributing 9.3% to GDP, mobile money is now deeply woven into everyday life and commerce.

Yet, while access is nearly universal at 97%, challenges persist; only 32% of Ghanaians are financially literate, and the market remains highly concentrated, with MTN controlling 73% of the market share.

What do you think the next innovation in mobile money will be: cross-border payments, financial education, or something else entirely? Share your thoughts in the comments below.