Key takeaways

- You can easily sign up for My Own Pension via MTN Mobile Money by dialling *170#.

- You choose how much to contribute and how often: daily, weekly, or monthly.

- Pension withdrawals are possible after five years under specific conditions.

Due to complex pension requirements, many informal workers in Ghana, such as traders and artisans, lack access to retirement benefits.

My Own Pension offers a simple solution through MTN mobile money. We’ll show you how to easily sign up, contribute, and manage your savings.

What is My Own Pension?

My Own Pension (MOP) is a voluntary, mobile-based pension scheme introduced by MTN Ghana in partnership with United Pension Trustees. It allows workers in the formal and informal sectors to save for retirement using MTN MoMo.

The scheme comprises two subaccounts: Pension and Investment. The investment subaccount offers an annual interest rate of 18% to 22%. MOP is open to all MTN MoMo users aged 15 and above.

How to register for My Own Pension?

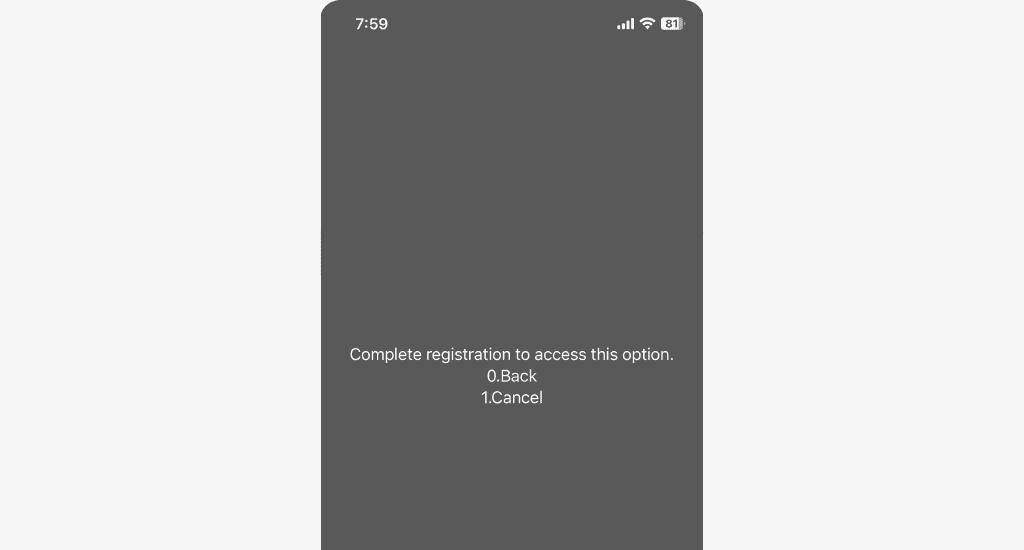

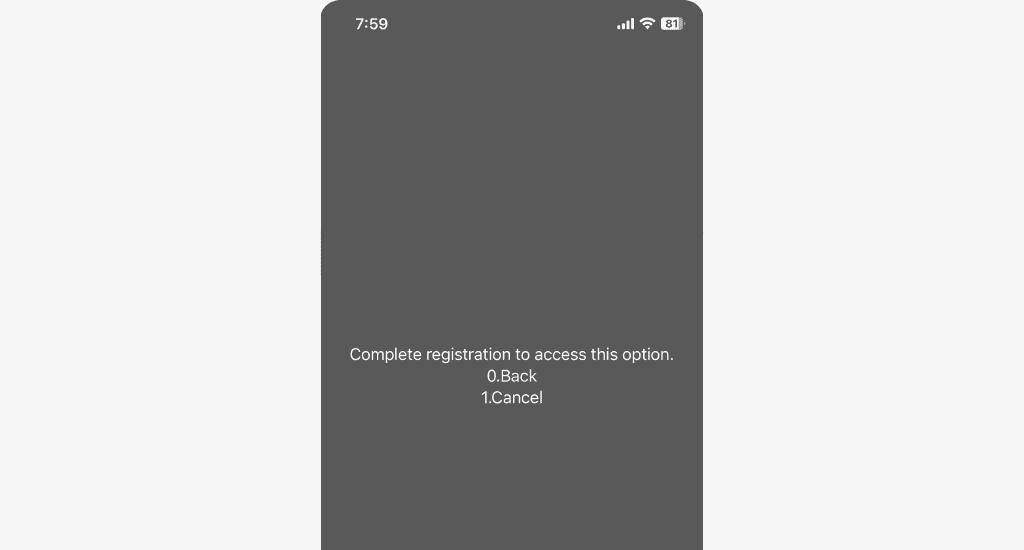

Follow these steps to get started:

- Dial *170#.

- Select Financial Services.

- Select Pensions and Investments.

- Select My Own Pension.

- Choose Enrol.

- Select Register to confirm the My Own Pension terms and conditions.

- Provide your residential address.

- Enter the name of your next of kin.

- Enter the contact information for your next of kin.

- Choose your preferred payment cycle.

- Enter the amount you wish to contribute based on your selected cycle.

- Create a four-digit PIN to access your pension account.

Note: We recommend creating a PIN that is different from your MoMo PIN to help protect your pension scheme account in case your MoMo PIN is ever compromised.

- Confirm the new PIN.

- Approve the auto-payment request by entering your MoMo PIN to complete your registration.

Once successful, you’ll receive a confirmation message.

Based on your selected amount and cycle, contributions will be automatically deducted from your MoMo account and credited to your MOP account.

My Own Pension contribution options

You decide how often and how much to contribute. The minimum amounts are:

| Payment cycle | Minimum amount (GHS) |

| Daily | 1 |

| Weekly | 5 |

| Monthly | 20 |

Each contribution is split equally between your Pension and Investment subaccounts.

For example, if you contribute GHS 20 weekly, GHS 10 goes into your pension subaccount and GHS 10 into your investment subaccount.

How to withdraw from My Own Pension account?

To withdraw from your pension account:

- Dial *170#.

- Select Financial Services.

- Select Pension and Investments.

- Select My Own Pension.

- Select Withdrawal.

- Choose the subaccount from which you want to withdraw.

- Enter the amount.

- Enter your four-digit PIN to complete the process.

Withdrawals are processed within 72 hours and credited into your MoMo wallet.

Important withdrawal notes

Before withdrawing, it’s essential to understand the rules for each subaccount.

- Pension subaccount: Withdrawals are allowed after five years of contributions and if you are 55 or 60 years old, medically unfit to work, deceased (in which case your beneficiaries can claim), purchasing an annuity for regular pension payments, or using the funds as collateral for a home loan.

- Investment subaccount: You can withdraw a lump sum after one year. Up to 50% of your savings can be withdrawn anytime, but no interest is earned on withdrawals made before the first year. This subaccount can also be used as collateral for a personal loan.

How to deactivate My Own Pension?

To cancel your My Own Pension registration:

- Dial *170#.

- Select Financial Services.

- Select Pension and Investments.

- Select My Own Pension.

- Enter 5 for More.

- Select Cancel Mandate.

- Enter 2 to confirm cancellation.

Once completed, your MOP contributions will stop, and your account will be deactivated.

FAQs

How do I check my pension balance?

To check your balance, dial *170#, follow the prompts above to the My Own Pension menu, and select Check Balance.

Conclusion

Pension schemes are important long-term investment vehicles for workers, providing financial security and peace of mind during retirement.

With MTN’s My Own Pension, saving is now more accessible, especially for informal sector workers. Take advantage of this flexible, mobile-friendly service to build a better future.

Have questions or feedback? Please leave a comment below.

40 Comments. Leave new

Greetings, dear please, assuming after the five without reaching the age of 55 or 60 can I go to the office and request for my money????

Hello Abdul, we recommend reaching out to MTN directly regarding this to learn more.

What happens if I don’t have funds in my MoMo account when the month is due?

Hi Boakye, if your MoMo wallet doesn’t have enough funds when the payment date comes, the deduction will just fail for that cycle. Nothing will be taken, and your account won’t be closed.

Once you load money into your wallet, the next scheduled deduction will go through as normal.

Is one year and I wanted to withdraw my investment but they said am not eligible, why?

MTN’s My Own Pension has strict withdrawal terms, Wisdom. You can learn more here.

How do I know that they really add the interest because I can’t see it and they don’t say anything about at least we should get an alert that maybe you have earned this amount on your investment this is year 5 and I don’t know if interest was added for all those years or not

That’s true, Kwesiecho. We’d recommend reaching out to MTN directly to lodge a complaint to this effect.

If you are myown pension customer, just reach out to the trustees UPT and request for your statement. You will get everything in there. I request for my statement every year to know what is happening to my money.

It’s been one year and I’m trying to withdraw from the investment sub account but they are saying I’m not eligible to withdraw. Why’s that so because I thought it’s the pension sub account that has five years minimum

MTN My Own Pension has strict withdrawal policies. We’ve detailed this in our blog post.

How do I check the number of years I have been on MOP

Hi Grace, to check the number of years you’ve been on MTN’s My Own Pension (MOP), you’ll need to contact MTN directly. They can provide accurate account details including your registration date and contribution history.

You also reach out to UPT for a statement.

Please why is it that they are saying,

it not eligible to redraw my pension buh it five years now

We’re sorry to hear about your experience, Freda.

Please note that while you’ve been contributing for five years, eligibility to withdraw from MTN’s My Own Pension (MOP) also depends on age, i.e., if you are 55 or 60 years old, are medically unfit to work, or using the funds as collateral.

We recommend you contact MTN directly by dialing 100 on your MTN line or visiting any MTN service center for assistance specific to your account. They’ll be in the best position to explain your situation and help resolve it.

Please what is the Lump Sum for an amount of 50 cedis per month starting from the age of 21years to 60years

If you contribute GHS 50 per month from age 21 to 60, that’s a total of 39 years, or GHS 50 x 12 months x 39 years = GHS 23,400 in raw contributions.

However, since half (50%) goes to the investment subaccount, which earns interest (18%–22%) annually, your final amount will be much higher due to compound interest.

Let’s assume a 10% average annual return on the investment half and 0–3% on the pension half, your estimated total lump sum by age 60 could be GHS 90,000 – GHS 120,000+, depending on returns, consistency, and no withdrawals.

But this is only an estimate. So, don’t take it at face value, the actual results depend on inflation, changes in interest rates, etc.

Oh I thought the 18-22 interest affects all the money. That’s what motivated me

I want to know the time I can withdraw my five years pension

You can withdraw after 5 years if you’re 55 or older, medically unfit, or using the funds for a home loan or annuity. If you need it urgently, it’s best to contact MTN for help.

Will I get both my pension and savings contributions when I deactivate my accounts?

Hello Kojo, we recommend that you withdraw your pension and savings contributions before deactivating your account to ensure a smooth and complete payout process.

Hello…I am trying to withdraw from my pension after 5 years but I’m still told I’m not eligible…why us that please

Sorry Nana Yaa, we are unsure why that is. Please reach out directly to MTN to lodge a complaint.

What is someone accidentally deactivate me but I’m not eligible to withdraw yet

It’s unlikely that you’ll accidentally deactivate your account.

Does the pension subaccount have an interest or the interest only applies to the investment subaccount

Both subaccounts offer interest on the amount saved.

What do i do if i forget my password

Please reach out to MTN directly for assistance with the password reset.

U did not told us after 5years u have to wait for reaching 55 years I would not have done this investment,how many years does this generation get on this earth

Hello Collins, MTN’s My Own Pension withdrawal policy is well detailed in our blog post under Important withdrawal notes.

Please is it possible to earn interest on both pension and investment(all the money you’ve contributed) if you don’t withdraw anything until the retirement age?

Yes, both the pension and investment subaccounts earn interest as long as you keep contributing and don’t make withdrawals.

The pension side earns a lower but steady interest, while the investment side usually gives higher returns (18–22% annually). So if you don’t touch the money until retirement, you’ll benefit from compound growth on both.

Will I get my money after I deactivate the account

Yes Mavis, we recommend a withdrawal first, before deactivating your account.

What is the process for increasing my contribution, in both frequency and magnitude?

You can create a new payment cycle to increase your contributions and frequency.

You can make voluntary payment anytime you want on your momo accounts.