Key takeaways

- Dial *110# to apply for Ready Loan on Telecel.

- The loan comes with a 9% interest rate, and no collateral is required.

- You have 30 days to repay your loan. Repay on time to avoid a 12.5% late fee.

Running low on cash? Telecel Ghana has got you covered with Ready-Loan.

We’ll show you how to borrow money on Telecel and outline the key terms and conditions you should be aware of before applying.

What is Telecel Ready Loan?

Telecel Ready Loan is a quick and easy loan service (credit facility) available to Telecel customers with a registered and active Telecel Cash account.

It’s funded by Consolidated Bank Ghana (CBG) and offers short-term credit for 30 days at an interest rate of 8.9%, along with flexible repayment options tailored to your needs.

How to borrow money on Telecel (Ready Loan)?

You can apply for a Ready Loan right from your mobile device in just a few steps:

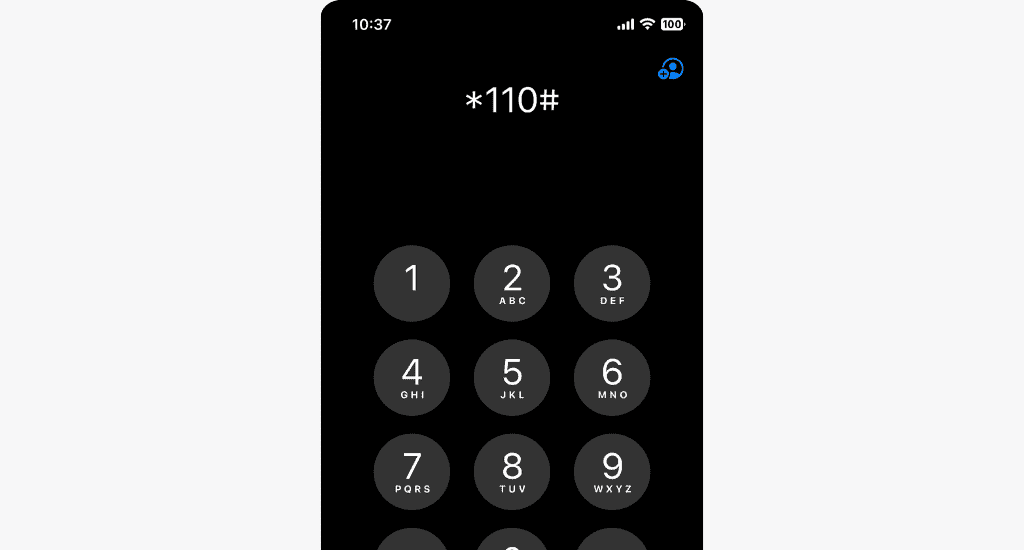

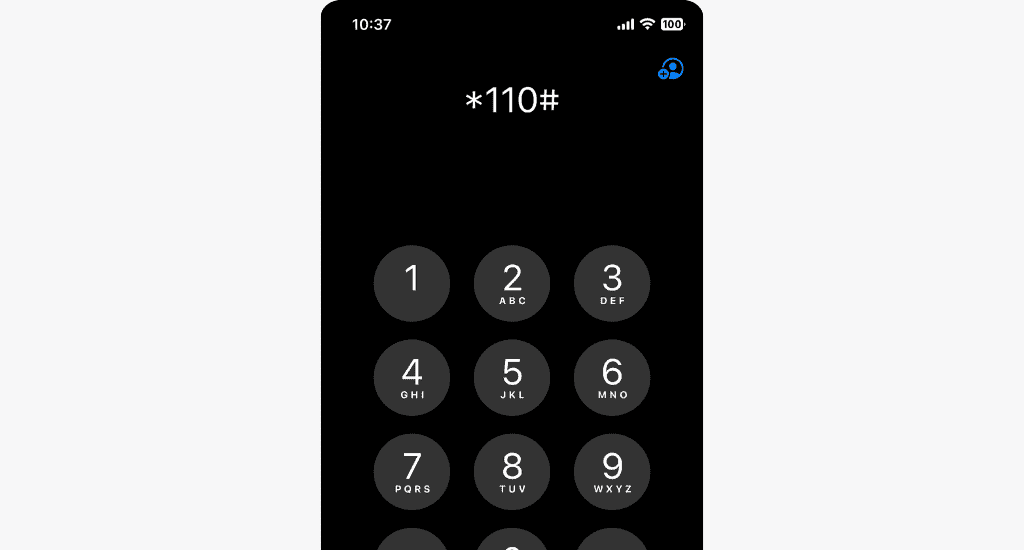

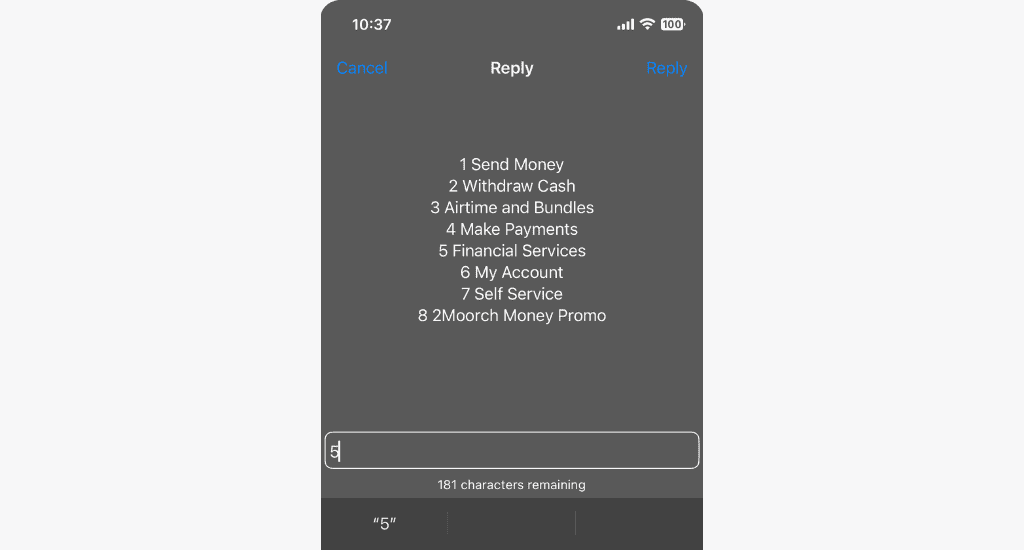

- Dial *110#.

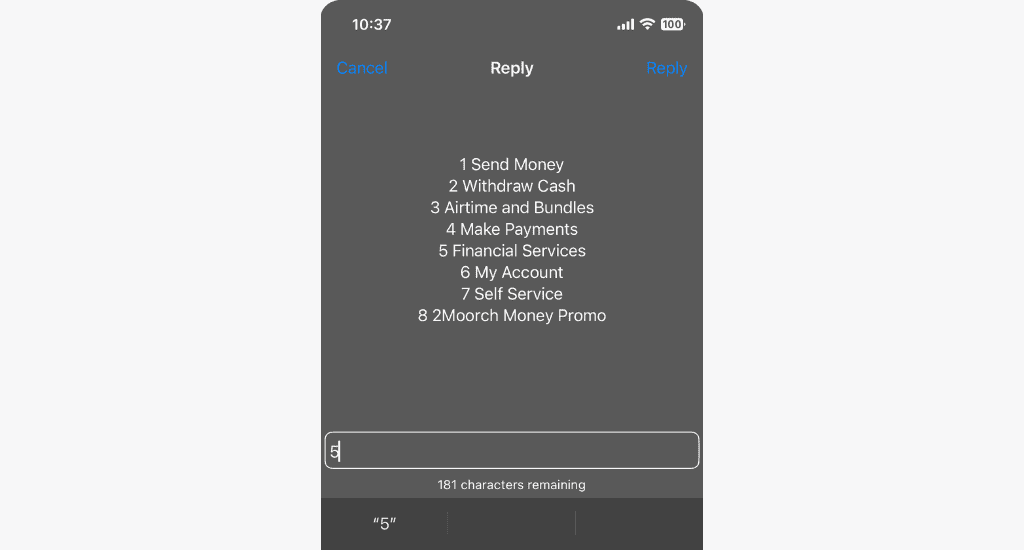

- Select Financial Services.

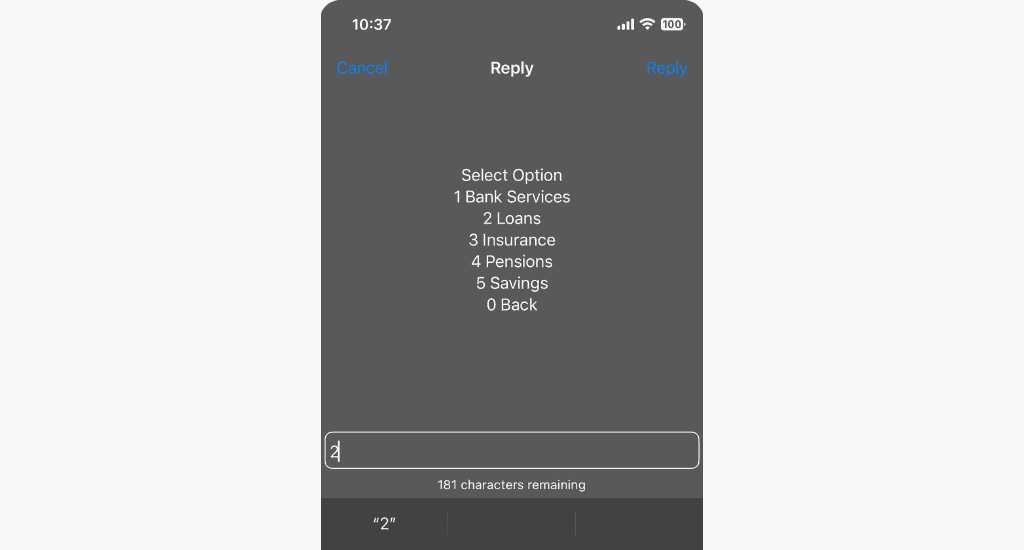

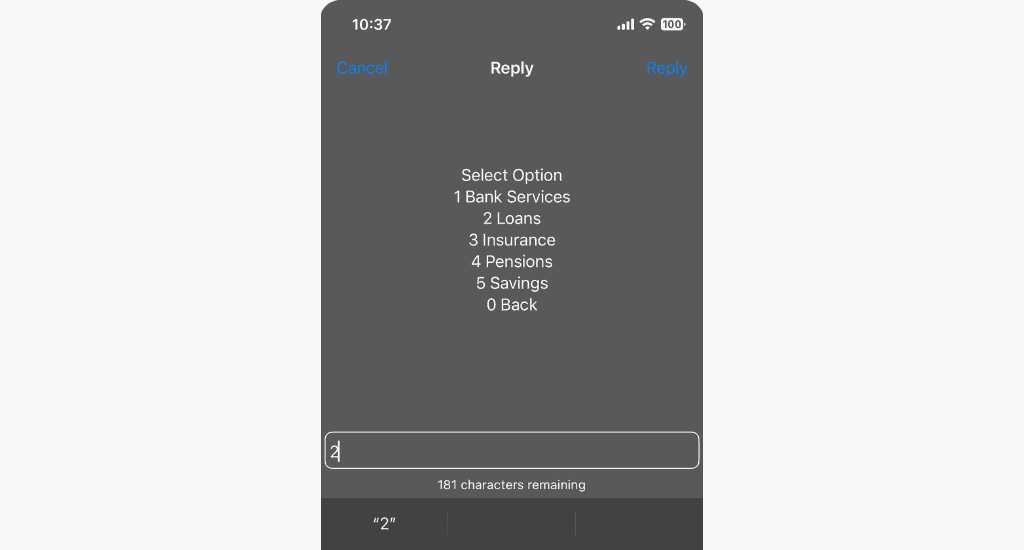

- Select Loans.

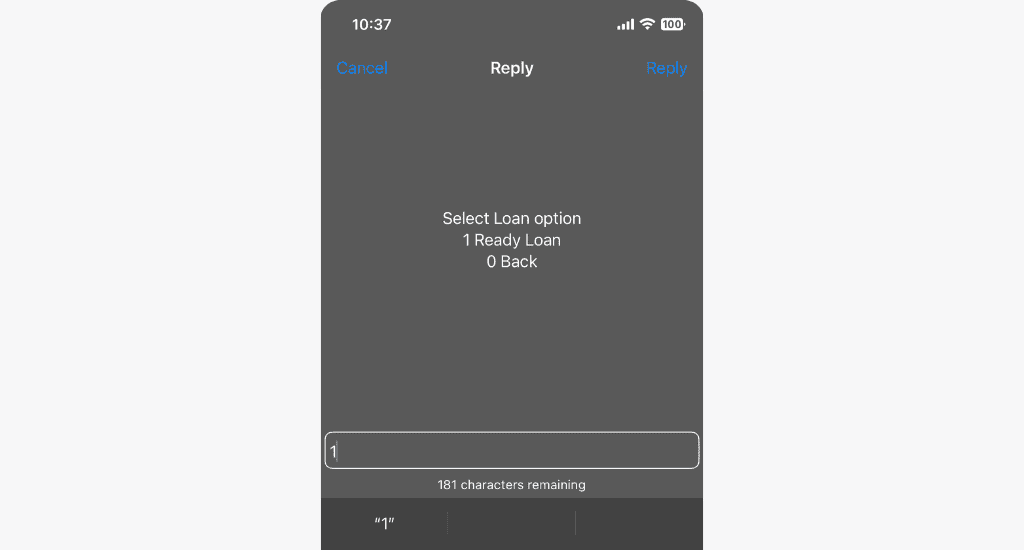

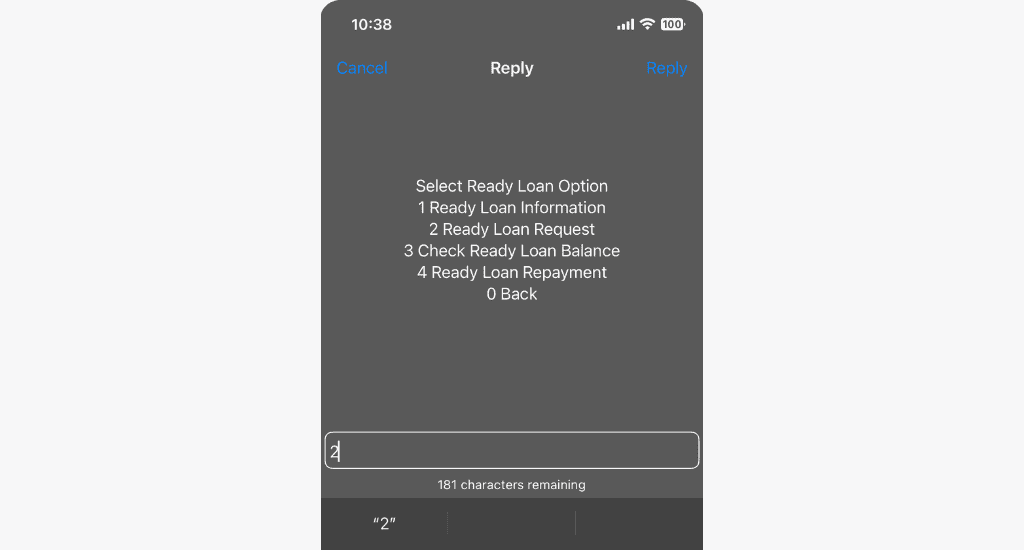

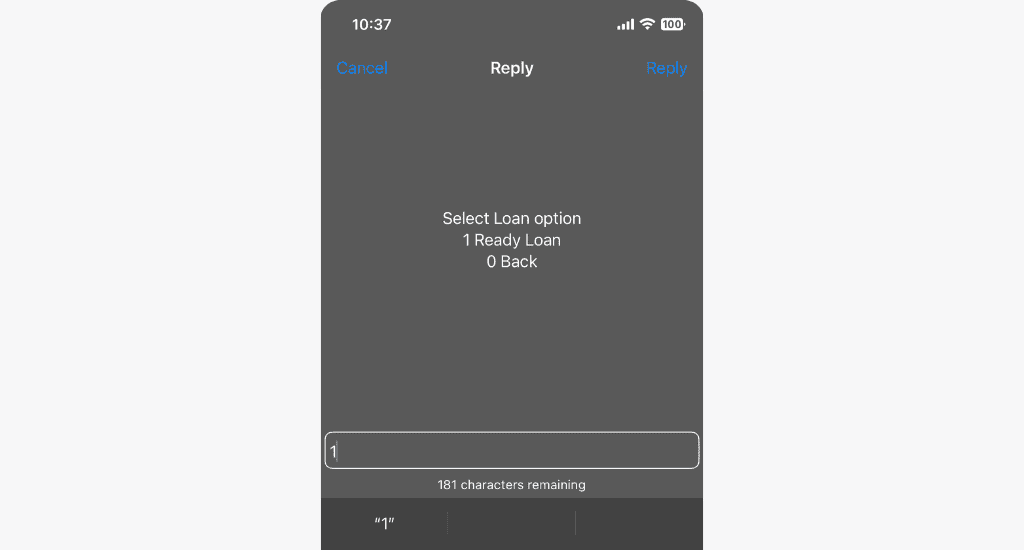

- Select Ready Loan.

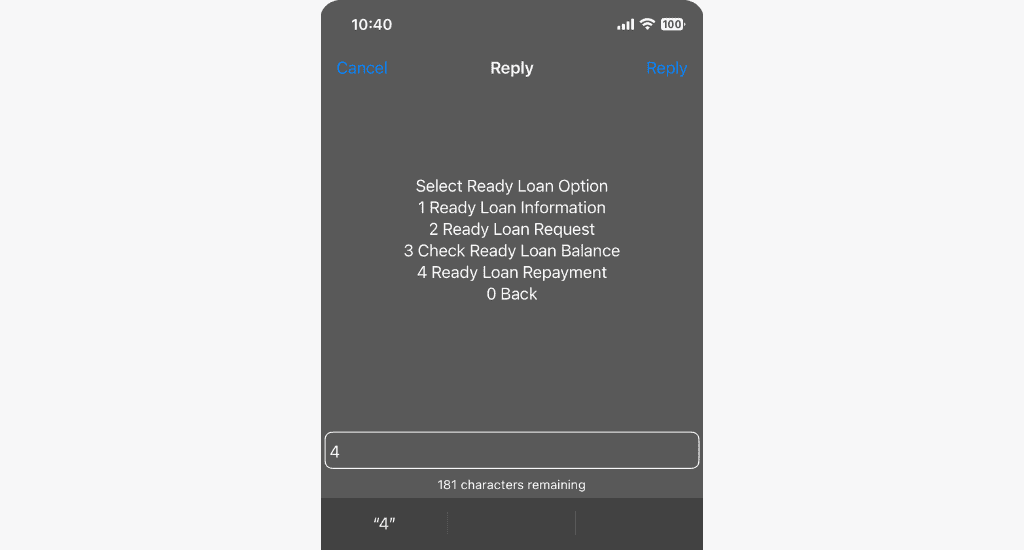

- Tap on Ready Loan Request.

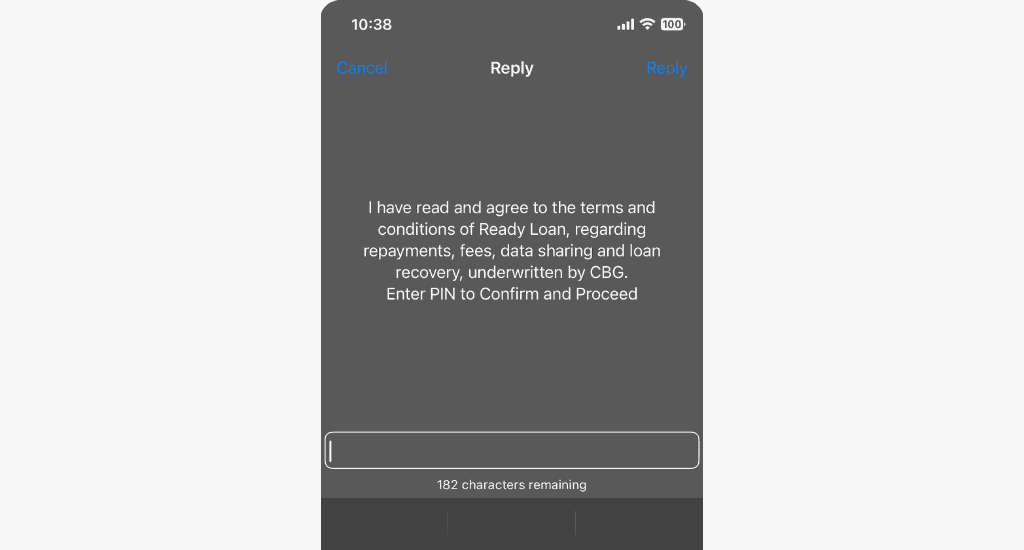

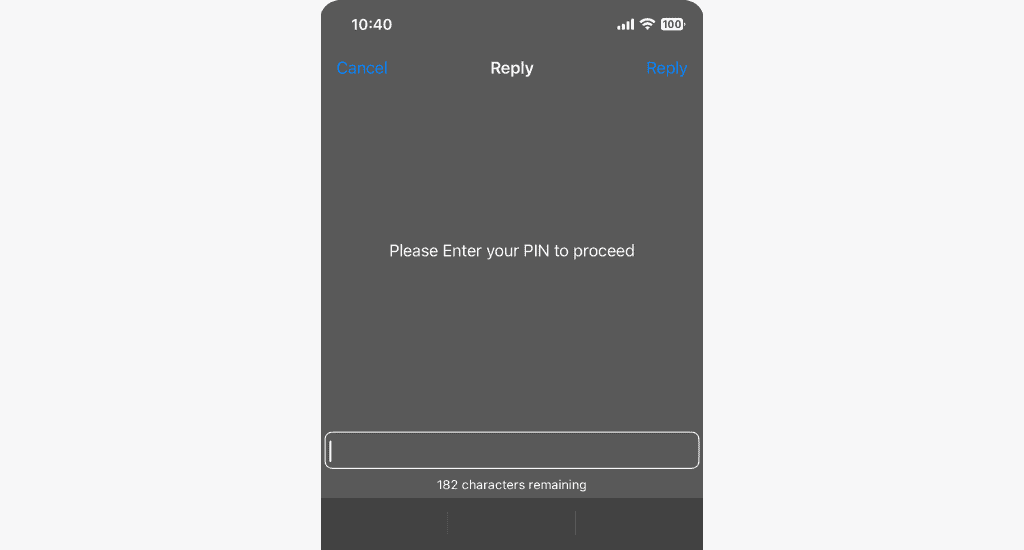

- Enter your T-Cash PIN to accept the Ready Loan terms and conditions.

- Select your desired loan amount from the available options.

- Review the loan terms and conditions. Enter 1 to accept and complete your request.

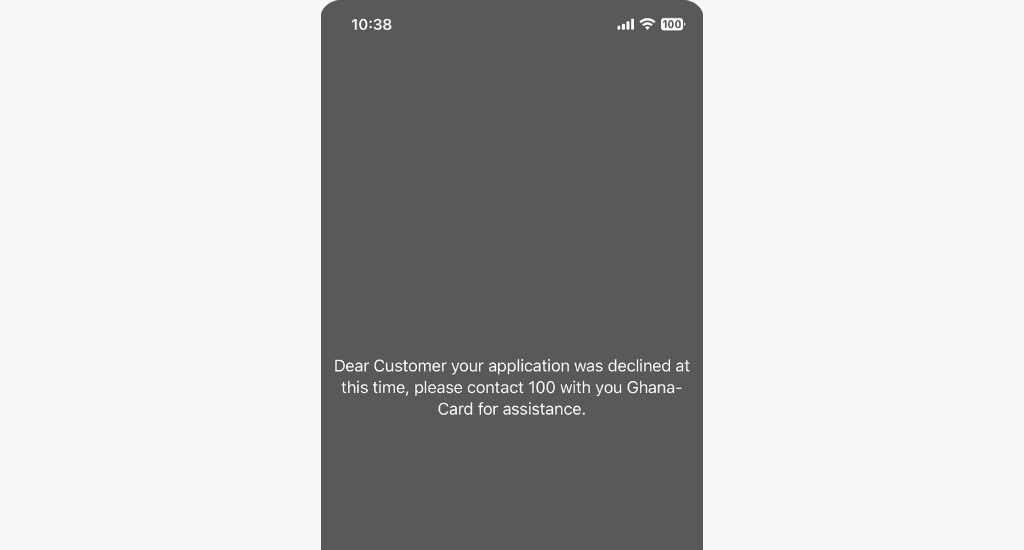

Once your loan is approved, the money will be instantly deposited into your T-Cash wallet, and you’ll receive a confirmation SMS.

How to pay back the Telecel Ready Loan?

Telecel offers two convenient ways to repay your loan within the 30-day repayment period:

#1: Automatic repayment

On the due date, Telecel will automatically deduct the repayment amount from your T-Cash wallet.

Ensure your wallet has sufficient funds to cover the full loan amount, as well as any applicable fees.

#2: Pay back yourself

You can repay your loan in full or in part before the loan term ends. Here is how:

- Dial *110#.

- Select Financial Services.

- Select Loans.

- Choose Ready Loan.

- Tap on Ready Loan Repayment.

- Enter your T-Cash PIN to proceed.

- Enter 1 for Full Payment or 2 for Partial Repayment.

Note: For partial payment, enter the amount you wish to repay.

After completing the repayment, you’ll receive an SMS confirming the transaction.

Important terms and conditions

Before applying, take note of the following terms:

- You must be 18 years or older and have an active Telecel Cash wallet.

- A service fee applies to every loan.

- If you fail to repay the loan by the due date, Telecel will charge you a 12.5% late repayment fee.

- If your loan is approved, the amount will be paid into your Telecel Cash wallet.

- The loan term is 30 days, starting from the date you receive the funds in your wallet.

FAQs

How long does it take for the loan to be paid into my Telecel Cash account?

Once your Telecel Ready Loan application is approved, the money is sent to your T-Cash wallet immediately.

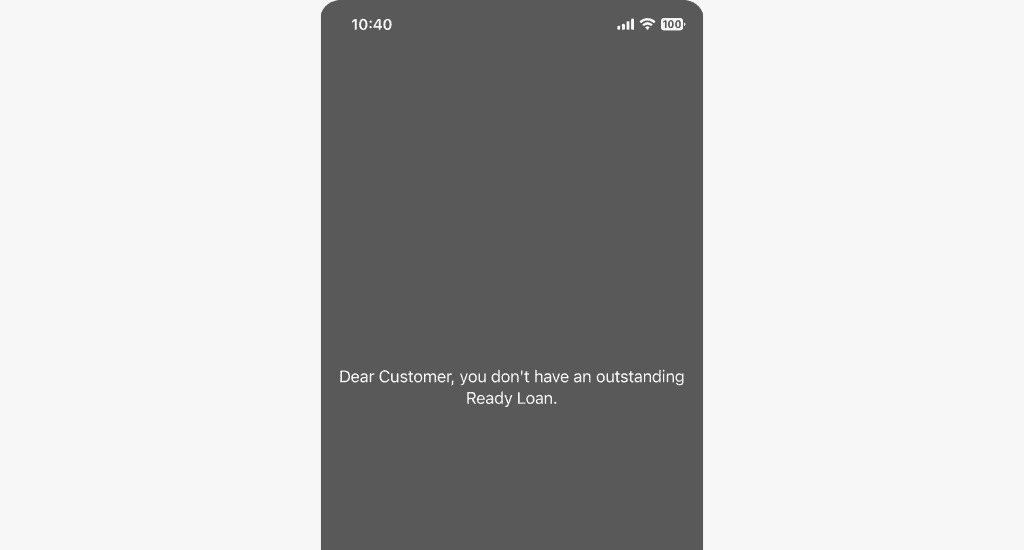

Is there a maximum Ready Loan limit?

Yes, there is a maximum Ready Loan limit, but it varies from person to person. It largely depends on your activity with Telecel Cash services, and it is displayed when you apply for a loan.

What happens if I don’t repay my Telecel loan on time?

If you don’t repay your Telecel Cash Ready Loan by the due date, a 12.5% late fee will be added. Should you default on your loan, your information will be submitted to the credit bureau, and you will be blacklisted.

Conclusion

Telecel’s Ready Loan is a fast, reliable way to access funds in times of need. With no collateral required, low interest rates, and a straightforward application process, it’s designed for your convenience.

Do share your questions with us in the comments.

1 Comment. Leave new

Awesome post! Really enjoyed reading it.