Key takeaways

- MTN MoMo pays automatic interest on your wallet balance; dial *595# if not active.

- MoMo interest rate depends on individual transactions, balance history, and other regulatory factors.

- Interest is calculated on your average balance and paid every three months.

MTN mobile money (MoMo) offers a unique feature for its users: the ability to earn interest on the balance in their wallets.

In this guide, we explain how this works, including the payout schedule, eligibility requirements, and how to activate the service if you’re not automatically subscribed.

What is MTN MoMo interest?

MTN MoMo interest is a reward system introduced by MTN Ghana to encourage customers to keep money in their MoMo wallets.

Aimed at making mobile wallets a convenient alternative to traditional savings accounts, you earn interest on any amount kept in your wallet, just like you would with a traditional savings account.

The interest rate applied to your MoMo wallet is systematically determined based on your transaction activity and balance history. Regular use of your MoMo wallet and maintaining a higher balance increases your earnings.

Who qualifies for MTN MoMo interest?

To qualify for MTN MoMo interest, you must:

- Be an active MTN MoMo user.

- Have a registered and verified MTN mobile money account.

If you meet these conditions, you are automatically eligible to earn interest on the balance in your MoMo wallet.

How to activate MTN MoMo Interest?

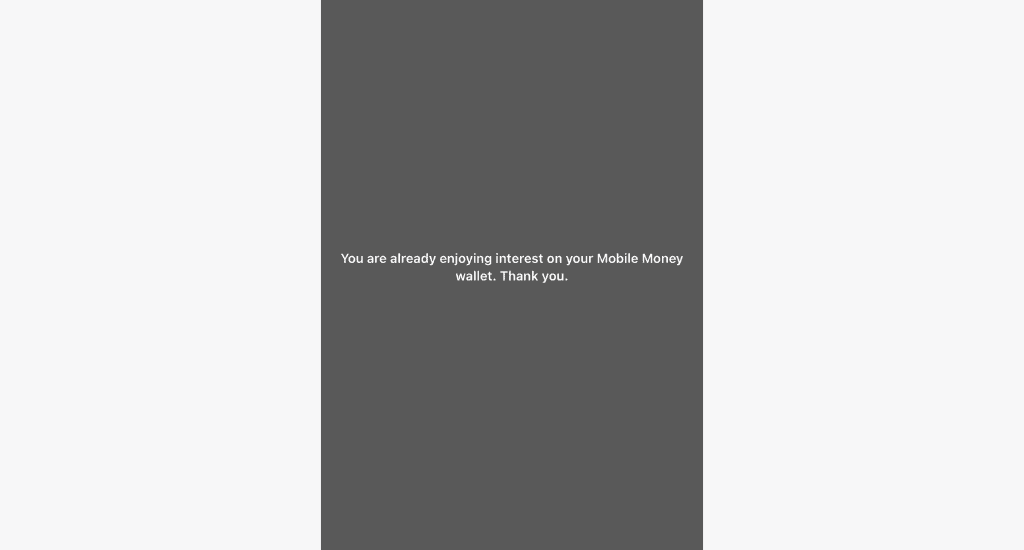

MTN automatically activates MoMo interest for eligible users.

However, if you want to ensure you’re enrolled or if you suspect you might not be included, you can manually activate it by following these steps:

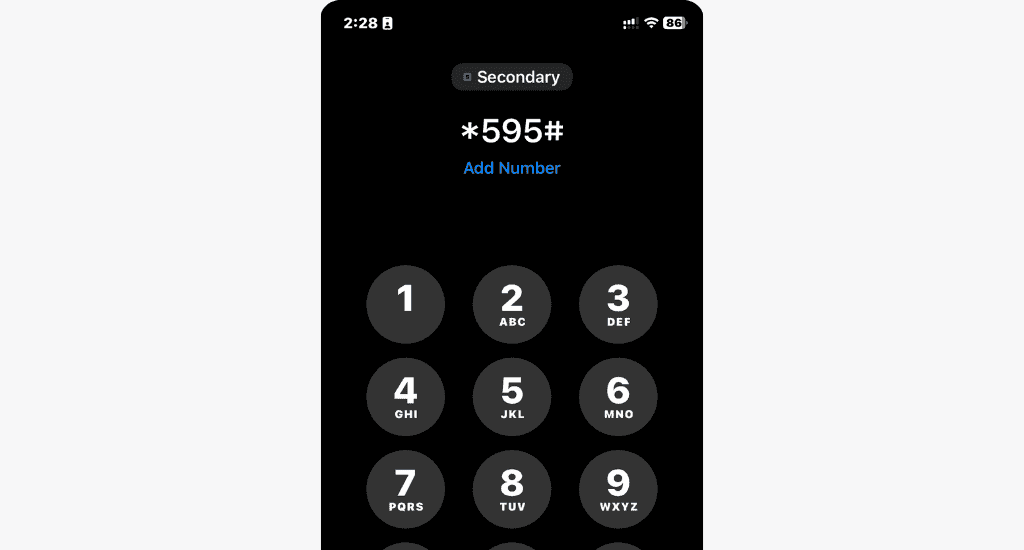

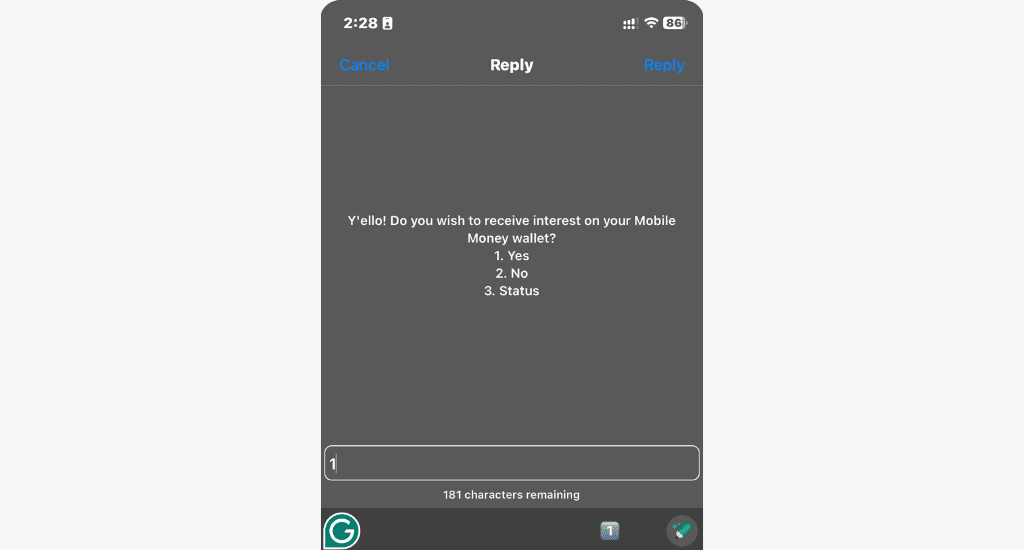

- Dial *595#.

- Select Yes to confirm activation.

- Wait for the prompt to confirm your choice.

This ensures you don’t miss out on earning interest on your MoMo savings.

When does MTN pay out interest?

MTN pays out MoMo interest quarterly, which means once every three months. The interest is calculated based on your average monthly balance during the quarter and is credited directly to your mobile money wallet.

MTN MoMo vs. MTN savings interest

In addition to mobile money, MTN offers other financial services from which customers can earn interest, including Yello Save, SIKA Save, and Pesewa Susu.

However, SIKA Save and Pesewa Susu are currently inactive. Unlike traditional banks in Ghana, which typically offer interest rates of 3% to 4% per annum on savings accounts, MTN’s MoMo savings offer potentially higher interest rates.

Below is a comparison between MTN MoMo interest and Yello Save:

| MTN MoMo | Yello save | |

| Eligibility | Must be an MTN MoMo subscriber | Must be an MTN MoMo subscriber |

| Activation | Mostly automatic but can be activated manually | Requires manual registration |

| Payout frequency | Quarterly payouts on average balance | Calculated daily but paid out monthly |

| Interest rate | Variable | 8% per annum, reduced to 3% for more than three monthly withdrawals. |

| Partner | MTN | Fidelity bank |

FAQs

How do I stop MTN MoMo interest payments?

You can stop receiving MTN MoMo interest payments by contacting MTN customer service to deactivate the feature.

Conclusion

MTN MoMo allows you to grow your savings without a traditional bank account.

It’s a hassle-free way to earn extra while managing your day-to-day expenses. If you want more control over your savings and potential earnings, try MTN Yello Save for an additional savings option.

Have questions about MTN MoMo interest? Share them in the comment section.

21 Comments. Leave new

When is the next pay out interest

MTN pays out MoMo interest quarterly, which means once every three months. We’re unsure if the last quarter has been paid yet.

I don’t understand….I earned 500 for pass three months,this time I earned 380 meanwhile the money in the account is more than first…I deposited more to see the next interest and it drops.eeei mtn

Hello Commey, MoMo interest is not just about how much money you have. It also depends on how often you use your account. That’s why the interest can go up or down.

If you’re still worried, you can call MTN on 100 to ask more. 🙂

Thank you very much

I’m confused here but if I may asked, if I save 20000 in the account for 3 months ,how much I I get?

Unfortunately, MTN doesn’t give a fixed amount for interest. It depends on how often you use your MoMo account and how much money you save within the quarter.

Thanks a lot

How can I get my interest after the activation process.

Hi Peter, after you activate the service, MoMo interest will be automatically paid to your MoMo wallet every three months or quarter if you had money in your wallet during that period.

The more you keep in your wallet, the more interest you earn.

When is the next payout since we’re one day left to enter the month of November?

Please will you still receive the momo wallet interest when deposit all your amount to Yello save

No, you’ll only receive MTN MoMo wallet interest if you have money in your MoMo wallet.

They are always cheating us. I still dont understand how they calculate the interest. And is it on monthly basis or the balance as at the end of the quarter.

MTN’s MoMo interest is credited to your account on a quarterly basis.

Have they started paying this Quarter interest

No, interest rates for the first quarter of 2025 haven’t been paid yet.

Between the transaction activity and the balance history which one boost the interest??

Both contribute to how much interest you earn. Your transaction activity determines what interest rate you get, but this is applied on your balance. So, both are equally crucial.

I have been saving money on my Momo wallet without interest. I’m being cheated

If you’re not earning interest on your MTN MoMo wallet, you have to activate it manually following the steps above.