Key takeaways

- MTN Qwikloan lets you borrow GHS 25 to GHS 1,000 with a 30-day repayment period and a 6.9% interest rate.

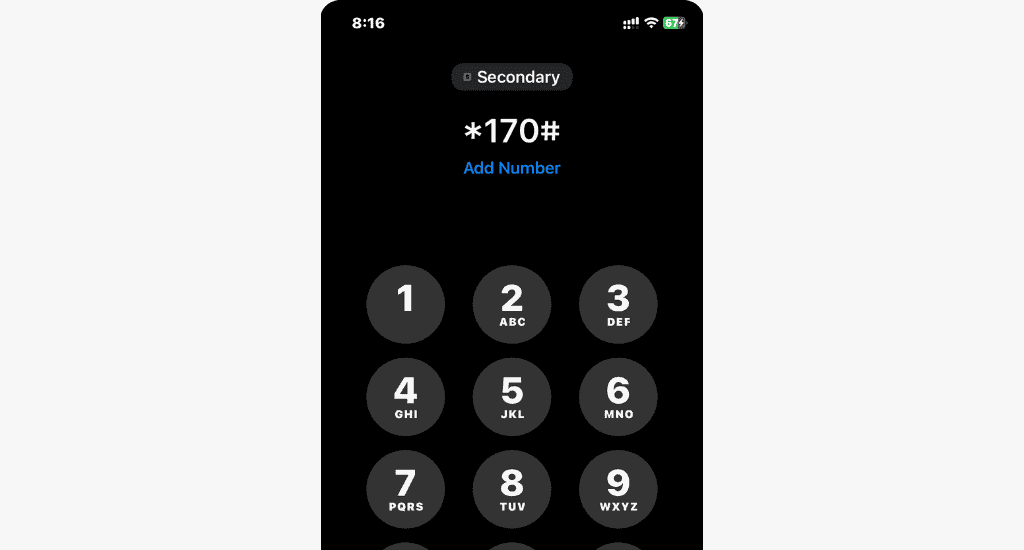

- To apply for a Qwikloan on your phone, dial *170#. No paperwork, guarantors, or collateral is required.

- Other MTN loan services include Xpressloan, Ahomka Loan, and MTN XtraCash.

MTN Ghana, in collaboration with AFB Ghana, launched Qwikloan to borrow and repay small loans with minimal interest. In this guide, we go over the entire process of getting a loan, from eligibility to repayment.

What is MTN Qwikloan?

Qwikloan is an easy-access, small-scale loan service for MTN mobile money users. The service lets you borrow between GHS 25 and GHS 1,000 and pay back after 30 days with an interest rate of 6.9%. This means that if you take a loan of GHS 25, you will pay back a total of GHS 26.73.

MTN Qwikloan eligibility criteria

Not everyone with an MTN MoMo account qualifies for a Qwikloan. To apply for the loan service,

- You must be 18 years and above.

- You must have a registered MTN Ghana SIM card.

- You must be an active MTN user for at least six months.

- You must actively use your MTN Mobile Money wallet for at least three months.

If you meet these requirements, you can borrow money from the MTN Qwikloan service without a guarantor or complicated paperwork.

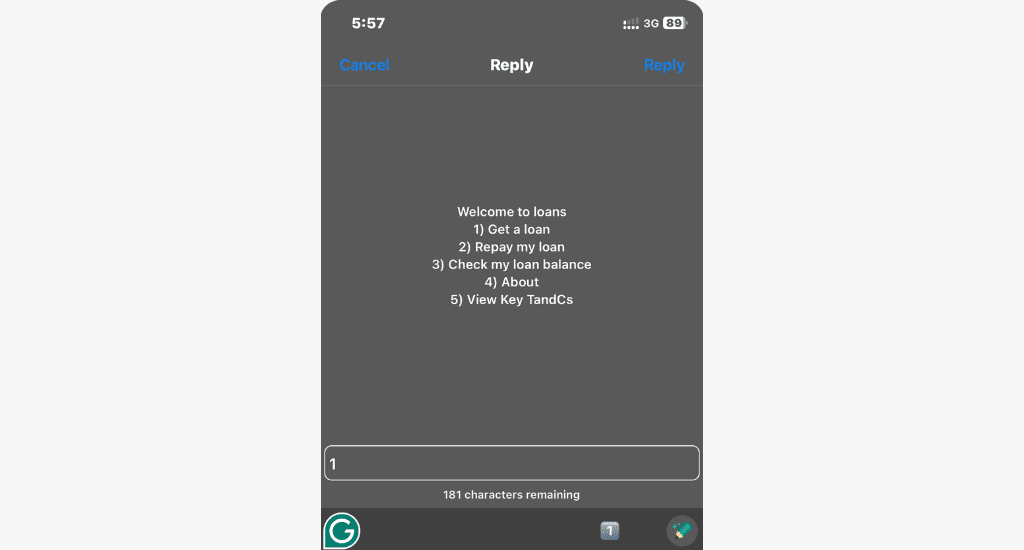

How to borrow money from MTN (Qwikloan)?

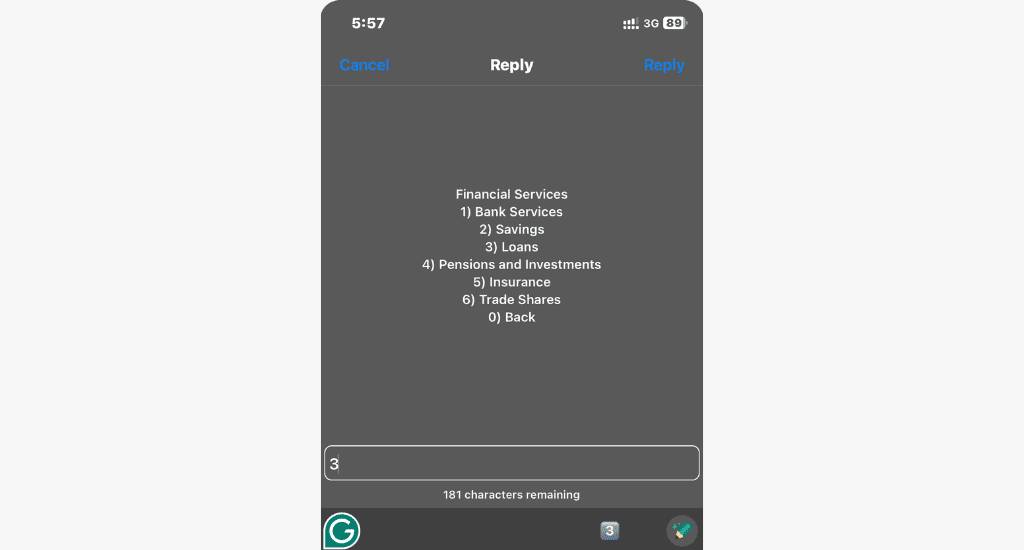

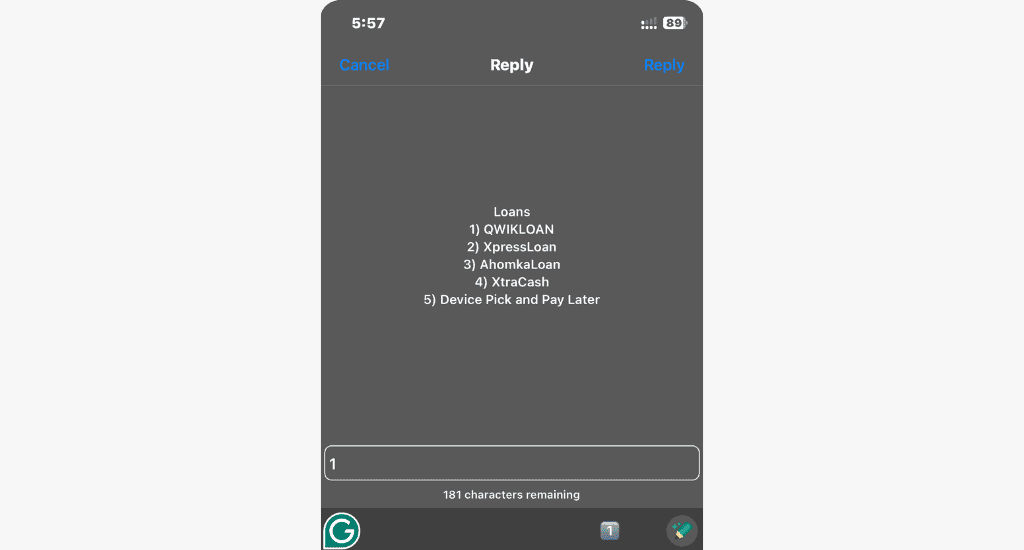

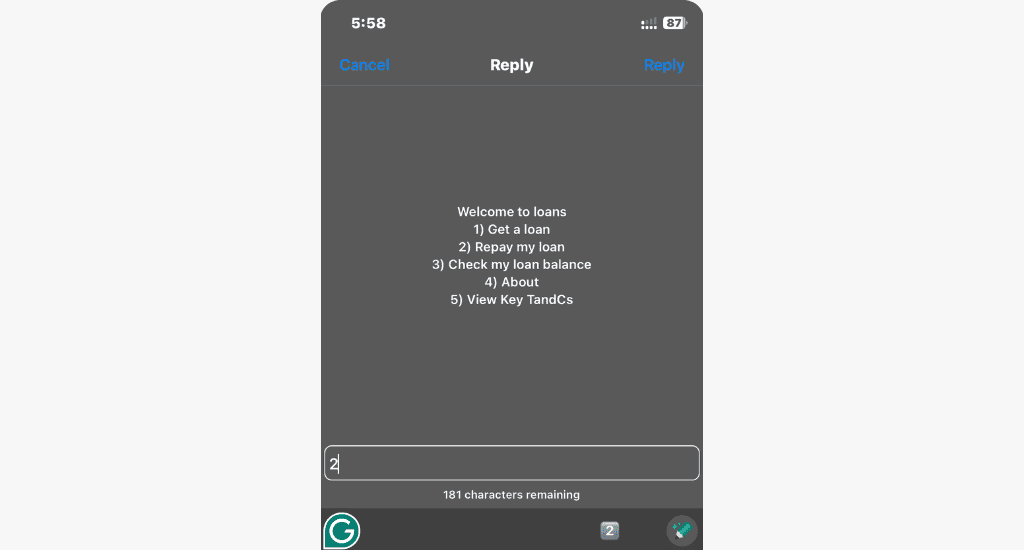

Here’s how to apply for an MTN Qwikloan:

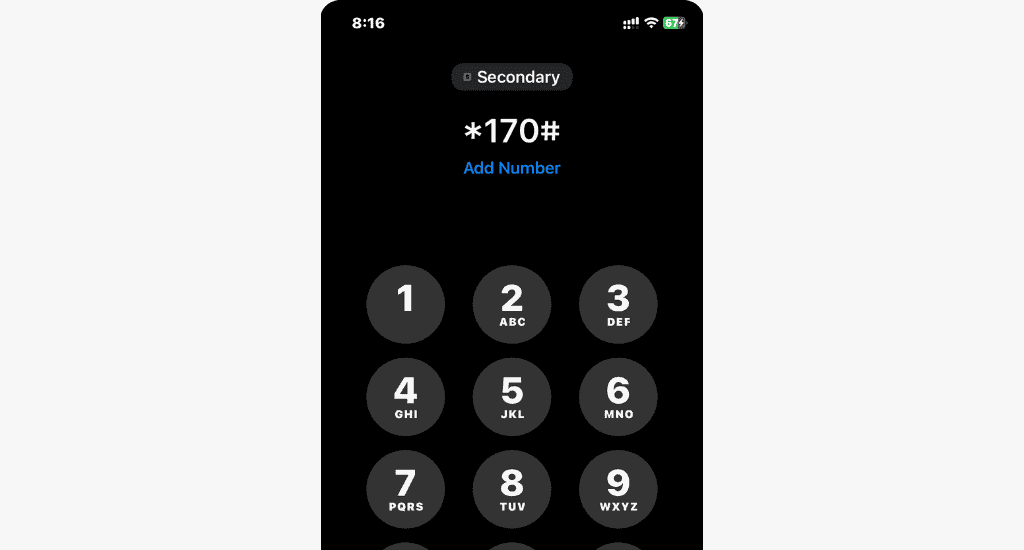

- Dial *170#.

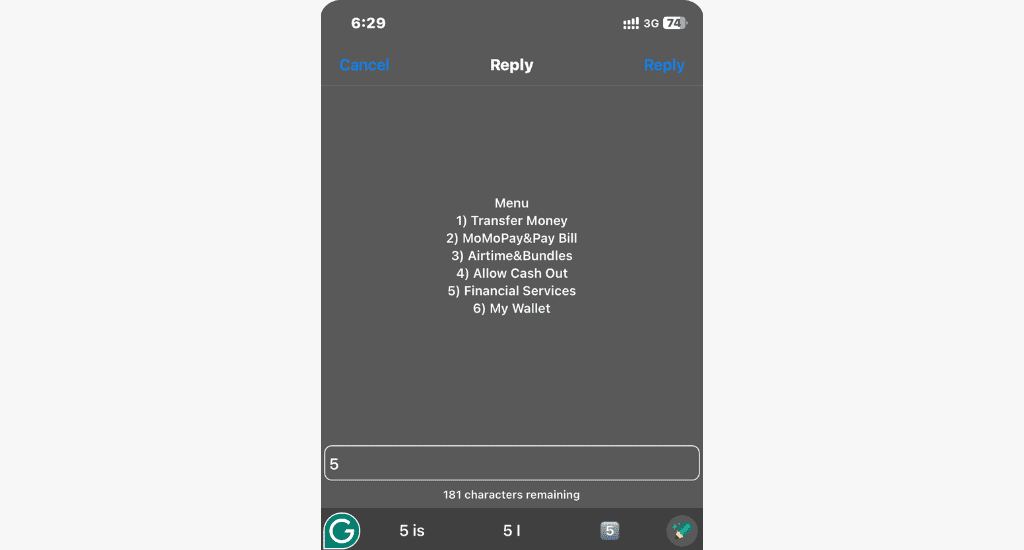

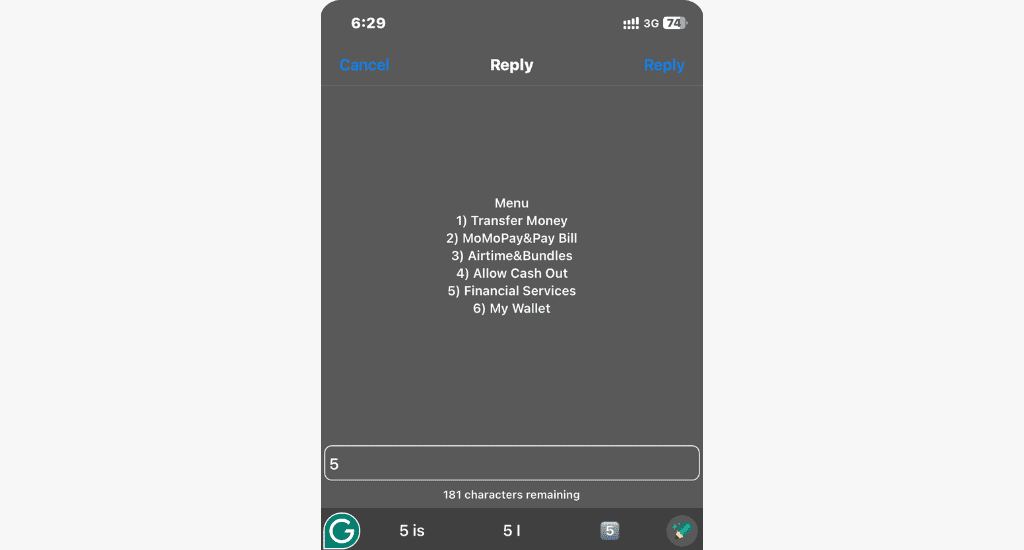

- Select Financial Services.

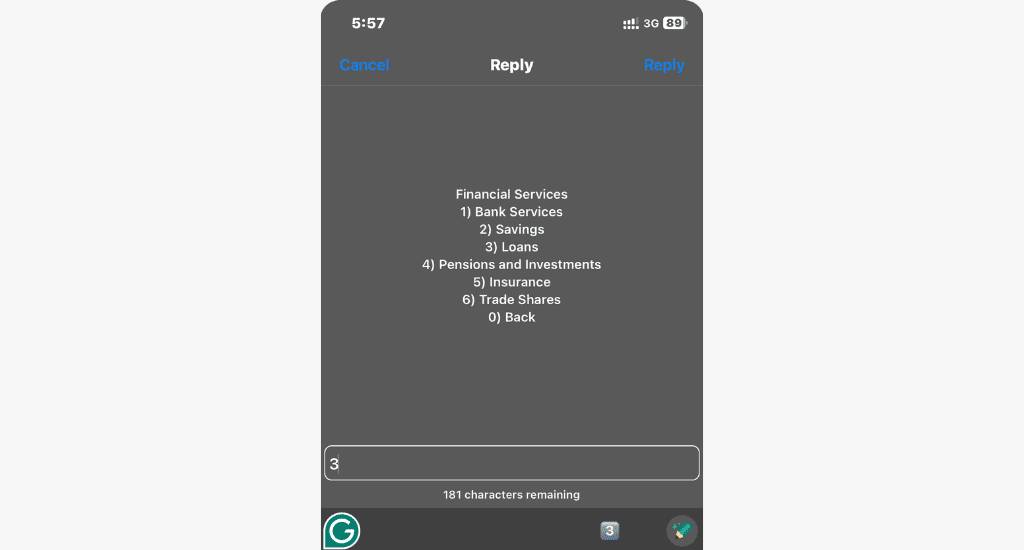

- Choose Loans.

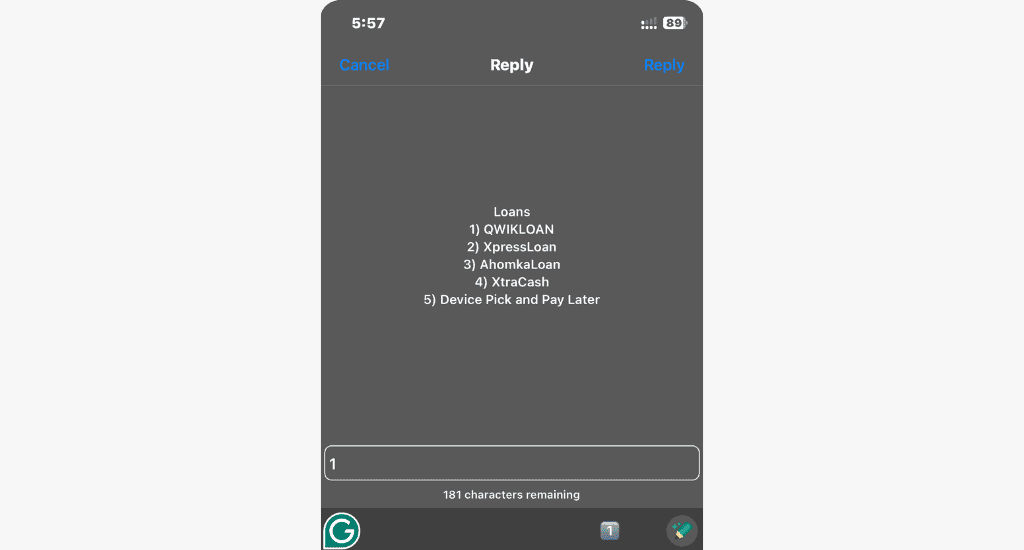

- Select QWIKLOAN.

- Choose Get a Loan.

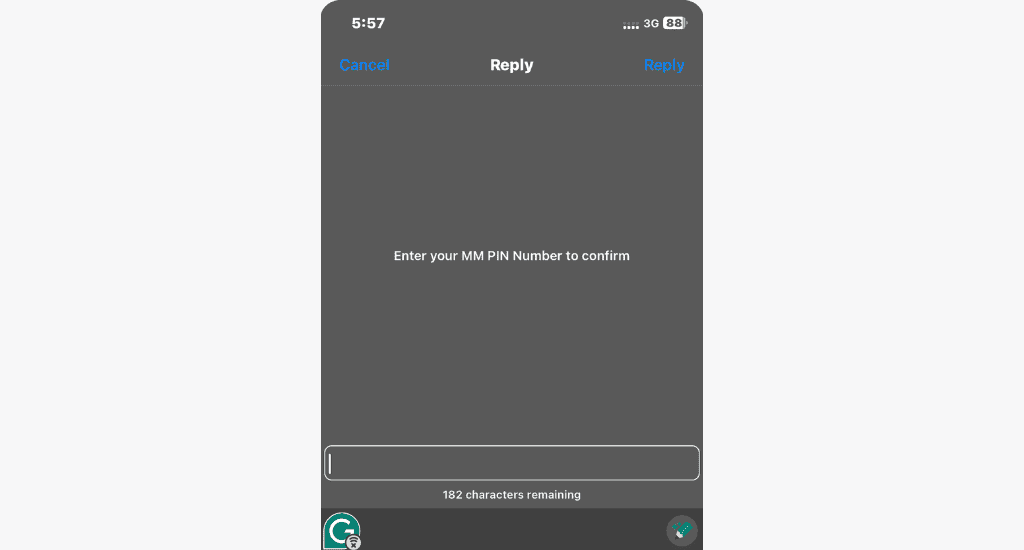

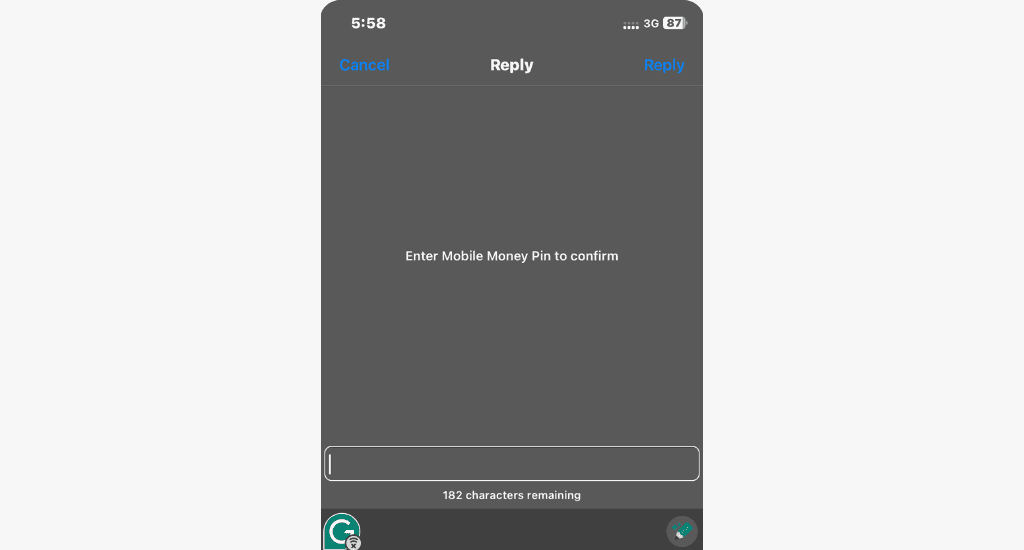

- Enter your MoMo PIN code for approval.

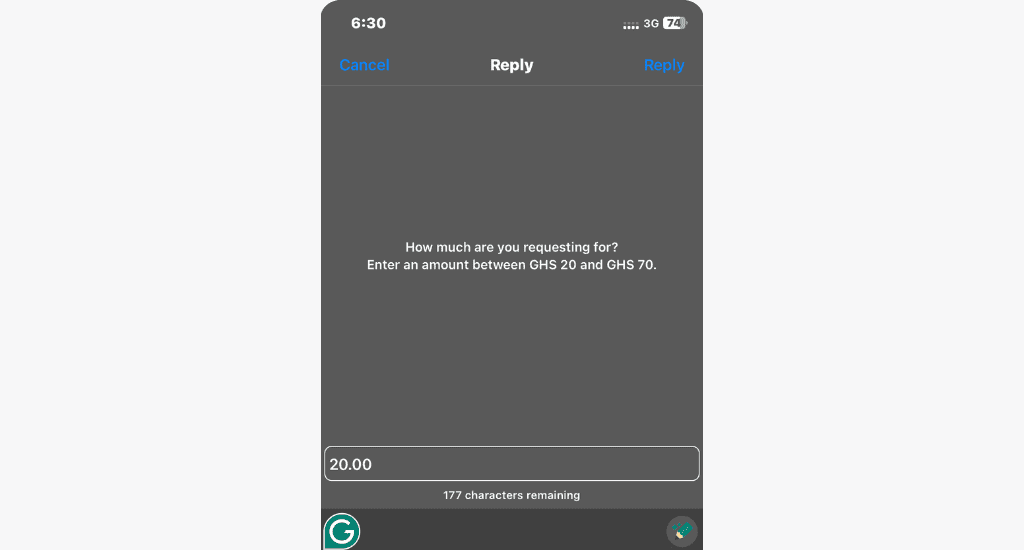

- Enter an amount within the given range.

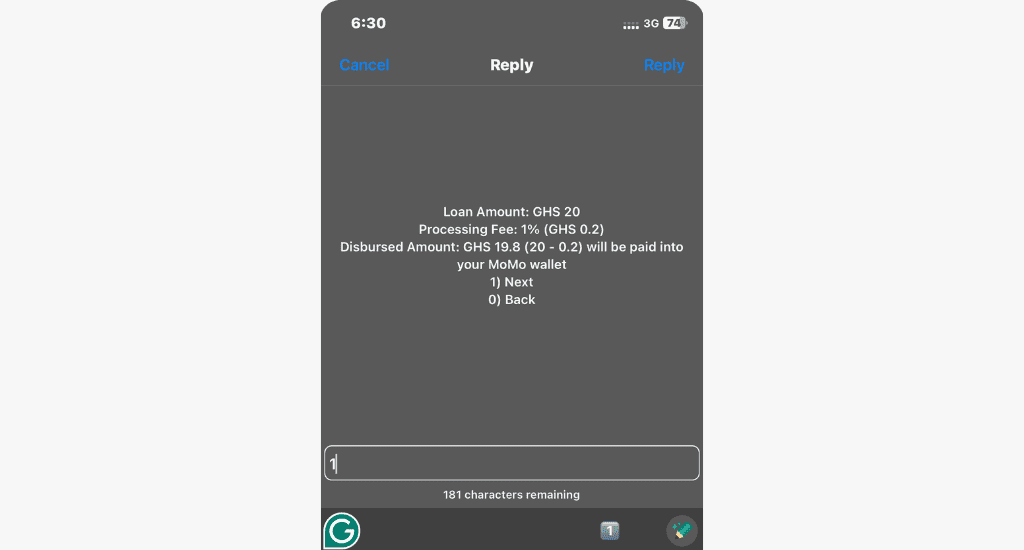

- Confirm loan amount and fee.

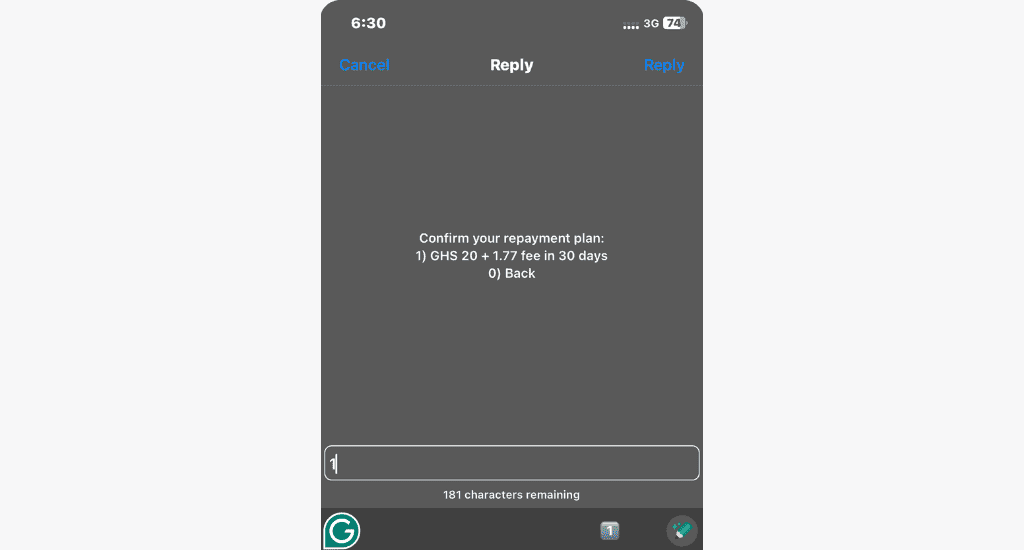

- Confirm repayment plan.

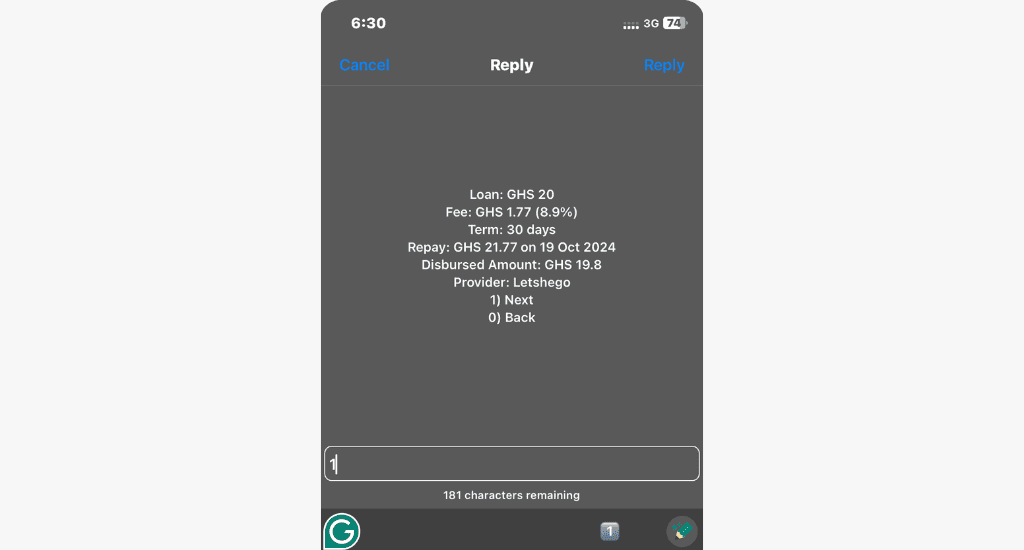

- Review the loan terms for the selected amount.

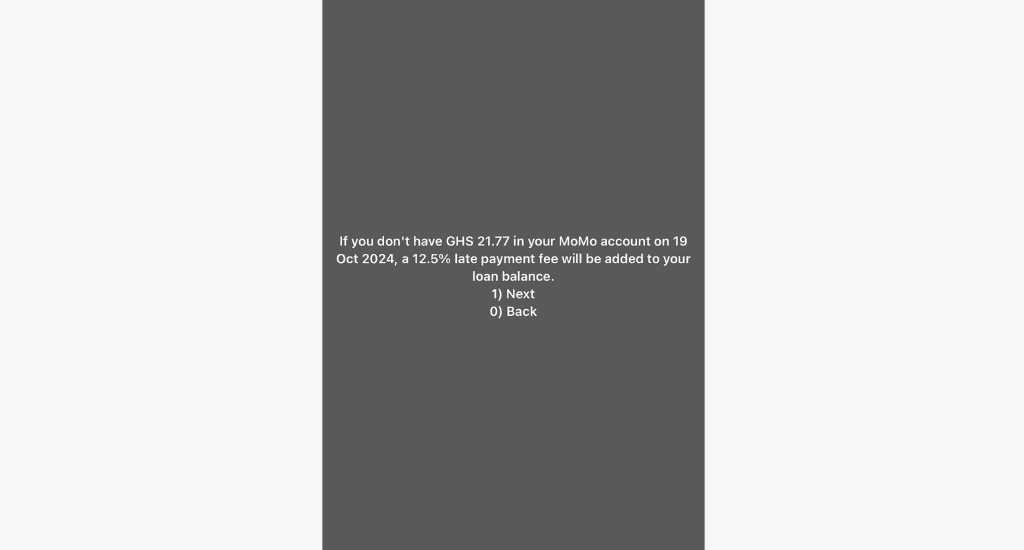

- Select Next to agree to late payment terms.

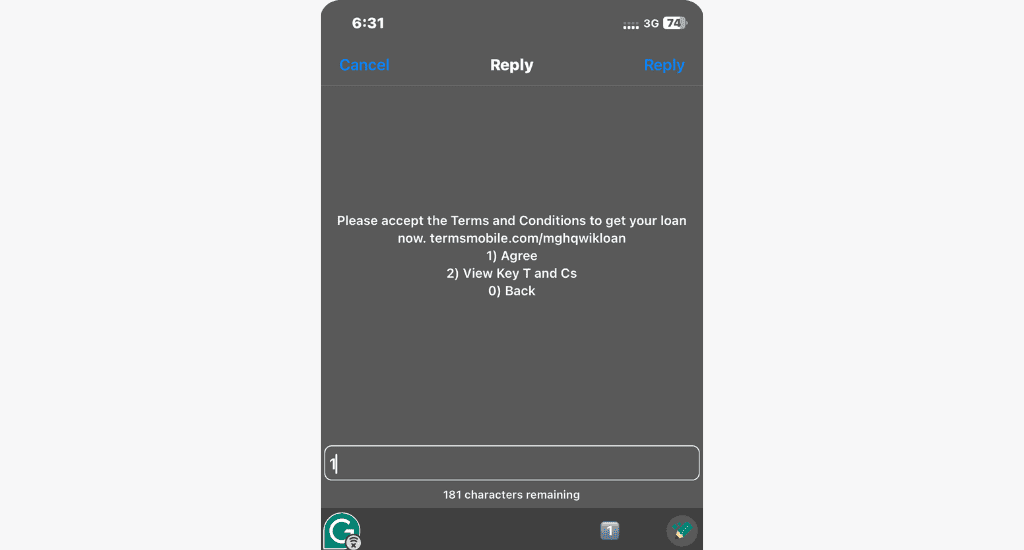

- Select 1 to agree to MTN Qwikloan’s terms and conditions.

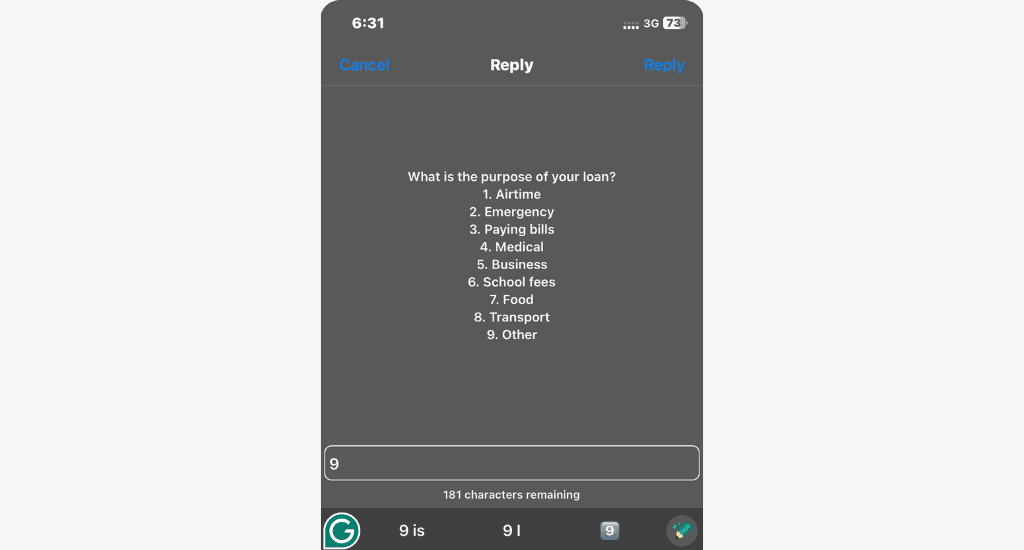

- Choose the purpose for your loan.

- Your application is now complete.

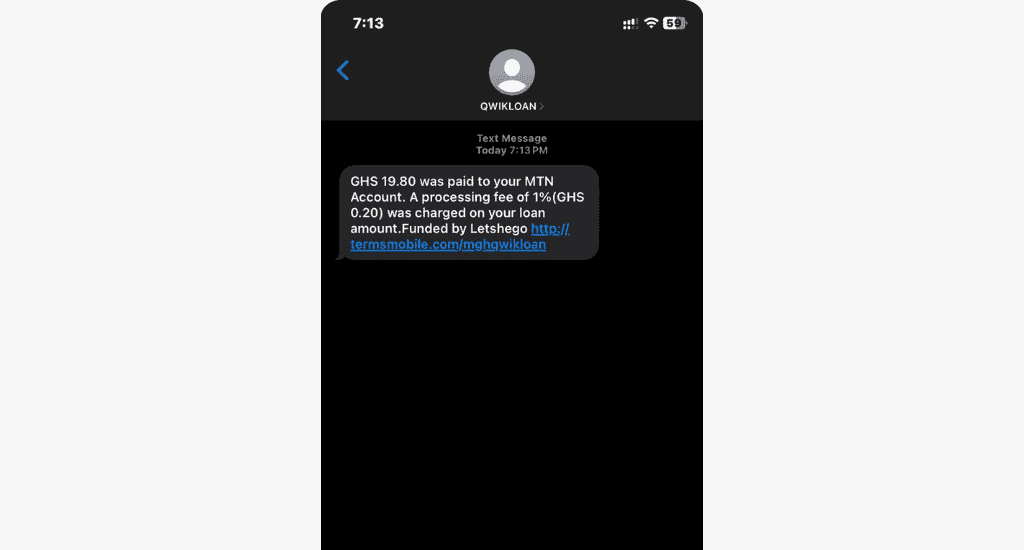

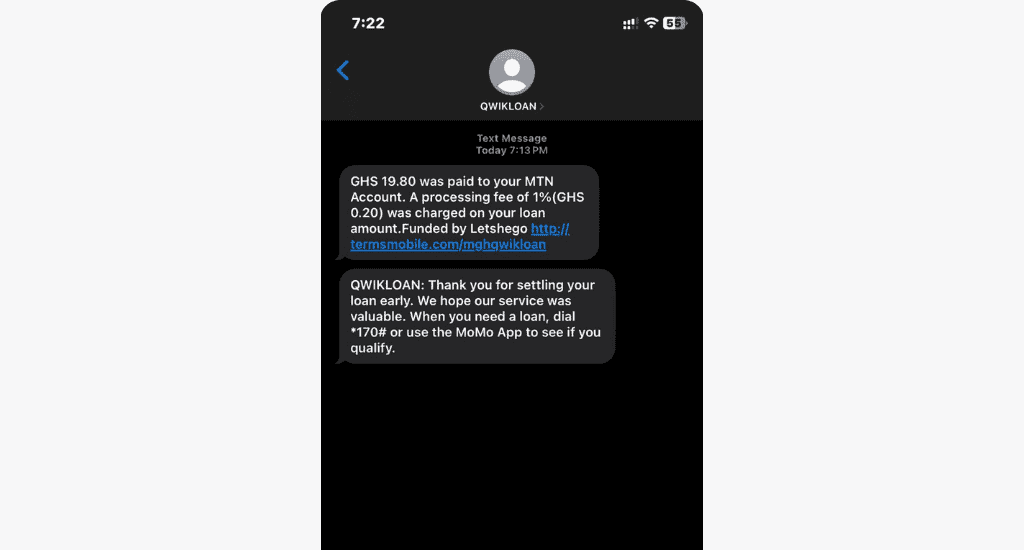

An SMS like the one above will be sent to you once your account is credited with the borrowed amount.

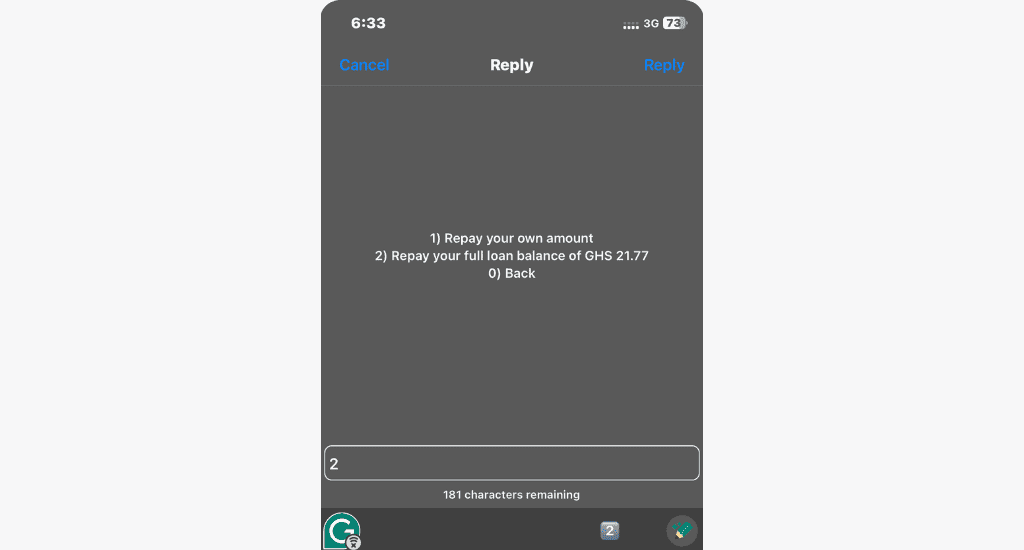

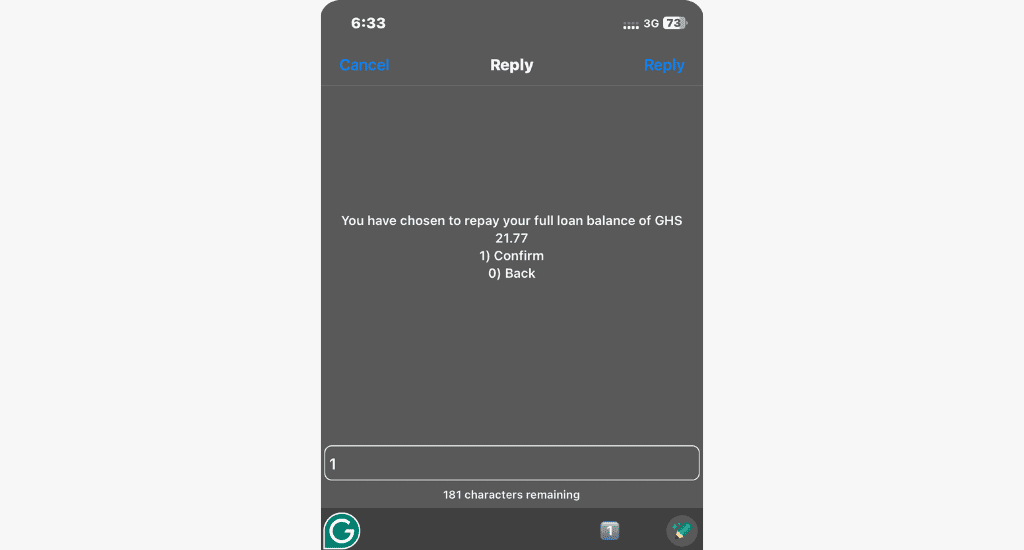

How to repay your Qwikloan?

MTN Ghana offers 30 days to repay your Qwikloan at an interest rate of 6.9%. You have two repayment options:

Option #1 – Manual repayment

You can manually repay your loan in installments or in full within the 30-day period. Deposit the total amount owed, including interest, into your MoMo wallet and follow these steps:

- Dial *170#.

- Select Financial Services.

- Choose Loans.

- Select QWIKLOAN.

- Select Repay my loan.

- Enter your MoMo PIN to confirm.

- Choose a repayment option: part payment or full payment.

- Confirm the MoMo loan to repay.

- Wait for an SMS confirming the loan payment.

That’s it. You’ve successfully repaid your MTN Qwickloan.

Option #2 – Automatic repayment

For automatic repayment, wait till the end of the 30 days. The system will automatically deduct the payment from your wallet. You must have sufficient funds in your MoMo account to cover the amount owed and accrued interest.

Other MTN loan options

Besides Qwikloan, MTN offers loan options through partnerships with other financial institutions. Here are three of them:

- Xpressloan: Set up in 2019 by ECOBANK Ghana and Jumo, the service provides affordable, collateral-free microloans to petty traders and individuals at an interest rate of 6.9%, paid back in 30 days.

- Ahomka loan: In response to the COVID-19 pandemic, the Ahomka loan offers affordable and short-term loans with an interest rate of 6.9%, just like Xpressloan and Qwikloan.

- MTN XtraCash: MTN Ghana, in collaboration with Forms Capital, has introduced Xtracash, which allows you to borrow money (GHS 50 or less) and pay it back in 7 days. Late payment attracts a 10% extra on the amount borrowed.

MTN also has a pick-and-pay-later service. Unlike cash loans, qualified customers can purchase a device (phones and tablets) and pay through their mobile money account over 6-12 months.

3 tips to qualify for an MTN loan

Just because you are eligible doesn’t mean you are qualified for an MTN Qwikloan. Here are three of the most important tips to look out for.

- Regularly use MTN mobile money services.

- Register and link your MTN SIM card to your Ghana card.

- Maintain a good repayment history with any previous loans. You must pay all outstanding loans on time. This also allows you to access higher loan amounts.

FAQs

What is the maximum MTN loan limit?

The maximum loan amount you can get from MTN Qwikloan is GHS 1,000.

What happens if my MTN loan is not paid on time?

If you don’t pay your MTN Qwikloan on time, the interest rate will increase from 6.9% to 12.5%. Also, not paying your loan on time or not paying at all will automatically disqualify you from applying for another loan in the future.

Conclusion

MTN Qwikloan offers a quick and convenient way to borrow money from your mobile phone. It’s instant and an ideal solution for handling urgent financial needs.

There is no need for guarantors, processing of formal documents, bank accounts, or putting up properties as collateral. Share your questions and experiences with us below.

50 Comments. Leave new

I took out a loan from Quick several times and always paid it back on time, but then they suddenly refused me. Now there are no such items in the menu (neither in *170# nor in the app), but I constantly receive text messages from Xtracash saying that the loan has been approved. But I can’t get it. Why is this happening? MTN support says they don’t know anything about it and can’t do anything about it. Thank you in advance for your reply.

Hello Evgenii, sorry about the experience. We’ll recommend going to the MTN office to learn more about your situation.

Please can you borrow me money

What if you take a loan and you are asked to pay in 7 days but you want to extend the time

Hi Owusu, normally the loan has to be paid within the timeframe. If you want to extend the time, the best thing is to reach out to MTN customer service directly so they can explain your options.

Please I request for the loan but I didn’t get

Please reach out to MTN to learn why.

helloooo pls how is it that whenbu psy your loan on time and want to collect it back it will tell u you do not vilified pls people are complaining too much do something about it

I need a loan

Please, how much are you eligible to loan from Quickloa on the first time you’re taking a loan. And the minimum too?

Usually, you can borrow between GHS 25 and GHS 1,000 if it’s your first time.

I paid my loan but i collect

another your not give me

This happens due to many other factors. Please call MTN directly to learn why.

I need loan money

I said that me i want loan! but you do’t want give me my loan. why….

I have paid my loan before due date and decided to apply for other one they say am not qualif for other loan since yesterday but some people don’t pay on the due date some even delay payment but the moment they pay and apply for other one they get it so i don’t understand. People who pay before due date don’t get it but those who pay late get it when they apply for other loan.

But we borrow Ghc 10,000

Is it possible to take Ahomka loan and also go for Xtracash?

We’re unsure of this. Please reach out to MTN directly to learn more.

It’s impossible to do that . Once you have applied for loan from a particular loan app you are not eligible for loan with another until you repay

I just payed my quick loan from mtn and they are refusing to borrow my the money aggan

Please reach out to MTN directly regarding this.

Please help me calculate a loan of 498.76 cedis and unable to pay within a space of 3 months

The final amount owed after 3 months could go up to GH₵ 710.16 if MTN applies the penalty of 12.5% to your outstanding debt every month.

How can I get a loan with MTN merchant sim?

You cannot borrow with an MTN Merchant SIM.

I have applying for a loan for the past two months and I have declined for that

Please do something about it for me

Please contact MTN customer care directly to discuss this.

How much loan can you give someone

This depends on your individual usage patterns. Generally, MTN offers loans between GHS 25 to GHS 1,000.

Download the momo app and they will give you the loan ….it’s Network it happened to me before n again and again

I have paid my loan on time and I need another loan, but they said i have already existing on other services

Have you checked to confirm if you do not have any other loan? This can be a call credit/data loan.

What happens when you pay your loan before 24 hours of borrowing and how long Will it take to be qualified to borrow again

You should be able to borrow again after you’ve settled the amount you already owe. However, MTN sometimes holds out for a while. Please contact their support team if you’re unable to borrow after payments.

I want loan

I have paid for my loan and if am abour to apply for new loan they will tell me I already have an existing loan. But I have paid it already

Please contact MTN customer care about this. It’s likely a glitch in their system.

Pls how do I qualify for Ahomka loan

Here are some tips to qualify for any of MTN’s loan offerings.

Plz do u have a loan called ahomeka loan???

Yes, MTN has a loan service called Ahomka loan.

Since I have paid on time you people refuse to give me a loan so sad I really needed a loan to pay my son school fees

My sim card got lost I re- registered and requested for a loan but they said am not qualified

It’s likely MTN is treating your replaced SIM as a new SIM card. Please contact their customer care to rectify the situation.

Over one year know man have stopped giving me loan

And I pay my loan I take it

I don’t know why

You add another one called extracash

To the existing 3

Some people do take from Ahomka and extra cash at the same time

Give me some of the loan

We already paid it back. 🙂

Service are sometimes very bad . How can some who pays her loan even before the due date , and when it’s time for another loan , you decline saying I’m not eligible. Why would you do that?

In such cases, we recommend contacting MTN customer care for assistance.