Key takeaways

- You can send money from MTN MoMo wallet to a bank in three ways: wallet-to-bank transfer, GhIPSS bank transfer service, or using the bank’s USSD code.

- Transfers from your MTN MoMo to a linked bank account are free, while unlinked bank transfers incur charges.

- MTN MoMo to bank transfers are instant but can take up to 24 hours, depending on the bank.

MTN mobile money wallets are interoperable with local banks in Ghana. So, you can transfer funds instantly from your wallet to any registered bank account in Ghana, improving convenience and eliminating the need for in-person banking.

How to do MTN MoMo to bank transfer?

Transferring money from your MTN MoMo wallet to your bank is quite easy. We’ll go over all three ways you can do this:

Method #1 – Wallet to bank transfer

Wallet-to-bank transfers require that your MTN MoMo wallet is linked to your bank account.

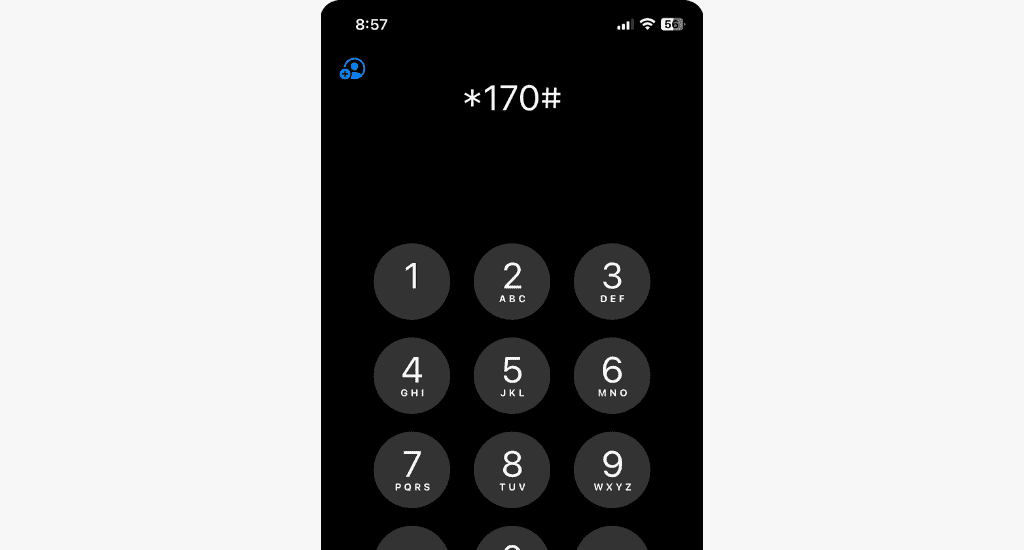

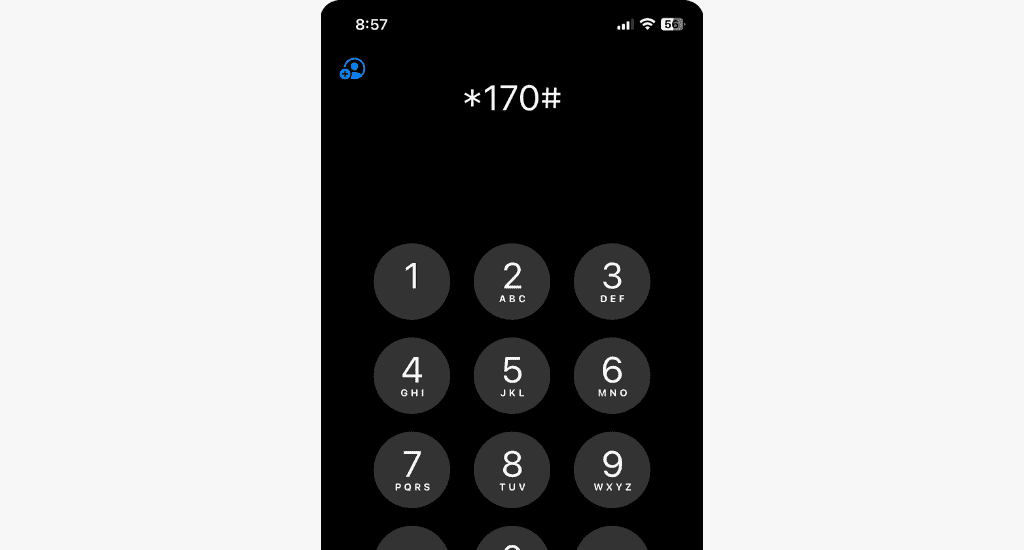

- Dial *170#.

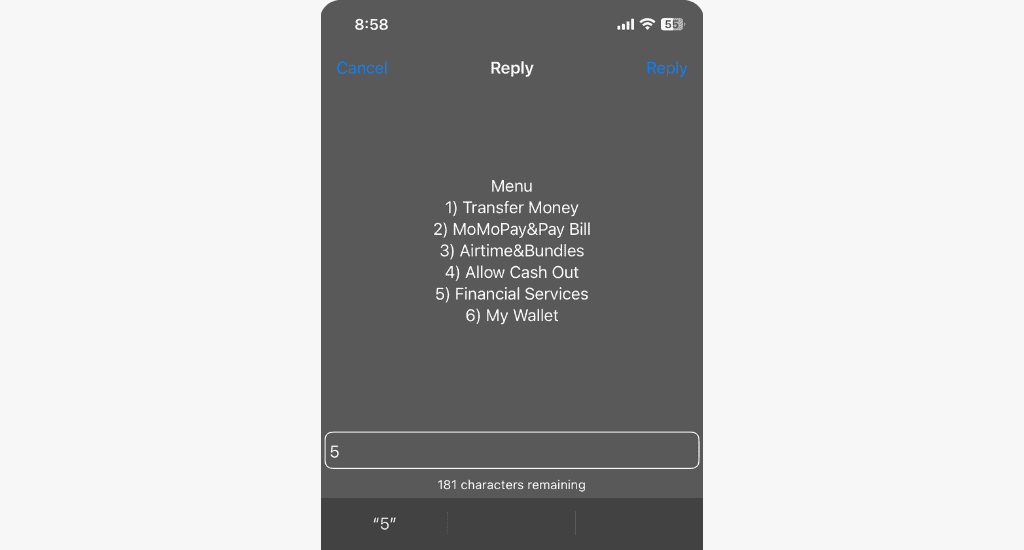

- Select Financial Services.

- Select Bank Services.

- Choose Transfer to Bank.

- Select your bank.

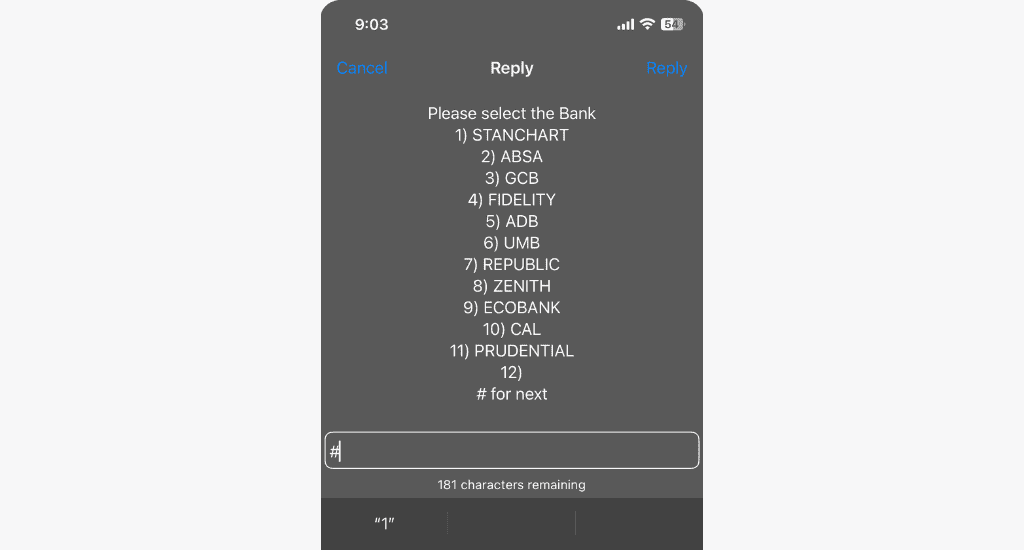

Tip: Enter # for more bank options if your bank isn’t in the initial list.

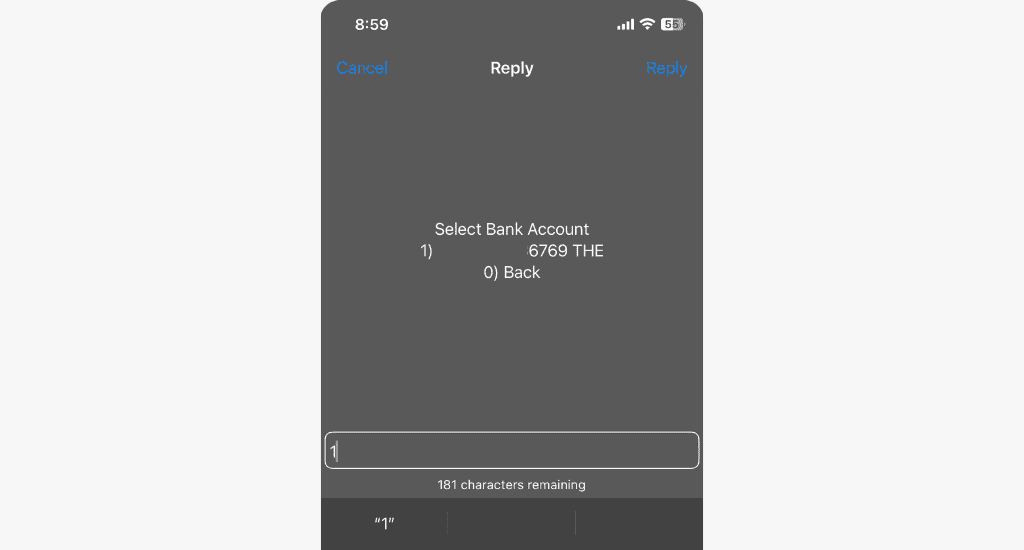

- Select the bank account number you wish to transfer money to.

- Enter the amount you want to transfer.

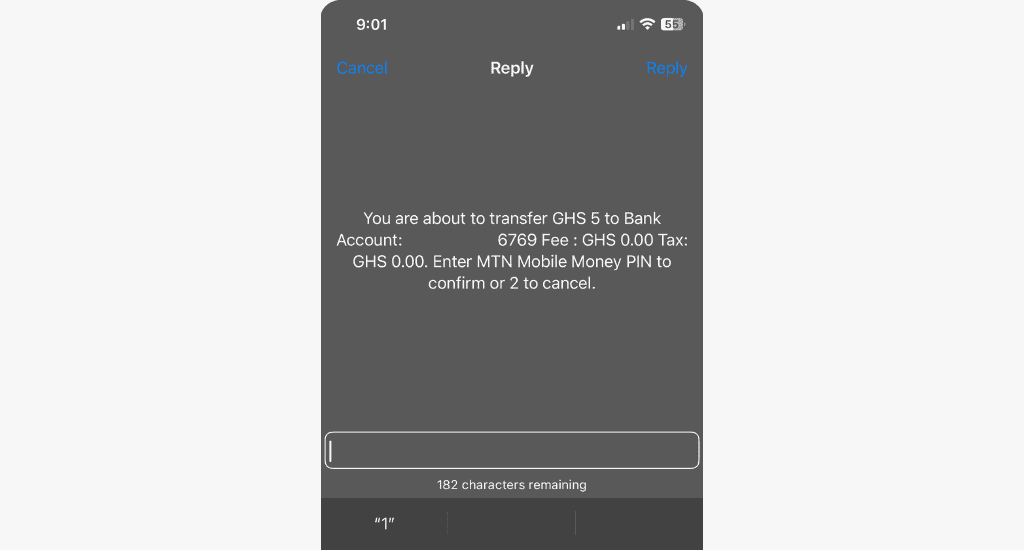

- Enter your MoMo pin.

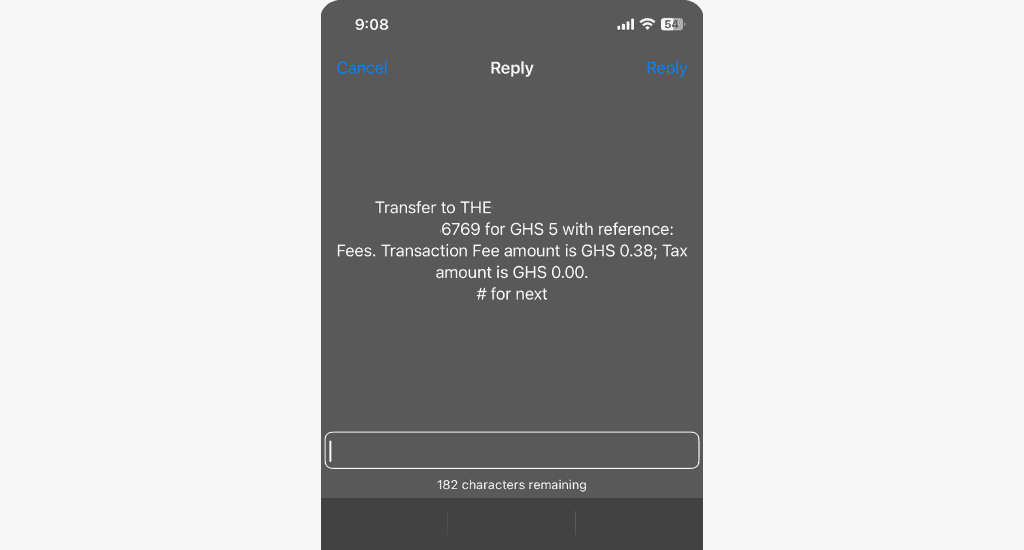

You’ll receive a message confirming the transaction.

Method #2 – GhIPSS bank transfer service

This method uses the GhIPSS mobile money interoperability service, which allows you to transfer funds from your MTN MoMo wallet to any bank account electronically, whether they’re linked or not.

- Dial *170#.

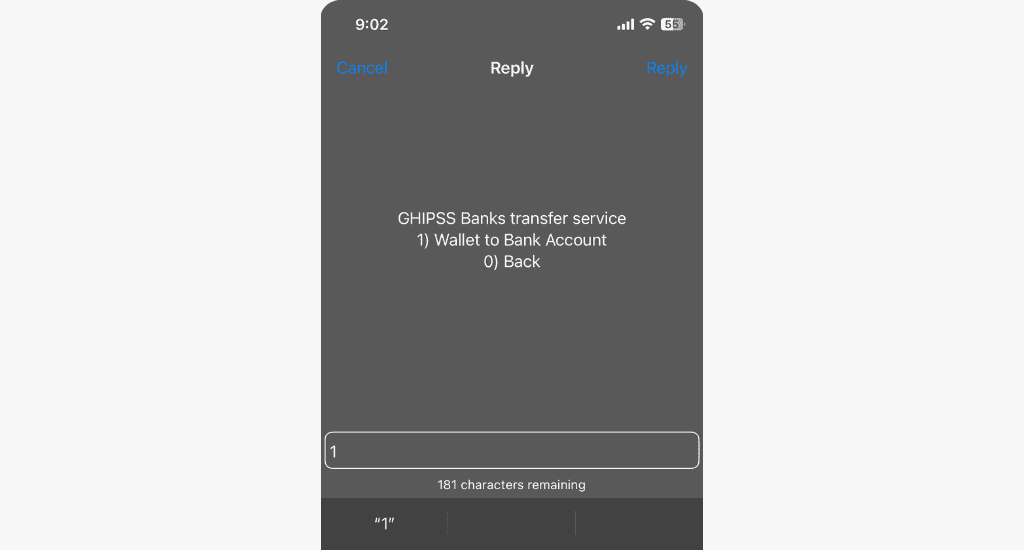

- Choose Transfer Money.

- Select Bank Account.

- Choose Wallet to Bank Account.

- Select the bank you wish to transfer money to.

- Enter the bank account number and confirm it.

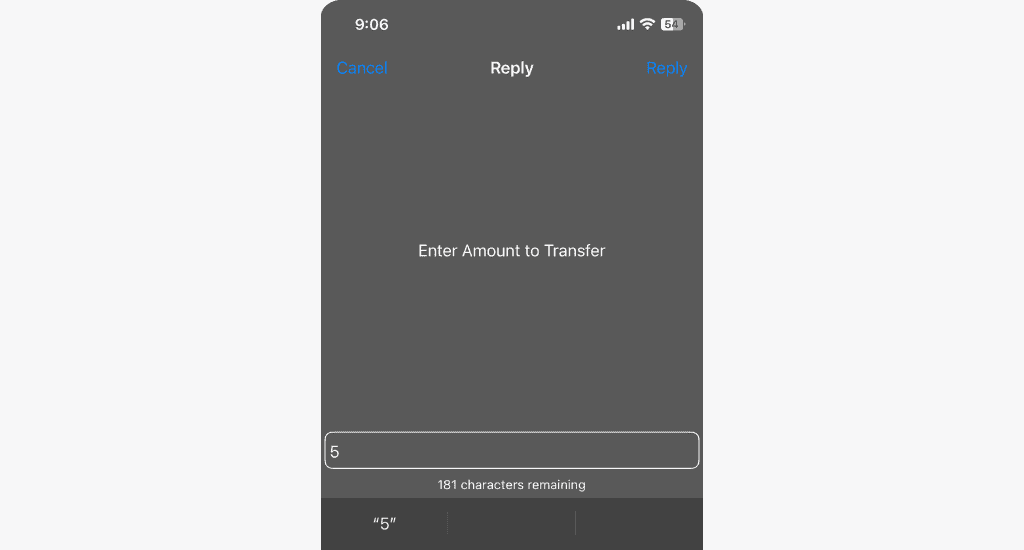

- Enter the amount to transfer.

- Enter a reference ID to remember what the money was for.

- Enter your MoMo PIN to confirm the transaction.

That’s it, your money should be on its way.

Method #3 – Using the bank code

Another way to initiate a bank transfer is by using your specific bank’s USSD code.

You must link your bank account to your MoMo wallet to use this method. Simply dial the bank’s designated USSD code and follow the prompts to initiate and complete the transfer.

MTN MoMo to bank charges

When your MTN MoMo wallet is not linked to your bank account, you incur charges when transferring funds, as seen in the table below:

| Amount (GHS) | Charge | E-Levy |

| 0.01-50 | GHS 0.38 | – |

| Between 50-100 | 0.75% | – |

| Between 100-1,000 | 1.5% | |

| Above 1,000 | GHS 7.5 |

Note: Each person has a daily tax-free limit of GHS 100 for transfers. You can send up to GHS 100 per day without paying the levy.

On the other hand, bank transfers are free when you link your bank account to your MoMo wallet (transferring using method #1). Visit your bank to link your bank account to your MoMo wallet.

Important security measures to note

When using MTN MoMo for bank transfers, prioritise security to keep your transactions safe.

Here are important safety guidelines:

- Keep your MTN MoMo PIN secure, and never share it.

- Always verify the recipient’s information and transaction amount before approving transfers.

- Be cautious of suspicious messages requesting your personal information or approving transfers.

- Contact MTN customer support immediately if you suspect fraudulent activity on your account.

FAQs

How long does the MTN MoMo transfer take to show up in my bank account?

Bank transfers using MTN MoMo are usually instant, but sometimes it can take up to 24 hours, depending on your bank’s processing time.

What are the daily and monthly limits on bank transfers?

The daily and monthly limits on MTN MoMo transfers depend on the type of account you have:

| Account type | Daily transaction limit (GHS) | Monthly transaction limit (GHS) |

| Minimum | 3,000 | 10,000 |

| Medium | 15,000 | Unlimited |

| Enhanced | 25,000 | Unlimited |

Please note that individual banks may also have daily and monthly transaction limits. It’s advisable to check with your bank to understand any additional restrictions that may apply.

Conclusion

Following these steps, you can easily transfer money from your MTN MoMo wallet to your bank account. Always prioritise security by keeping your MoMo PIN safe, verifying transaction details, and staying alert to potential fraud.

Don’t hesitate to contact MTN customer support or your bank’s customer support for further assistance. Do share your thoughts and questions with us in the comment section.