Key takeaway

- You can transfer money internationally to an MTN Momo account in Ghana through international remittance services like Remitly, World Remit, Taptap, and Western Union.

- MoneyGram and Western Union have agent locations in Ghana, making cash pick-ups possible.

- Factors to consider when selecting an international money transfer service include exchange rates or fees, delivery times, and daily and monthly transfer limits.

Thanks to mobile money, receiving money in Ghana from across borders quickly and securely is easy. In this guide, we’ll take you through sending money to an MTN mobile money account in Ghana using International Money Transfer Services (IMTS).

5 IMTS to send MTN MoMo to Ghana

To send money to MTN Mobile Money in Ghana, first, ensure your recipient has a registered MTN Momo account. Then, use any of these international money transfer services to process your transaction.

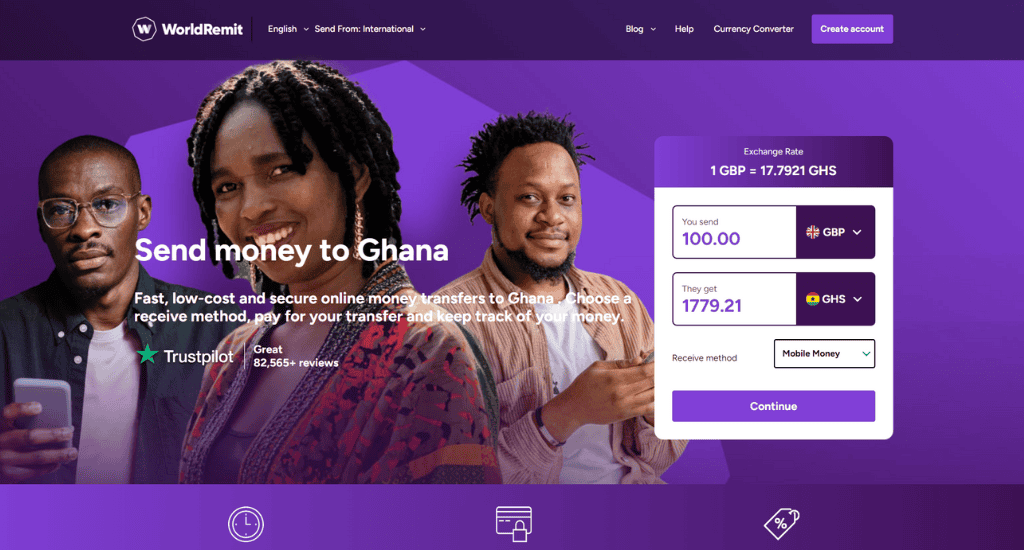

1. Remitly

Remitly is a popular choice if you want a hassle-free way to send money to an MTN account in Ghana from the USA and many other countries worldwide. They are a US-based remittance service with seamless user experience, competitive rates, and commitment to customer satisfaction.

To make a transaction, create an account through their website, App Store, or Google Play app, sign up, and follow the prompts to send money to MTN mobile money in Ghana. Remitly’s delivery speed (standard or express) depends on your transfer account. Bank transfers take between three to seven days, whereas credit/debit card transfers are almost instant.

Pros

- Fast transfer speed

- Offers for new users and first transfer

Cons

- Limited availability

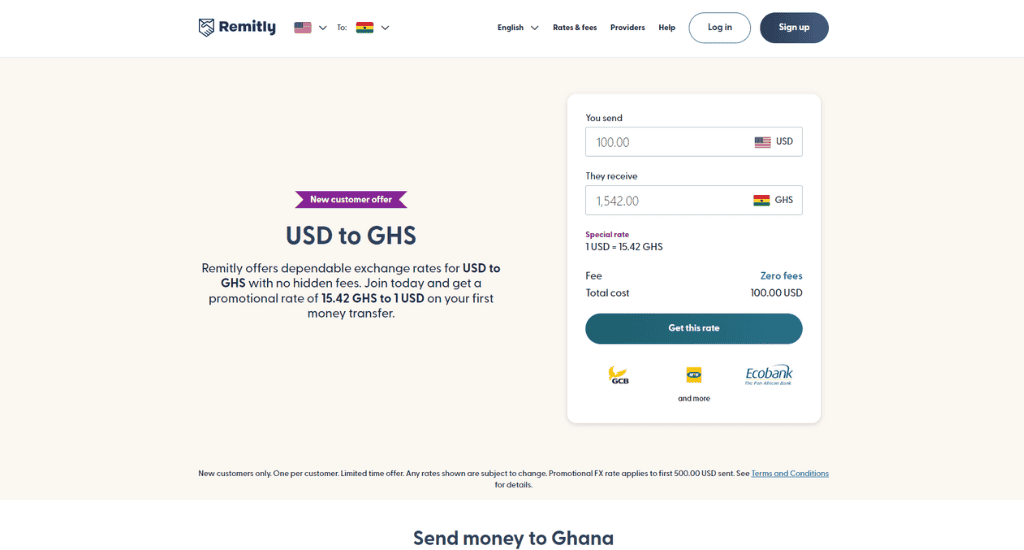

2. WorldRemit

WorldRemit is one of Ghana’s popular choices for sending money to loved ones. With WorldRemit, anyone can send money to more than 130 nations across the globe. WorldRemit is known worldwide for its quick transfer times and competitive exchange rates.

To send money to Ghana via MTN Mobile Money using World Remit, create an account and sign in on the app or the website. Then select Mobile Money Transfer from the service options, MTN Mobile Money as the payout method, currency, and the amount you wish to send. Once the transfer is complete, you’ll receive an SMS notification.

Pros

- Wide range of payout options

- Offers a mobile app for on-the-go transfers

Cons

- Transfer fees are higher for some countries or regions

- Limited coverage in certain areas

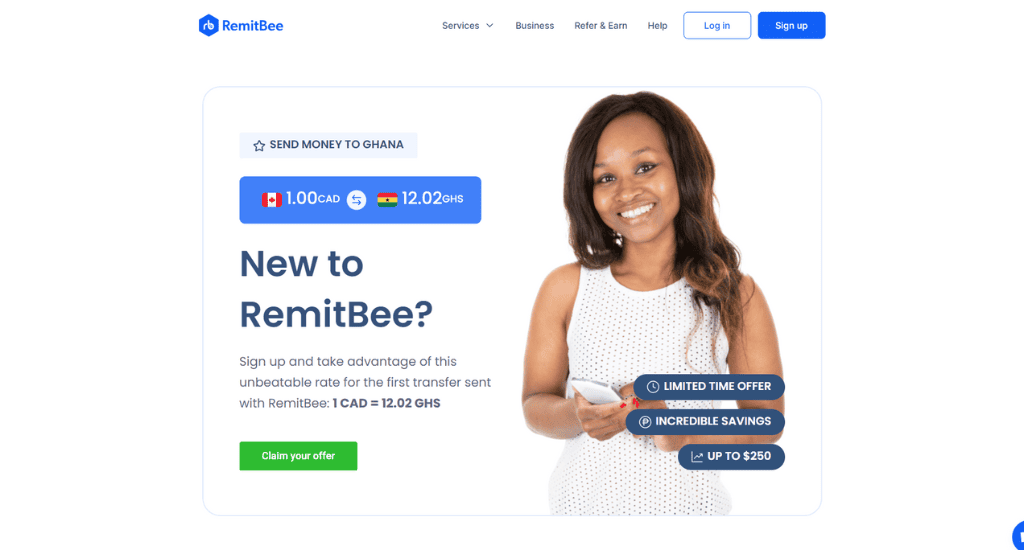

3. Remitbee

Remitbee makes it simple for customers to transfer money across borders. With affordable costs, a user-friendly app interface, and reasonable exchange rates, it is a well-liked option for individuals and companies searching for effective remittance solutions.

To use Remitbee, download the Remitbee app and sign up. Select Ghana as the destination country and pick Mobile top-up as the receiving option. Then, choose MTN Money from the bank drop-down options and input the receiver’s MTN Money account number in the bank account space.

You also have to select the transfer’s purpose from the drop-down box after entering the amount you wish to send. Choose a payment method, follow the instructions, and press the send button to execute the money transfer.

Pros

- Low fees and high exchange rates

- Fast transfer speed

- Offers promotions and referral bonuses

Cons

- Limited availability

- Restrictions on transfer amounts for new users

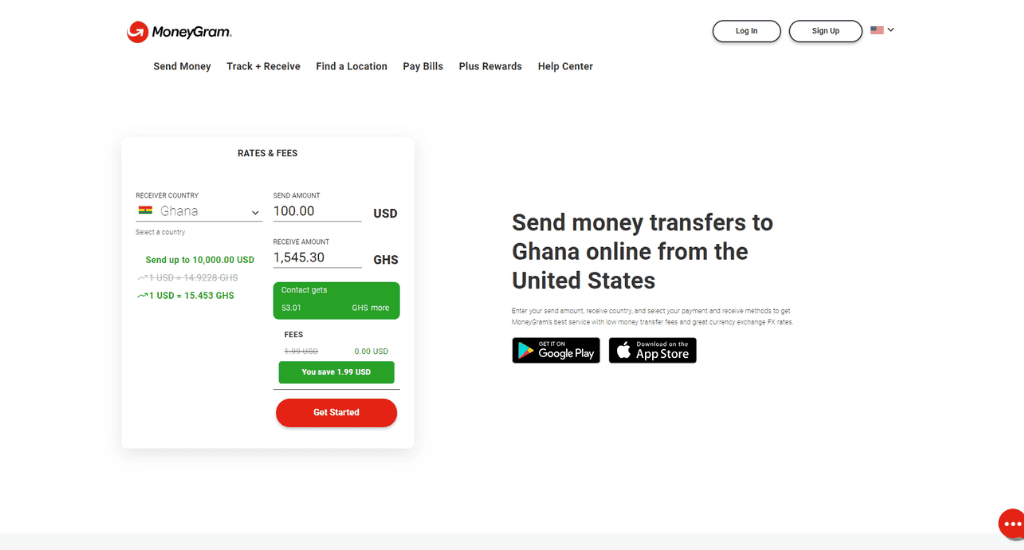

4. MoneyGram

MoneyGram is a reputable and dependable option for international remittances and financial transactions, facilitating the safe and swift transfer of money across international borders to businesses and individuals. MoneyGram offers a large network of agent locations, mobile apps, and online platforms.

On the MoneyGram website or mobile app, go to the Send Money section and tap on the box. Select Change Receive Country and select Ghana from the list of countries. Enter the amount you wish to send, either in the sending country’s currency or GHS, choose your payment method, select Mobile Wallet as the receive method, click on Next, and select Add Receiver.

Under receivers, provide the details, including the recipient’s name and contact information and follow the prompts to send the money.

Pros

- Extensive global network of agents and locations

- Offers multiple transfer methods, including online, mobile app, and in-person.

- Quick and reliable transfer process

- Offers a loyalty rewards programme for frequent users

Cons

- Higher fees compared to some other transfer services

- Exchange rates may sometimes be less competitive

- Limited coverage in certain remote areas

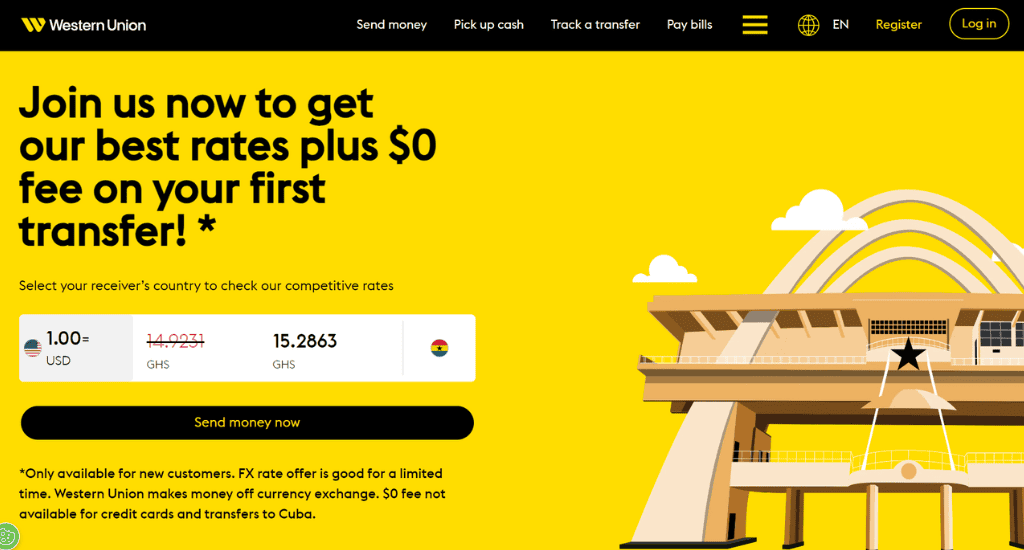

5. Western Union

Western Union is a global leader and a reputable option in cross-border money transfers, providing individuals and companies with a secure and convenient means of sending and receiving money. Western Union offers a wide network of agent locations, digital platforms, and transfer methods.

To use Western Union, download the Western Union app and set up your profile. Start your money transfer by entering Ghana as your destination country where you want to send the money. Then, specify the amount of money you would like to send and choose the payout method. Enter the receiver’s details (name and mobile number).

Once done, you can choose a secure payment method. Western Union allows you to pay directly from your bank account or cash at a participating agent location.

Pros

- Wide network of agent locations worldwide.

- Quick and reliable transfer process.

- A cash pickup option is available in Ghana.

Cons

- Higher fees compared to some other transfer services.

- Exchange rates may not always be as favourable as the mid-market rate.

- In-person transfers may require additional time and effort.

How to choose the best service to send mobile money to Ghana?

Factors to consider when choosing the best international money service provider to send money to Ghana through MTN Mobile Money include:

- Exchange rate or fees: The fees or charges of the money transfer services are mostly included in the exchange rates they provide, which results in the varying exchange rates of each money transfer service.

- Delivery times: Transfer speeds and delivery times differ for all the services. To choose the best service, consider the transfer speed and how urgently the receiver needs the money.

- Daily and monthly transfer limits: This is usually important when transferring large sums or small amounts of money. Confirm on the website of the transfer service before transferring.

Note: MTN Ghana has changed its processes, and international transfers to MTN Business Mobile Money are no longer permissible. Therefore, you should ensure that the mobile money account you wish to transfer money to is personal before initiating the process.

Which countries and regions can send mobile money to Ghana?

Let’s look at some countries or regions where you can send money to Ghana via MTN Mobile Money using the following international money transfer services:

| Money Transfer Service | Countries |

| Remitly | US, UK, Canada, Australia, European countries, Middle Eastern countries, Asian countries, and African countries. |

| World Remit | Australia, Canada, the EU, the UK, Hong Kong, Japan, Malaysia, New Zealand, Singapore, Somaliland, Tanzania, the US, and South Africa. |

| RemitBee | US, Canada, Australia, the UK, the European Union, etc. |

| Money Gram | UK, US, Canada, Australia, Turkey, South Africa, the United Arab Emirates, etc. |

| Taptap Send | UK, European Union, US, Canada, the United Arab Emirates, etc. |

| Western Union | US, UK, Canada, Australia, European countries, Middle Eastern countries, Asian countries, and African countries. |

Quick tip: To send money from regions not listed here, confirm on the official website of the money transfer service.

Conclusion

There are numerous options for sending money to Ghana via international money transfer operators and apps.

So, compare the exchange rates and service fees to choose the best money transfer service.