Key takeaways

- AirtelTigo offers short-term loans to eligible users, credited directly to their AirtelTigo money wallet.

- Unfortunately, both loan offers, Speed Loan and Fido Loan Payback services, are currently unavailable due to platform upgrades.

- The loans have a 30-day term with a fixed interest rate of 5.9%.

In this article, we explain everything you need to know about borrowing money on AirtelTigo.

What is the AirtelTigo cash loan?

AirtelTigo, in partnership with Speed Microfinance Limited, offers loans to eligible customers for up to 30 days.

These loans have interest rates and applicable fees. For added convenience, you can also access loans from Fido directly into their AirtelTigo Money wallet.

AirtelTigo loan eligibility

To be eligible to receive AirtelTigo loans, you must:

- Be at least 18 years old.

- Have an active AT Money account registered in your name.

- Ensure your AirtelTigo SIM is linked to your Ghana card.

How to borrow from AT Money?

Borrowing money from AT Money is simple. Just follow these steps:

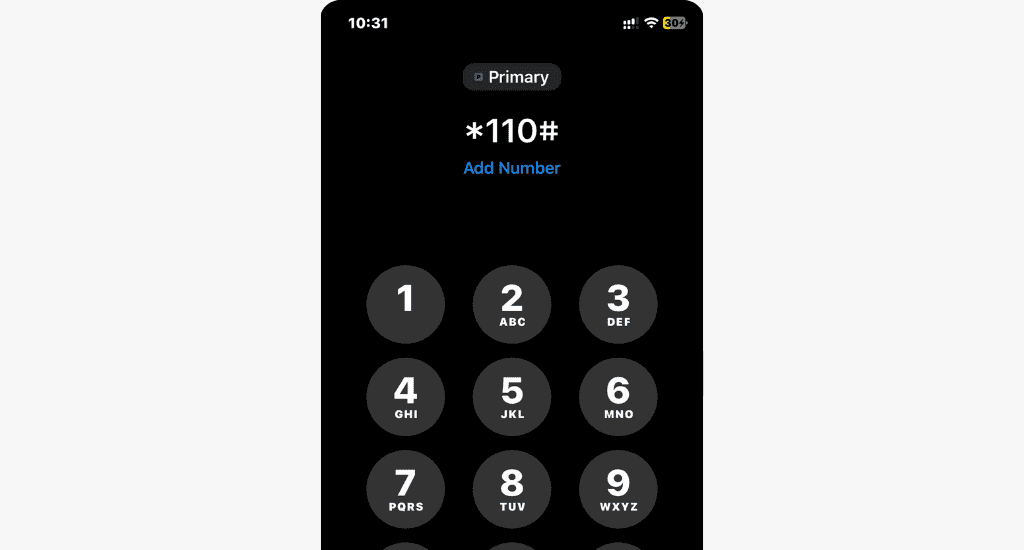

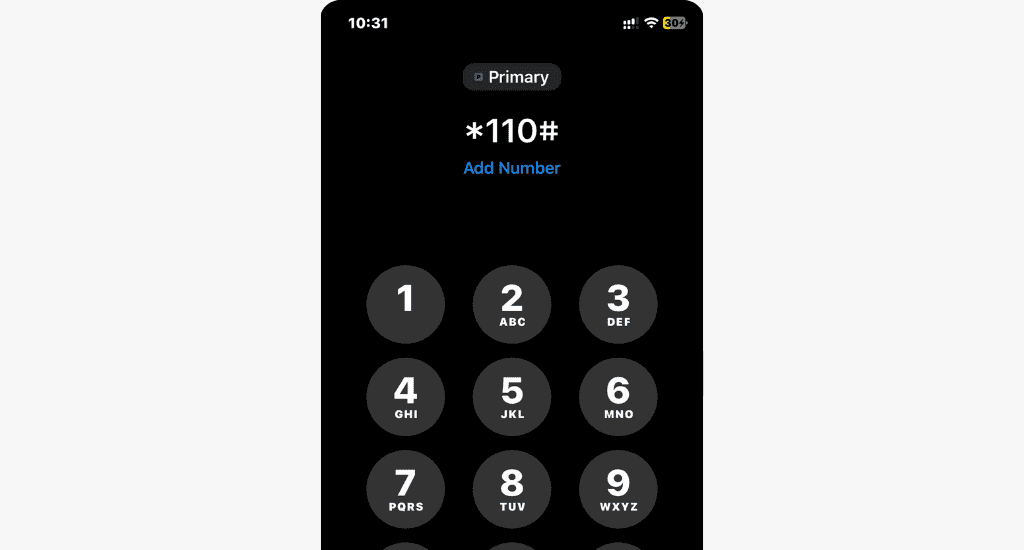

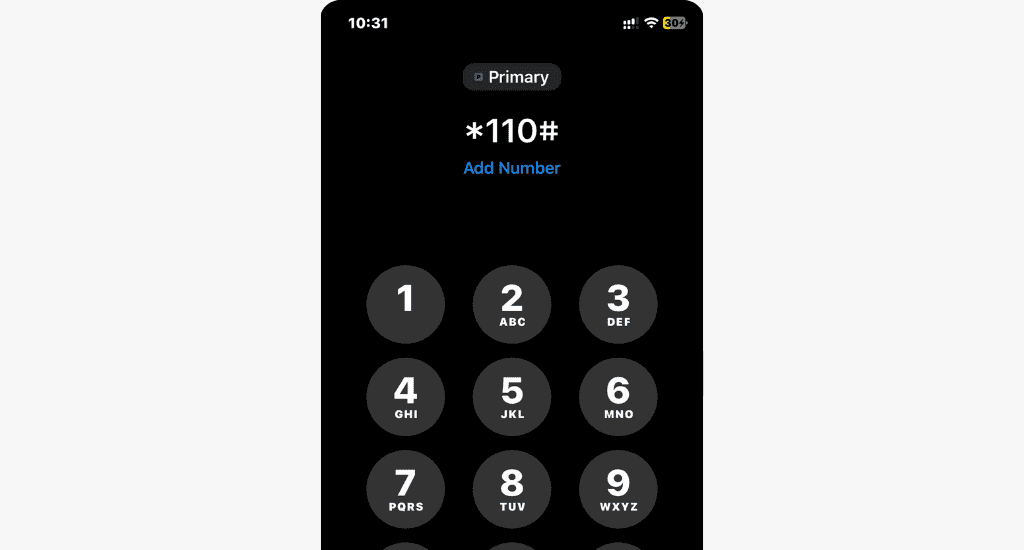

- Dial *110#.

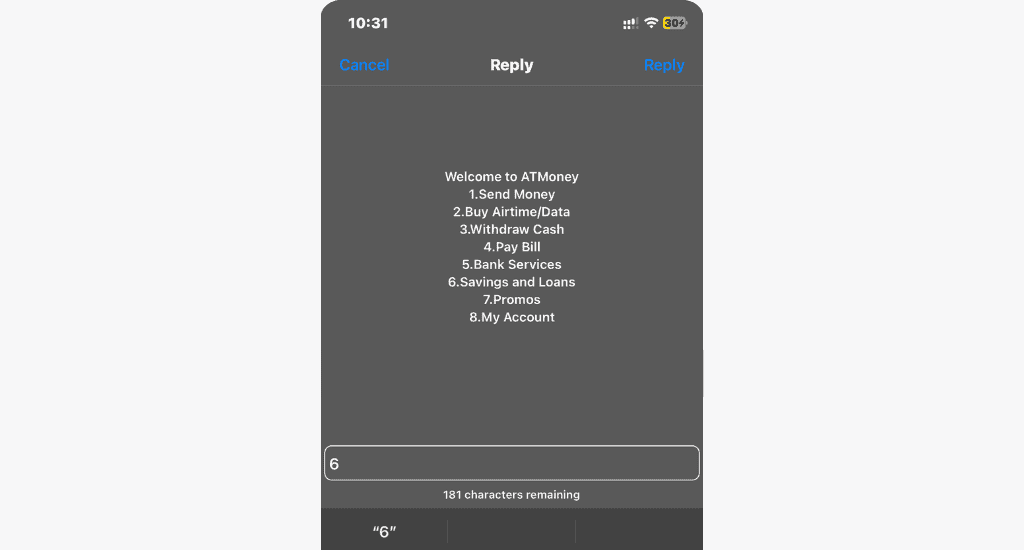

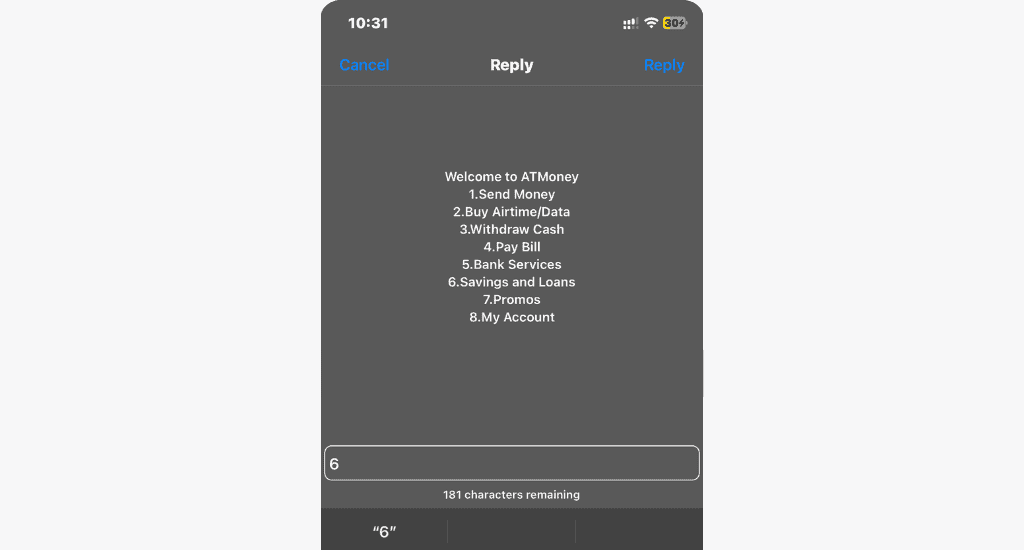

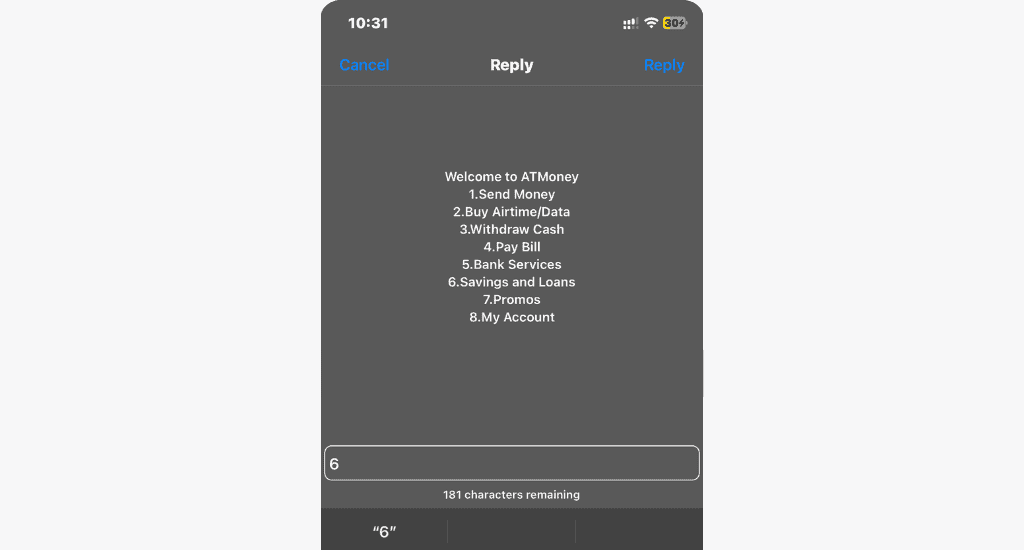

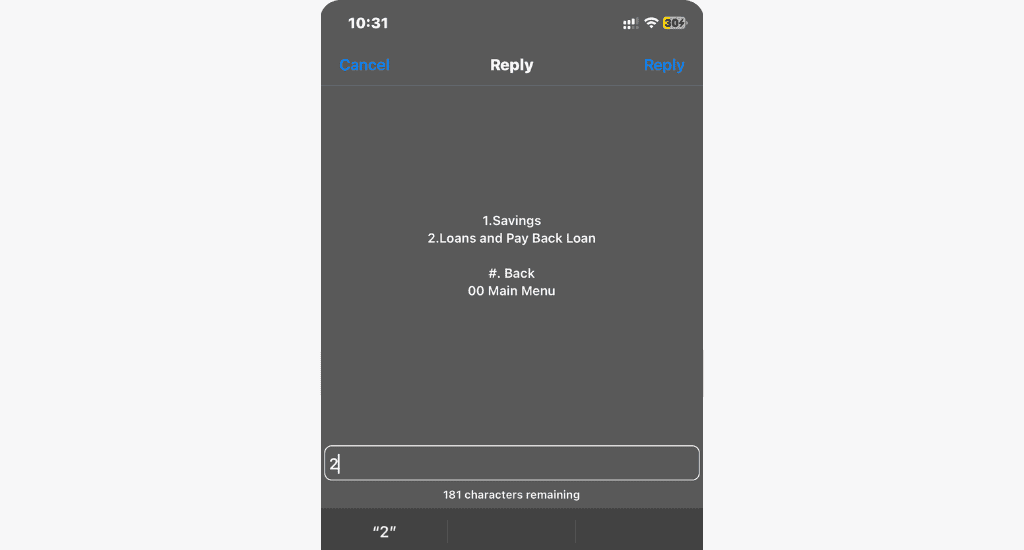

- Select Savings and Loans.

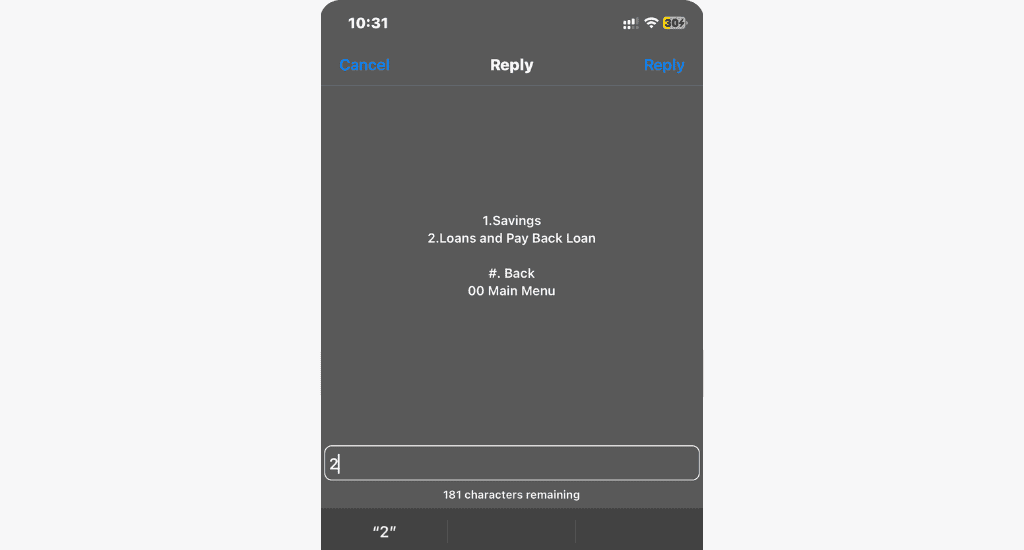

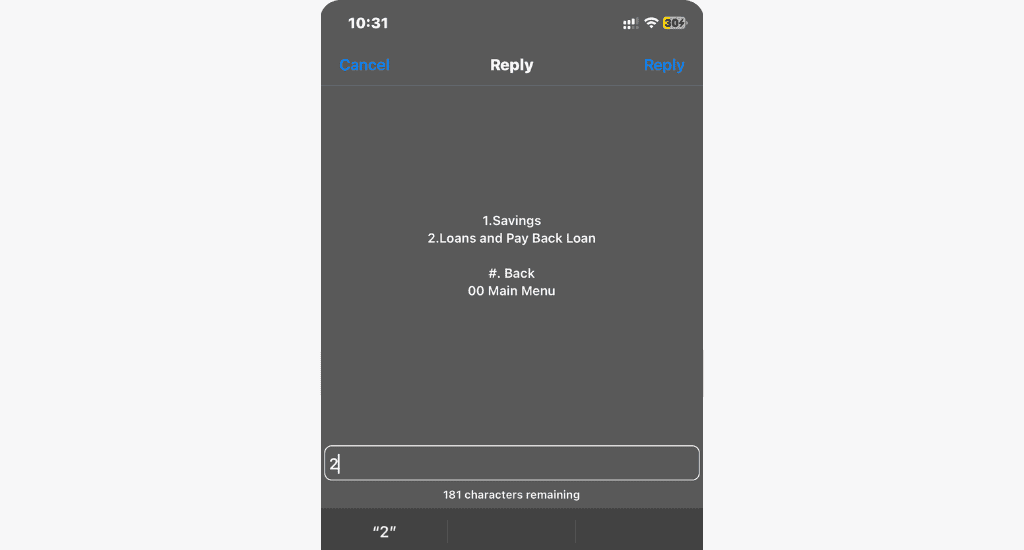

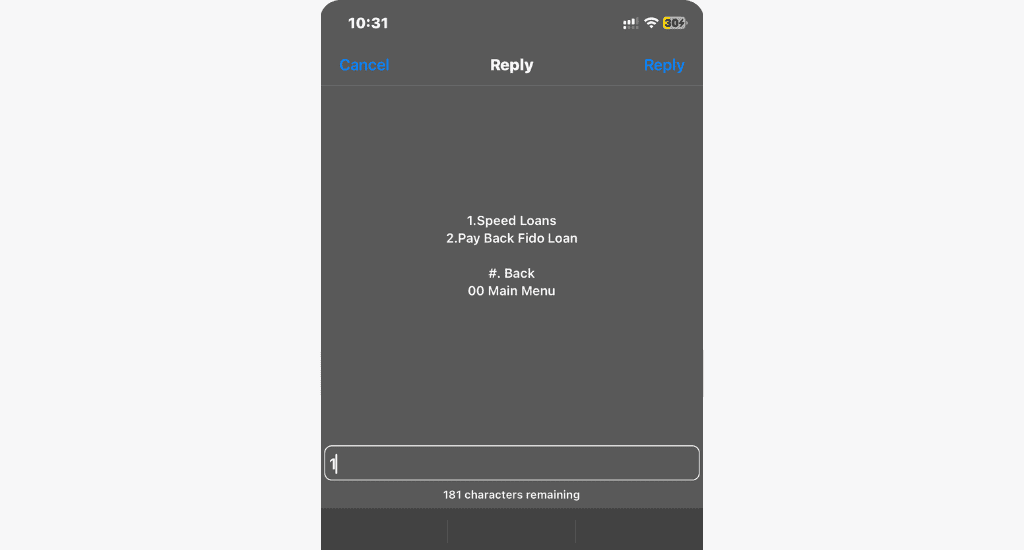

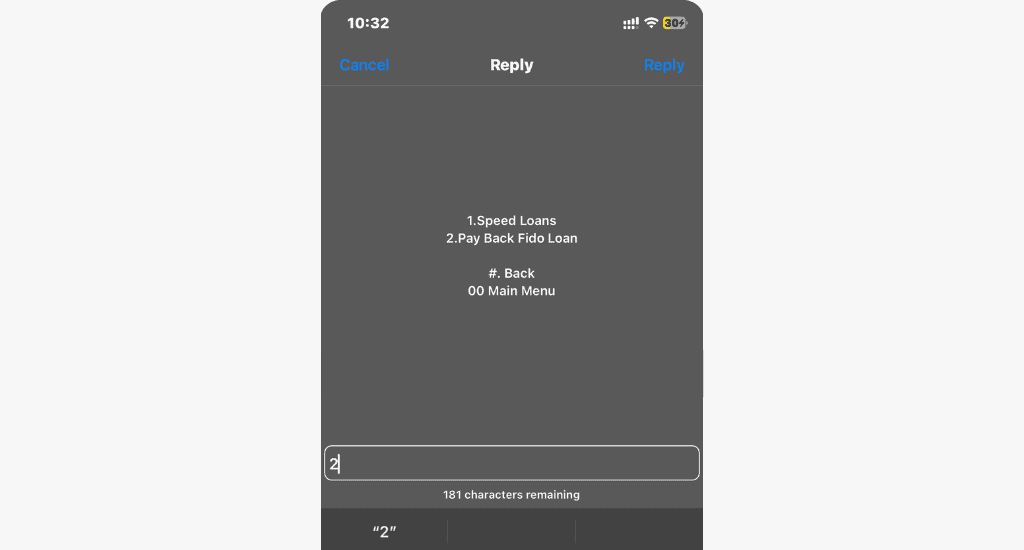

- Select Loans and Pay Back Loan.

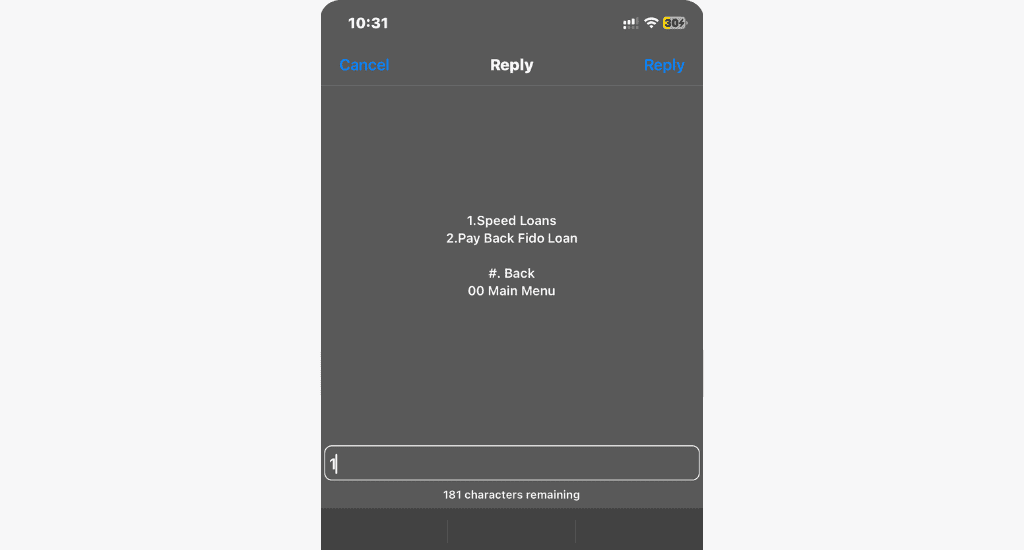

- Select Speed Loan.

- Follow the prompts to complete the process.

Once complete, you’ll receive an SMS confirming the loan and the repayment amount (loan plus interest) due. The amount will be credited to your account within 60 minutes.

Note: The AT Money Speed Loan service is temporarily inactive due to ongoing platform upgrades. Once the upgrade is complete, AirtelTigo will notify all customers.

How to repay your AirtelTigo loan?

You can repay your AirtelTigo loan either manually or through automatic deduction.

#1: Manual repayment

If you prefer to repay your AirtelTigo loan manually, the process is quite simple and gives you full control over when and how the repayment is made. Here’s how:

- Dial *110#.

- Select Savings and Loans.

- Select Loans and Pay Back Loan.

- Select your Speed Loan.

- Follow the next prompts to repay your loan.

If you have a Fido loan, you can conveniently repay your loan through AirtelTigo Money:

- Dial *110#.

- Select Savings and Loans.

- Select Loans and Pay Back Loan.

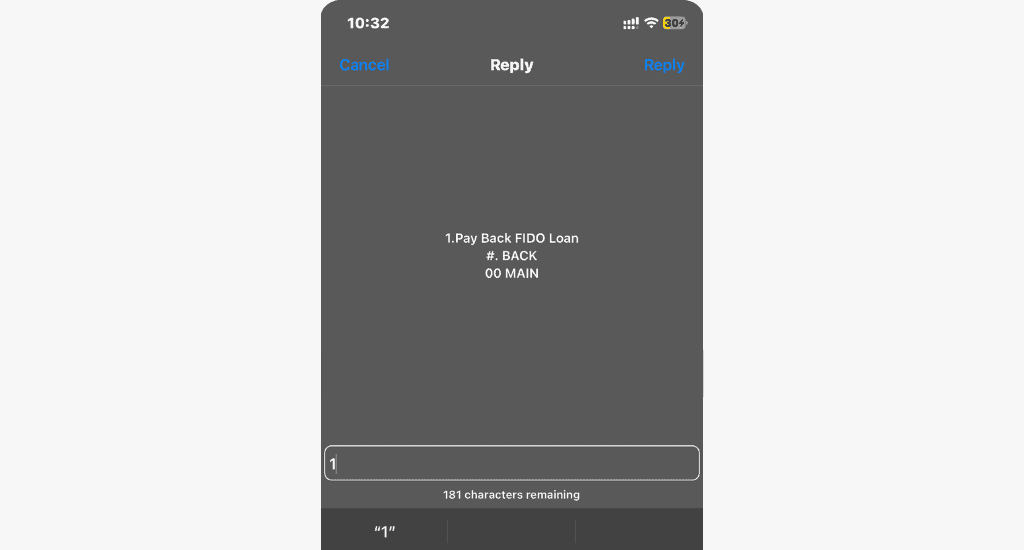

- Select Pay Back Fido loan.

- Select Pay Back FIDO loan again.

- Follow the next prompts to complete the process.

Again, please note that this service is not currently available to customers.

#2: Automatic deduction

Alternatively, you can choose automatic repayment. The system will deduct the repayment amount from your AT Money wallet on the due date. You must have the repayment amount available in your AT Money wallet.

AT Money loan interest rate

The Speed Loan is offered at a fixed interest rate of 5.9% for 30 days.

For example, if you borrow GH₵100, you will be charged an interest of GH₵5.90, making the total repayment amount GH₵105.90.

If you don’t pay the full loan amount by the due date, a penalty fee of 15.5% will be charged on the unpaid amount.

Conclusion

Borrowing money from AirtelTigo is a simple and convenient process that helps you in times of need. The next time you’re running low, remember that AirtelTigo has you covered.

We’d love to hear from you—feel free to share your experiences and feedback with us!

12 Comments. Leave new

For my first time, can they offer me a loan for about 10,000 GHC?

First-time borrowers usually get smaller amounts, Shadrack, and loan limits increase over time based on repayment history.

I need money for education

So when will it be available?

At the moment, we’re not sure when the AirtelTigo loan service will be available again. However, it’s likely that AirtelTigo will make an official announcement or press release once the service is reactivated.

We’ll be sure to update the post if any new information comes out.

After everything then it comes pls wait but nothing show up

Yes, Philip. The AT Money Speed Loan service is temporarily inactive, as AirtelTigo says their platform is undergoing upgrades.

I really need this money to sustain my self for the come month

I need more for education

I need money for educational purposes

I need money for education

👍